Climate data solutions provider Jupiter Intelligence announced the launch of a series of new tools, aimed at enabling banks and asset managers to quantify physical climate risk within their portfolios and to calculate the ROI on resilience investments.

The new tools will form part of Jupiter Intelligence’s flagship ClimateScore Global climate analytics platform. Launched in 2020, the platform was designed to enable financial institutions to understand and respond to physical climate risks.

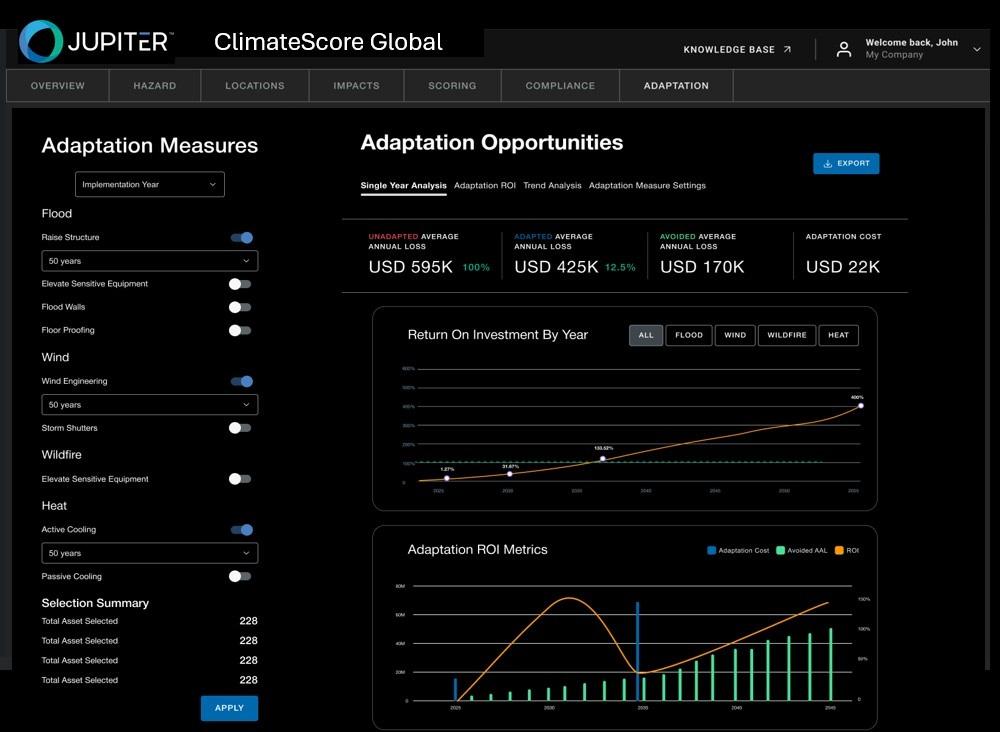

Among the key new features introduced on the platform are the “Jupiter Adaptation Hub,” with capabilities enabling the quantification of avoided losses and calculation of ROI across a series of adaptation strategies, and “Jupiter Entity Modeling,” providing climate risk insights across entities including securities, funds, corporates, and investment vehicles.

Additional capabilities added to the platform include “Jupiter MetricEngine,” aimed at providing quant teams and risk officers with scenario-specific model outputs, including custom return periods, exceedance probabilities, daily threshold counts, and loss distributions, and “Subsidence Peril Metric,” focused on modelling structural risks from soil-moisture fluctuations in clay-rich soils, including a model that estimates average annual damage based on foundation type and construction materials.

According to Jupiter Intelligence, the new capabilities come as climate change accelerates and intensifies the damage and financial impact caused by severe weather events around the world, leading to a need by financial institutions and institutional investors to quantify climate risk and model their response strategies.

Rich Sorkin, co-founder and CEO, Jupiter Intelligence, said:

“These platform advances ensure that customers have the tools needed to lead their sectors in climate-informed decision-making with the precision and defensibility that investment committees, regulators, and boards now require.”