Reports of a surprise Israeli strike on Hamas targets in Qatar jolted markets, lifting Brent briefly above $67/bbl as traders priced in a higher Middle East risk premium and potential supply-security disruptions.

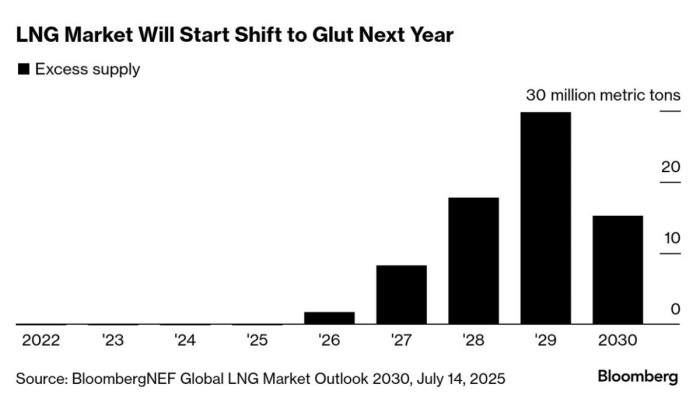

Gas Markets Brace For Generational Supply Glut

– Following four years of tightness, global LNG supply is set for a prolonged period of oversupply as the United States, Qatar, Canada and even Russia all add hefty volumes of incremental supply from 2026 onwards.

– Simultaneously to the US ramping up Plaquemines and Corpus Christi III, Qatar’s largest expansion since 1997, the 32 mtpa North Field East, will start producing LNG mid-next year.

– Higher supplies should also mean higher LNG demand as the boil-off tends to disincentivize storing gas for long stretches of time, with the IEA expecting a 7% year-over-year increase.

– Whilst LNG prices for October-delivery cargoes now hover within the $11.00-11.50/MMBtu range, leading banks anticipate both JKM and TTF prices to dip into single digits by Q4 2026 and stay below $10/MMBtu for the rest of this decade.

– Russia could become the LNG markets’ black swan factor over the upcoming years as China starting to buy sanctioned gas from the 19.8 mtpa Arctic LNG 2 plant could add to the oversupply.

Market Movers

– UK oil major BP (NYSE:BP) signed a memorandum of understanding with Egyptian authorities to drill five new gas wells in the Mediterranean Sea, boosting the country’s exploration efforts.

– Canada’s Strathcona Resources (TSO:SCR) raised its offer for peer oil sands producer MEG Energy (TSO:MEG), now offering $30.86 per share as it seeks to trump Cenovus Energy’s $27.79 per share bid.

– UK-based energy major Shell (LON:SHEL) farmed out a 55% interest in its offshore Block 04 in São Tomé and Principe’s territorial waters to Brazil’s Petrobras and Portugal’s Galp.

– Speaking at the 2025 APPEC conference in Singapore, Chevron (NYSE:CVX) top executive Brant Fish said that the U.S. oil major will invest heavily in petrochemicals in South Korea and cut down on its refining presence in Singapore.

Tuesday, September 09, 2025

OPEC+ pulled off a deft bit of expectations management—letting chatter build around a large output hike, then delivering far less. Even with an extra ~137,000 b/d coming from the group, Brent has rebounded to around $66.50/bbl, and it briefly jumped above $67 after reports of a surprise Israeli strike on Hamas targets in Qatar. Near-term upside risk also lingers if President Trump follows through on renewed talk of Russia sanctions.

OPEC+ Moves Ahead with Unwinding Cuts. Despite initial speculation that eight OPEC+ members could bring as much as 550,000 b/d of production back in October, the oil group agreed to raise collective output by ‘only’ 137,000 b/d to regain market share.

Saudi Arabia Slashes Asian Prices. Saudi national oil company Saudi Aramco (TADAWUL:2222) has reacted to the OPEC+ decision by cutting the official selling price for October-loading cargoes headed to Asia by $1 per barrel, dropping it to a $2.20 per barrel premium vs Oman/Dubai.

Gold Soars to New Highs on US Concerns. Underwhelming US labor data from last week’s nonfarm payroll data helped push gold prices above $3,600 per ounce for the first time in history, with traders now seeing an almost 90% probability of a quarter-point Fed rate cut in September.

Nigerian Oil Workers Call for Anti-Dangote Strike. Nigeria’s main oil and gas union Nupeng, has called for a nationwide strike starting September 8 over the 650,000 b/d Dangote refinery’s policy of banning its workers from unionizing, jeopardizing West African fuel supply.

Japan Seeks Third-Party Opinion on Alaska LNG. Japan’s Ministry of Economy, Trade and Industry (METI) hired energy consultancy Wood Mackenzie to assess the $44 billion Alaska LNG project promoted by US President Trump, adding to worries about its profitability.

ExxonMobil Slams EU Energy Policy. US oil major ExxonMobil (NYSE:XOM) has publicly criticized Europe’s ‘high-regulation, high-cost’ emission policies, saying the ongoing industrialization is hurting EU economies as the oil major seeks to sell its chemicals business on the Old Continent.

Russian Companies Rush to Issue Yuan Bonds. The Beijing-Moscow energy axis has been booming since last week’s SCO summit in China, with Russia’s state-controlled Gazprom, Rosneft and Rosatom all moving ahead with sales of yuan-denominated ‘panda’ bonds.

Canada’s Key Ports Sets Sight on Dredging. Canadian pipeline operator Trans Mountain expects by early 2027 ships taking crude at TMX’s Westridge terminal would be finally able to load 100% of an Aframax tanker once ongoing dredging works finish, with capacity currently capped at 550,000 barrels.

Key Copper Mine Halted Amidst Mudslides. US copper giant Freeport-McMoran (NYSE:FCX) halted mining operations at Indonesia’s Grasberg mine, the second-largest copper mine in the world, after mudslides blocked access to parts of the underground infrastructure.

India Revokes Grid Access to Renewables. India’s power grid authority has revoked grid access for almost 17 GW of renewable energy projects in order to prioritize smooth connectivity of other generation capacity that’s operational or nearing completion soon.

Gazprom Claims a Deal that Wasn’t. Russia’s gas giant Gazprom claimed to have clinched a deal to increase gas flows to Kazakhstan in 2025-2026, seeking to offset list volumes to Europe; however, the Kazakh side played it down by saying there were only discussions on potential cooperation.

Top 2025 Mining Merger Is Happening. London-headquartered mining giant Anglo American (LON:AAL) announced that it has agreed to merge with Canada’s copper miner Teck Resources (TSO:TECK), creating a new entity Anglo Teck with the former owning 62.4%.

Malaysia’s Key LNG Plant Under Threat. Malaysia’s largest LNG export facility, the 29.3 mtpa Bintulu terminal located in the state of Sarawak, was placed under heightened security measures after it received threats to ‘burn it down’.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com