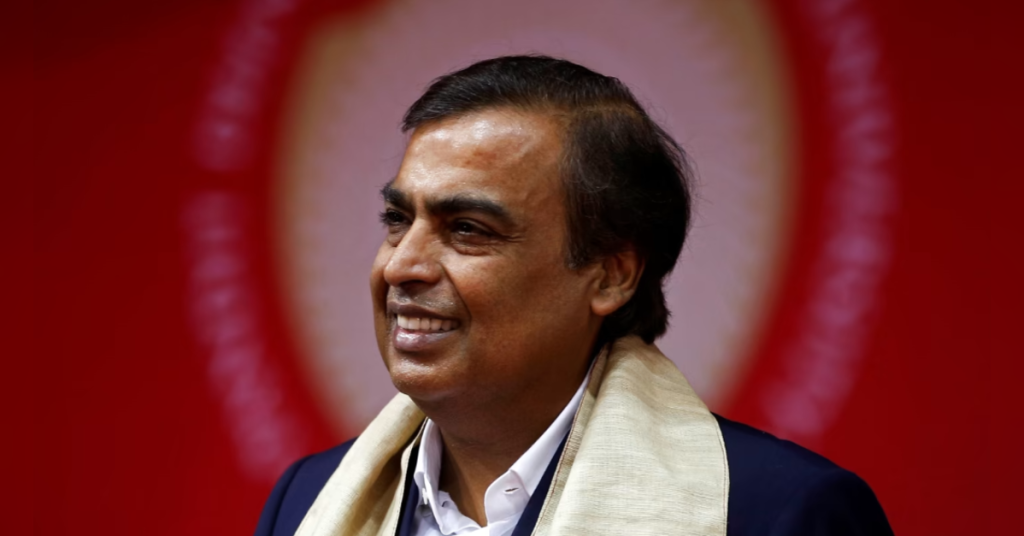

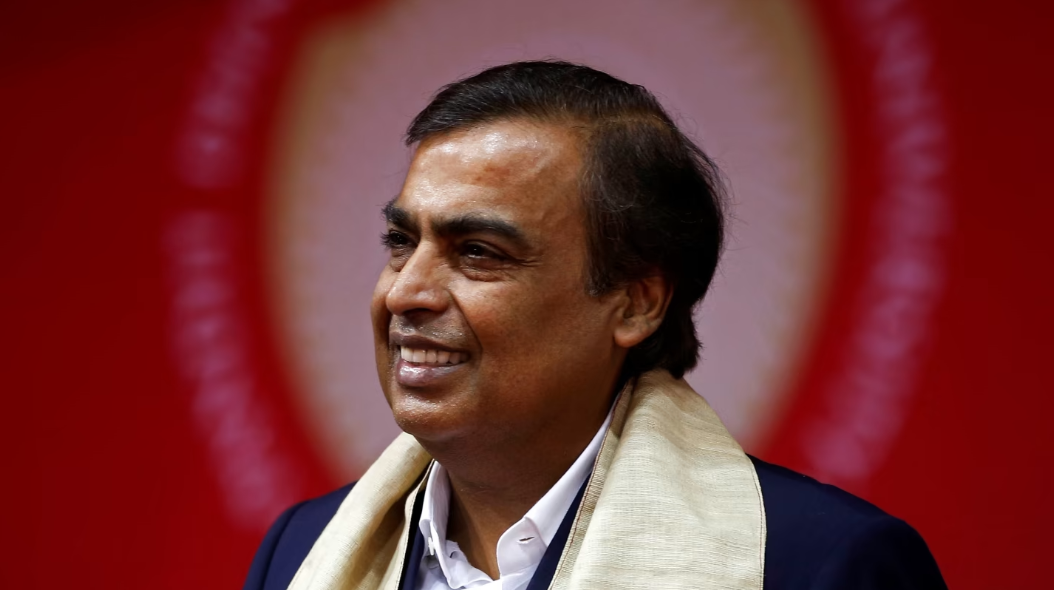

During Q1 FY26, energy markets faced heightened uncertainty due to sharp fluctuations in crude prices, said Reliance Chairman and MD, Mukesh Ambani, adding that the company’s Oil to Chemicals (O2C) business posted strong growth by focusing on domestic demand and value-added solutions through the Jio-bp network.

Performance was supported by improvement in fuel and downstream product margins. Natural decline in KGD6 gas production resulted in marginally lower EBITDA for Oil & Gas segment, he said.

Reliance’s core oil-to-chemicals segment, which contributes about 57 per cent to overall revenue, had come under pressure in recent quarters as the global economic slowdown and destocking of inventories led to a sharp decline in transportation fuel cracks and sluggish demand for petrochemicals. However, the oil-to-chemicals segment benefited from improved domestic fuel retail margins, a recovery in transportation fuel cracks and a rise in petrochemical demand.

RIL’s O2C EBITDA rose 10.8 per cent year-on-year in the June quarter, supported by improved domestic fuel retail margins, stronger transportation fuel cracks, and better PP and PVC spreads. However, segment revenue declined 1.5 per cent year-on-year, impacted by lower crude prices and reduced volumes due to a planned shutdown. Increased domestic fuel placement via Jio-bp partly offset the decline.

The company reported a 1.2 per cent year-on-year decline in revenue from its Oil and Gas segment in Q1 FY26, mainly due to reduced sales volume of KGD6 gas amid natural production decline, lower CBM gas prices, and weaker crude price realisations. The impact was partially offset by better KGD6 gas price realisation. Segment EBITDA also fell 4.1 per cent year-on-year, driven by lower revenues and higher operating costs from increased maintenance activities during the quarter.