(Bloomberg) — Mexico’s economy expanded slightly in the first quarter on a jump in agricultural output, allowing President Claudia Sheinbaum to avoid recession as she steers the nation through an unpredictable US tariff policy.

Most Read from Bloomberg

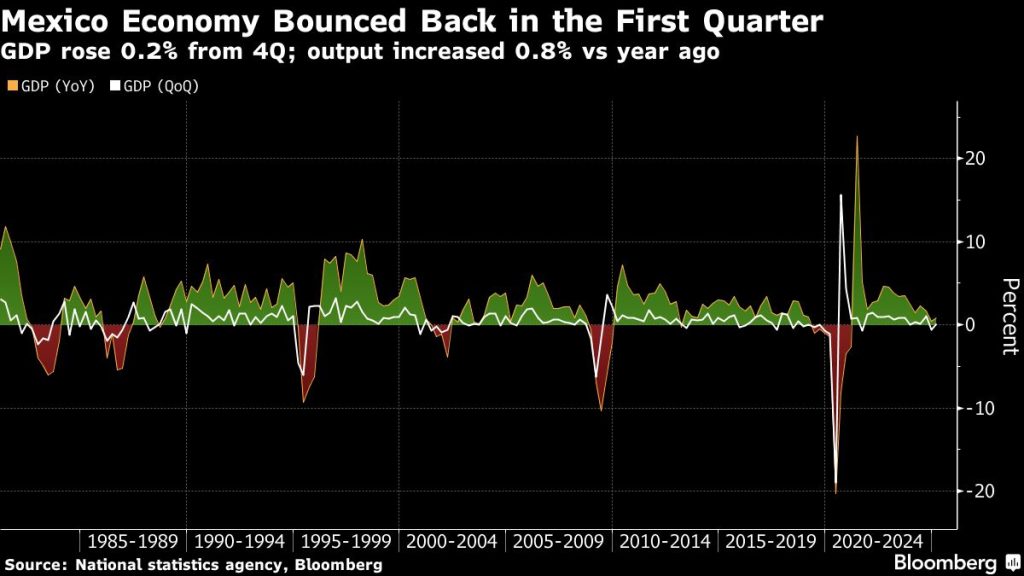

Gross domestic product grew 0.2% in the three months through March, above the 0.1% median estimate of economists surveyed by Bloomberg, after a 0.6% decline in the prior quarter. From a year before, GDP expanded 0.8%, higher than the 0.7% median estimate, according to preliminary data published Wednesday by the national statistics institute.

Quarterly growth was driven by an 8.1% surge in the agricultural sector, which bounced back from a plunge at the end of 2024. On the other hand, industry shrank 0.3% during the period and the services sector was flat.

The jump in agriculture “offset weakness in both the services and the industrial sector,” Kimberley Sperrfechter, an emerging markets economist at Capital Economics, wrote in a research note.

Since Donald Trump’s return to office, analysts have expected Mexico’s economy would slow for a fourth year in 2025 on a proliferation of headwinds including the “America First” trade protectionism from its northern neighbor. Surprisingly, those same concerns helped first-quarter results. Although manufacturing output was weak, exports were strong, with US importers bringing forward orders to dodge more punitive tariffs on Mexico’s goods.

What Bloomberg Economics Says

“GDP data show the Mexican economy rose in the first quarter and narrowly avoided a technical recession, but it doesn’t ease concerns about the growth outlook. Results along with monthly data through February point to activity and domestic demand falling in March in line with waning tailwinds from businesses front-running tariffs that contributed to first-quarter growth.”

— Felipe Hernandez, Latin America economist

— Click here for full report

The risk of onerous duties on exports to the US, far and away Mexico’s top trading partner, continues to loom with Trump’s threats of “reciprocal” tariffs on more goods still a very real possibility.

Levies on products that are not covered by North America’s free trade agreement are already in place, along with duties on steel, aluminum and the portions of finished automobiles that aren’t made in the US.

Sheinbaum has been trying to reduce the tariffs via direct phone calls with Trump while Mexican officials also travel to Washington on a weekly basis.

Answering a question about how the GDP contraction in the US during the first quarter could affect Mexico, Sheinbaum said later on Wednesday she was confident that the local economy is doing well, since a recession was avoided, unemployment remains low and inflation is stable.

“There is growth, 0.8%, of course we want more, but in the face” of tariffs and the “uncertainty of all these months, it is good news,” she said during a press conference.

Growth Forecasts

Since Trump’s victory, businesses in Mexico have been preparing for a scenario of high levies by increasing their exports to the US and looking for parts suppliers from countries other than China.

Meanwhile, real estate developers have been offering incentives to foreign companies to stay in Mexico, betting the local nearshoring boom will not end.

Still, Latin America’s No. 2 economy shrank by the most since 2021 in the last quarter of 2024, and many analysts have been marking down their 2025 growth forecasts.

Mexico’s central bank recently cut its 2025 GDP estimate in half to 0.6% while a Citi survey of analysts pegged it lower still at 0.2% — down from 1% in February.

Asked about the Finance Ministry’s more optimistic forecast of economic growth of 1.5% to 2.3% this year, Finance Minister Edgar Amador said estimates are “complicated” due to changes in international trade. “Our base scenario is not a recession, but an expansion of the economy” in 2025, he said during a press conference.

Economic growth during the second quarter will be critical to understanding the impact of tariffs in Mexico, added Rodrigo Mariscal, an official at the ministry’s economic planning unit.

The weak first quarter GDP data will reinforce the central bank’s concerns about the health of the economy, “which currently appears to be playing a more prominent role than inflation” for policymakers, Sperrfechter wrote. “This should pave the way for another 50bp rate cut at Banxico’s meeting next month.”

National Mood

Sheinbaum’s administration, in turn, has offered incentives to foreign companies to relocate operations to Mexico, especially through generous tax breaks and the promise of significantly reduced red tape.

Every Thursday at her daily press conferences, she announces millions of dollars in promised investments from local and foreign companies as a sign of investor confidence.

At the same time, Sheinbaum’s popularity has surpassed that of her predecessor and mentor, Andres Manuel Lopez Obrador, as she rallies the country behind her.

While about 80% of Mexicans believe tariffs have hurt the economy, roughly three-quarters say they are confident Sheinbaum will be able to negotiate new agreements to reduce them.

Most Mexicans also see the country heading in the right direction overall, with 54% saying they expect the economy to improve over the next six months against 21% who see it worsening, according to LatAm Pulse, a survey conducted by AtlasIntel for Bloomberg News and published on Monday.

Despite that optimism, the first quarter GDP report was consistent with the broader picture of slowing economic growth under the weight of tighter financial conditions and worsening external headwinds, Andres Abadia, chief Latin America economist at Pantheon Macroeconomics, wrote in a note.

“Output in key sectors is under severe strain, underscoring the complexity of the macro backdrop,” Abadia wrote. “Activity will likely remain subdued in the near term. Industrial production is set to stay under pressure, though output could see a temporary lift as firms build inventories ahead of potential new US tariffs.”

–With assistance from Rafael Gayol, Robert Jameson and Maya Averbuch.

(Updates with Finance Minister’s comments in 15th paragraph.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.