Iran unrest and tempered Venezuela expectations lifted Brent toward $63 a barrel.

Friday, January 09, 2026

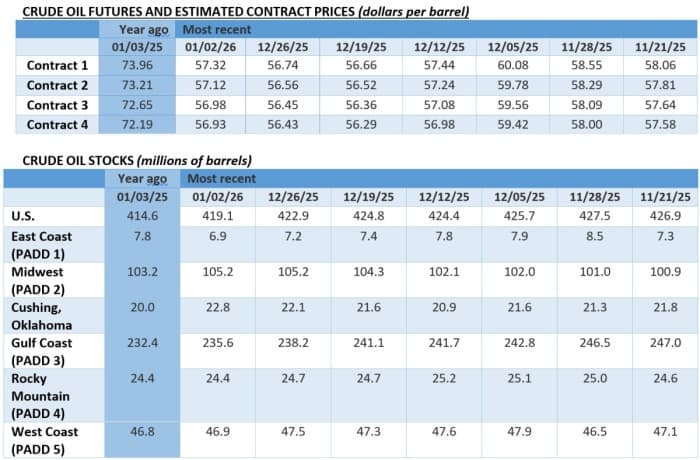

Iran protests have added some impetus to 2026’s heretofore surprisingly bullish start, putting potential supply disruptions back on the agenda. Moreover, the failure of the Trump government to entice US oil majors to invest in Venezuela and Treasury Secretary Bessent’s call for ‘wildcatters’ to drill there soothed some concerns that Venezuela’s oil production could soar in the near term. As such, ICE Brent is set to end this week with a $2 per barrel gain at almost $63 per barrel, the third weekly gain in a row.

US Seizes Escaping Russian-Flagged Tanker. The US military seized the Russian-flagged Marinera tanker in the northern Atlantic Ocean after a three-week pursuit, simultaneously to the boarding of the fully laden M Sophia in Caribbean waters for allegedly ‘conducting illicit activities’.

Iraq Nationalizes Its Largest Producing Oil Field. Iraq has approved plans to nationalize the 500,000 b/d West Qurna 2 oilfield, taking it over from previous operator Lukoil, which was forced to call a force majeure in November due to US sanctions and letting state-owned Basrah Oil run its operations.

Rio Tinto-Glencore Merger Blows Metal Markets Up. Two of the world’s largest mining companies, Rio Tinto (NYSE:RIO) and Glencore (LON:GLEN), stated they’re in early talks to create the world’s largest miner with a combined value of $207 billion, building on a stalled 2024 merger proposal from Glencore.

Trading Sharks Latch onto Venezuelan Volumes. Global trading giants Vitol and Trafigura are reportedly negotiating with the US government to market Venezuelan oil, according to media reports, several days after the White House announced a $2 billion deal with Caracas to sell 30-50 million barrels from PDVSA.

Seeking to Boost Synergies, Iberian Refiners Unite. Spain’s Moeve and Portugal’s Galp are in talks to merge their downstream businesses, combining assets with a total nameplate capacity of 690,000 b/d (or 5% of Europe and a retail network of more than 3,250 stations, targeting a mid-2026 closure.

Trump Withdraws US from Most International Organizations. US President Trump signed a memorandum on January 7 that triggers the withdrawal of the country from 66 international organizations, including the International Renewable Energy Agency and the UN’s climate change panel.

Trump Pitches 500% Tariffs on Russian Oil Buyers. The White House has greenlighted the US Congress to vote on a Lindsey Graham-sponsored bill that would authorize 500% tariffs on countries that buy Russian crude oil, extending the unprecedented tariff also on gas, uranium and refined product sales.

China Doubles Down on Saudi Crude Purchases. According to media reports, Chinese refiners have nominated 48-49 million barrels of Saudi Arabian crude in February, equivalent to 1.65 million b/d, boosting imports from the Gulf after Saudi Aramco cut prices for the third consecutive month.

Brazil Puts High-Impact Amazon Drilling on Hold. Brazil’s oil regulator ANP has mandated that state oil firm Petrobras (NYSE:PBR) halt offshore drilling in the Foz do Amazonas basin – an untapped oil-rich region where the Amazon meets the Atlantic – after a leak of synthetic fluid was reported this week.

US Oil Majors Eye Turkey’s Offshore Gas. Turkish national oil company TPAO has signed a memorandum of understanding with US major ExxonMobil (NYSE:XOM) to jointly explore gas reserves in the Black Sea and Mediterranean, seeking to build on the success of the 2020 Sakarya gas discovery.

Chinese Car Sales No Longer Looking Hot. Chinese car sales witnessed the steepest drop in almost two years in December, with nationwide sales totalling only 2.28 million units, down 14.5% from a year earlier and an 8.5% month-over-month decline as the government is phasing out trade-in subsidies.

US Aluminium Prices Spiral Out of Control. After Trump’s doubling of US aluminium import tariffs to 50% in June 2025, American premiums to global benchmarks have been constantly rising with prices in the Midwest now $2,100/mt above the LME three-month contract that trades around $3,100/mt.

Texas LNG Liquefaction Capacity Keeps on Growing. Privately-held US developer Glenfarne has started to look for potential project funders for its planned 4 mtpa Texas LNG project, its 2nd large infrastructure project after Alaska LNG, with Gunvor and Macquarie already locking in 20-year term deals.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com