Oil prices have rebounded sharply on geopolitical risk despite no meaningful supply losses.

Call Options Go Wild as Brent Traders Bet Big on Chaos

– Iran protests and the increasing probability that US President Trump would exploit that unrest for another series of strikes on Tehran have been dragging oil prices higher, boosting oil options trading in recent days.

– This Monday witnessed the busiest-ever single day of Brent crude call option trading (556,000 contracts) as market participants rushed to the market to protect themselves against sudden price spikes.

– According to Bloomberg, ICE Brent’s second-month options ‘skew’ now favours calls instead of puts, signalling the arrival of high-impact geopolitical stress ahead.

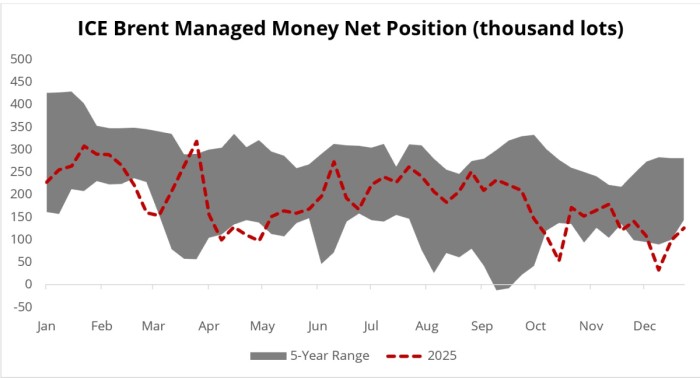

– In late December it seemed that market sentiment on crude would make hedge funds’ net positioning negative for the first time in 16 months (and only the second time in post-COVID years), with ICE Brent balancing on the brink of net length.

– By now however, money managers are eagerly taking up long positions on crude, with the net length in ICE Brent quadrupling to 122,965 lots (as of January 06) in just three weeks.

Market Movers

– US President Trump has signalled that he may exclude US oil major ExxonMobil (NYSE:XOM) from his Venezuela drive after CEO Darren Woods called the Latin American country ‘uninvestable’, a position that Trump labelled ‘too cute’.

– French oil major TotalEnergies (NYSE:TTE), along with Italy’s ENI and QatarEnergy, has been granted the Block 8 offshore exploration block in Lebanon’s waters, expanding its appraisal area in the Eastern Mediterranean.

– Seeking to reduce the shipping industry’s reliance on green bunkering fuels, shipping giant Maersk (COP:MAERSK) is seeking to boost its use of ethanol as a fuel, tapping into US and Brazilian production of the biofuel.

– The world’s largest mining company BHP (NYSE:BHP) is set to wait out the Rio Tinto-Glencore merger talks and not to bid for the Swiss firm, potentially paving the way for the $210 billion megamerger.

Tuesday, January 13, 2026

Social unrest in Iran, Trump’s 25% extra tariff on buyers of Iranian crude, confusion over Venezuela’s oil exports and repeated strikes on tankers in the Black Sea have prompted an impressive recovery in oil prices, with ICE Brent bouncing back to $65 per barrel. At the same time, there has been no physical impact on production (perhaps excepting Kazakhstan, the least talked-about subject on the list of disruptions), therefore it would only take one IEA report for the markets to start talking about oversupply again.

Traders Outpace Majors on Venezuela Return. Global trading giant Vitol and Trafigura have started offering Venezuelan crude cargoes to Indian and Chinese refiners, to be delivered in March, acting quicker than US oil majors that have voiced their reservations about a potential hasty return.

OPEC Output Falls on Geopolitical Risk. Trump’s maritime blockade of Venezuela and tighter US sanctions on Iran have lowered supply in both countries, leading to OPEC production declining month-on-month by 100,000 b/d to 28.4 million b/d instead of a planned 85,000 b/d increase.

Trump Eyes Lifting of Venezuela Sanctions. US Treasury Secretary Scott Bessent announced that the White House could start lifting sanctions on Venezuela as soon as next week to facilitate oil sales and that the Trump administration would be meeting with the World Bank and IMF to re-engage them.

Indonesia Eyes Belated Downstream Boost. Indonesia’s President Subianto inaugurated the $7.5 billion upgrade on the country’s key Balikpapan refinery, taking its capacity from 260,000 b/d to 360,000 b/d, promising that the country will no longer import gasoline, without providing a timeline.

Tehran Troubles Disrupt Loadings. After Iran turned off nationwide internet last week, loading activities in the country’s two main crude export terminals were disrupted, yet media reports show sales of Iranian crude to China continue unimpeded, with prices around a -$9 per barrel to Brent.

California’s Refiners Are No Longer Dreaming. US downstream giant Valero Energy (NYSE:VLO) decided to cease refining operations at its 145,000 b/d Benicia refinery in California at the end of February, two months ahead of its initial deadline as it seeks to avoid any additional turnarounds.

Ukraine Goes on Tanker Blasting Spree. Less than two months after a Ukrainian drone attack debilitated Kazakh crude loadings from the CPC terminal located in Russia, three Greek-operated oil tankers were hit by drones in the Black Sea this week, en route to load Kazakh-produced barrels.

US Court Disrupts Trump’s Offshore Wind Crusade. A US federal judge overturned Donald Trump’s ban on the nearly finished $5 billion Revolution Wind project, allowing the operator Orsted (COP:ORSTED) to resume work in defiance of the Interior Dept’s December 22 suspension order.

Norway Awards 2026 Exploration Awards. Norway’s Energy Ministry has awarded stakes in 57 offshore oil and gas exploration licences to 19 licences in its annual 2026 licensing round, with most of upcoming drilling activity still centred around the North Sea with only 5 blocks in the Barents Sea.

Tehran Frees Detained Oil Tanker. In a sign to appease US President Donald Trump, Iranian authorities have released the St. Nikolas tanker, operated by the Greek Empire Navigation, having seized it in Omani waters in January 2024 for what Tehran alleged was US ‘theft’ of Iranian oil.

Gold Keeps on Zooming as $5,000 Threshold Nears. Gold prices have posted another record high this week, hitting $4,629 per ounce in the Monday trading session, with the US December inflation data coming in flat at 2.7% only confirming expectations of two Fed interest rate cuts in 2026.

Canada’s Offshore Options Widen. The provincial government of Newfoundland is expediting approvals to facilitate a late Q1 FID for Equinor’s (NYSE:EQNR) Bay du Nord offshore deepwater project in Canada’s Atlantic waters, aiming for first oil from the 200,000 b/d field by 2030-2031.

South Korea Doubles Down on Nuclear. South Korea’s Climate and Energy Ministry plans to increase nuclear power generation to a 15-year high in 2026, boosting the utilization rate of its reactors to 89% (from 84.6% in 2025), seeking to lower LNG import requirements and restrict coal utilization.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com