Neuberger Berman Capital Solutions makes a growth investment in Sphera, expanding its role in sustainability and risk management software.

Blackstone retains majority ownership, continuing a partnership that began with its $1.4 billion acquisition of Sphera in 2021.

The deal highlights growing institutional demand for ESG data, life-cycle assessment, and supply chain transparency tools.

Chicago — New Capital for a Growing ESG Platform

Sphera, the Chicago-based sustainability and operational risk management software firm, has secured a new round of growth capital from Neuberger Berman Capital Solutions, adding a second major institutional backer alongside Blackstone. The terms were not disclosed, but Blackstone’s private equity funds will maintain majority control of the company, which they acquired in 2021 at a valuation of $1.4 billion.

The investment is aimed at scaling Sphera’s product portfolio and global reach at a time when demand for ESG data and risk management software continues to accelerate among corporates and investors.

Expanding Capabilities in Sustainability Software

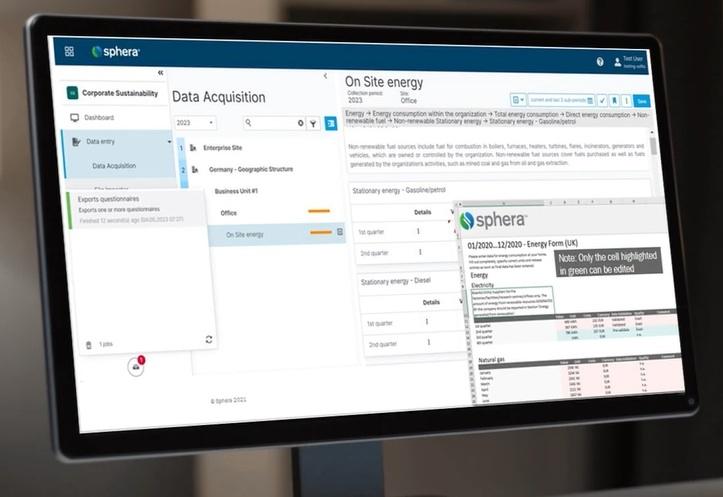

Founded in 2016, Sphera has grown into one of the most widely used platforms for integrating sustainability into enterprise operations. Its offerings include software and advisory services for environment, health, safety and sustainability (EHS&S), life cycle assessment, process safety management, product stewardship, and supply chain transparency.

The company says its tools now serve more than 8,500 customers and one million users in 100 countries. These include corporations under growing pressure from regulators, investors, and supply chain partners to provide verifiable sustainability and risk disclosures.

Sphera CEO and President Paul Marushka welcomed the new investment as a way to “accelerate innovation, expand our global reach and continue empowering organizations to navigate complexity and drive sustainable performance.”

Investor Confidence in ESG Data

For Neuberger Berman, the decision reflects conviction that the sustainability software segment is becoming essential to corporate governance and investor due diligence. David Lyon, Head of Neuberger Berman Capital Solutions, said Sphera “has long stood out as a differentiated, industry-leading company providing critical operational risk software and solutions with demand that is supported by long-term trends.”

The move also demonstrates how private capital is shifting toward scalable ESG infrastructure. With data quality, regulatory alignment, and risk transparency central to boardrooms worldwide, investors see platforms like Sphera as positioned to capture durable growth.

Blackstone Continues Its Bet

Blackstone executives emphasized that the company has already delivered strong performance since their 2021 acquisition. “Sphera has achieved impressive growth and product innovation during our investment, cementing its industry-leading position,” said Eli Nagler, Senior Managing Director, and Kelly Wannop, Managing Director. “We are very pleased to continue our partnership, together with the management team and Neuberger Berman, in support of the company’s continued expansion.”

The partnership structure suggests Blackstone is keen to retain control while bringing in an additional investor to help fund the next phase of expansion. For large private equity players, co-investments like this reduce concentration risk while allowing them to ride sector tailwinds.

RELATED ARTICLE: Blackstone and Rivean Acquire Solar Company Esdec

Strategic Context for Executives and Investors

For C-suite executives, the deal is another sign that sustainability reporting and risk management are moving from compliance to core business operations. With the EU’s Corporate Sustainability Reporting Directive (CSRD) and the International Sustainability Standards Board (ISSB) frameworks tightening disclosure requirements, companies are seeking platforms that can standardize and verify data across jurisdictions.

Institutional investors, meanwhile, are watching the growth of software providers like Sphera as potential long-term beneficiaries of the regulatory convergence. The sector is also seeing consolidation, as financial sponsors move quickly to secure platforms capable of integrating life cycle assessment, supply chain monitoring, and ESG assurance.

A Global Market Taking Shape

The Sphera deal reflects broader momentum in sustainable finance infrastructure. Software companies that can embed ESG into the operational fabric of corporations are becoming indispensable to meeting net-zero targets and managing reputational risk.

As capital markets lean on disclosure and verification, and regulators impose stricter guardrails, the demand for scalable, tech-driven ESG solutions is likely to expand further. For both Blackstone and Neuberger Berman, their continued bets on Sphera point to confidence that sustainability software has matured from a niche toolset into a critical part of the corporate governance architecture.

Follow ESG News on LinkedIn