New Delhi: Megha Engineering & Infrastructures Ltd has secured the landmark mandate to build and operate India’s first private-sector strategic petroleum reserve (SPR), said people with knowledge of the matter.

The ₹5,700-crore project with an estimated $1.25 billion (₹11,020 crore) crude oil filling cost at current prices would also mark the largest-ever private initiative to strengthen the country’s energy security.

Megha Engineering has five years to build and 60 years to operate a 2.5 million metric tonnes (MMT) SPR at Padur in Karnataka. That would significantly boost India’s current 5.33-MMT strategic stockpile which can cover only 8-9 days of crude demand when full.

Part of India’s existing strategic reserves are already located in Padur.

Indian Strategic Petroleum Reserves (ISPRL), the state-owned body managing existing SPRs, ran the bid, which hinged solely on the amount of viability gap funding (VGF) sought by bidders.

The VGF was capped at 60% of the ₹5,700-crore project cost, or ₹3,420 crore.

Megha’s bid, marginally below this ceiling, beat two rivals to win the mandate, said the people cited above. They did not name the rival bidders.

India’s existing SPR capacity of 39 million barrels is operated by ISPRL and located in underground caverns at Visakhapatnam, Mangaluru, and Padur. This is much less than the 727 million barrels of the US. China’s SPR capacity is estimated at more than 1,200 million barrels.

ISPRL is likely to soon sign the deal with Megha, and hand over, free of cost, the 214-acre land parcel for building the storage, the people said. The contract may also include clauses requiring the company to fill at least part of the SPR cavern to safeguard the government’s objective of emergency preparedness, they added.

Trading requires expertise

Megha will be able to recoup its investment by leasing storage space to the government or oil companies, and trading the crude it holds, with full commercial freedom, people said. Leasing part of the storage can secure steady cash flow, while trading entails higher risk and demands specialised expertise.

The government will retain first rights over the oil in times of emergency, ensuring the reserve serves as both a commercial asset and a national safeguard.

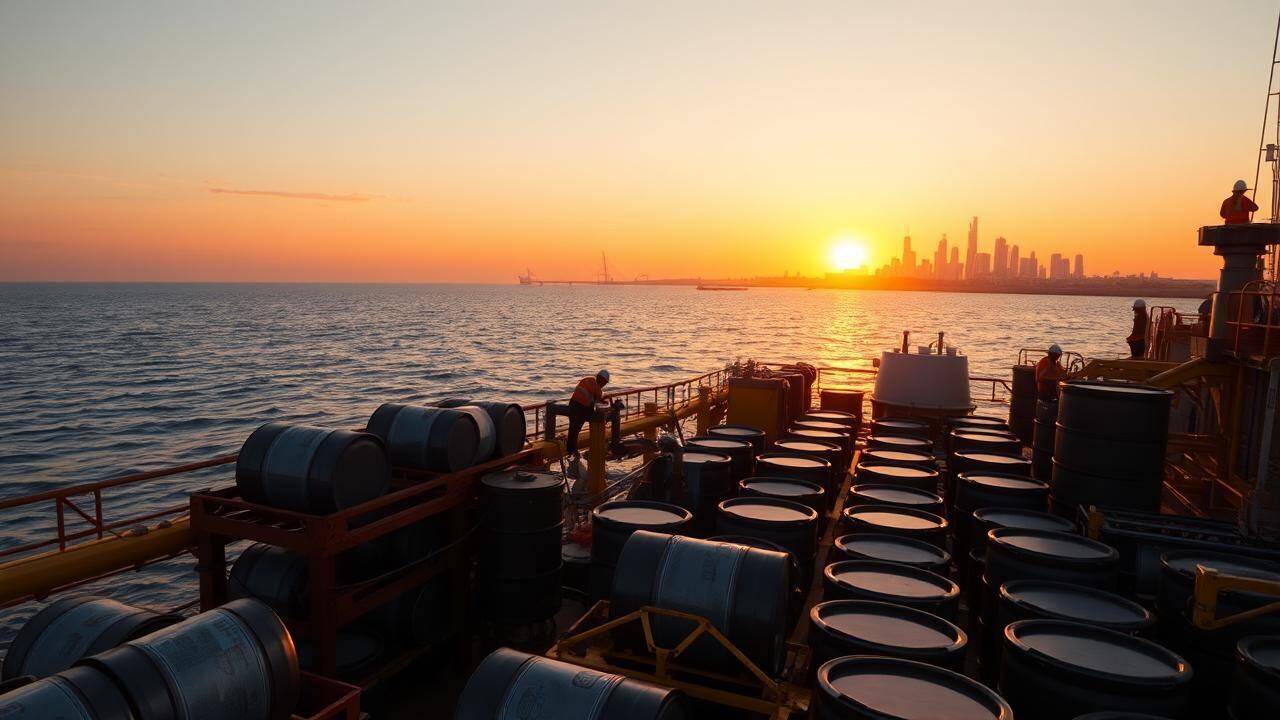

The Padur project also entails building dedicated oil loading and unloading facilities, along with onshore and offshore pipelines.

Megha has largely worked as an EPC contractor for oil and gas firms, constructing refinery units, laying pipelines, and supplying rigs. It is also building an underground LPG storage facility for Hindustan Petroleum. Running an SPR, however, would mark an entirely new frontier for the Hyderabad-based company.

Private sector participation in India’s strategic petroleum reserves was first mooted over a decade ago. The Union cabinet gave an in-principle approval in 2018 to two projects under a public-private partnership model.