(Oil Price)– Energy prices for consumers across the UK rose again this month.

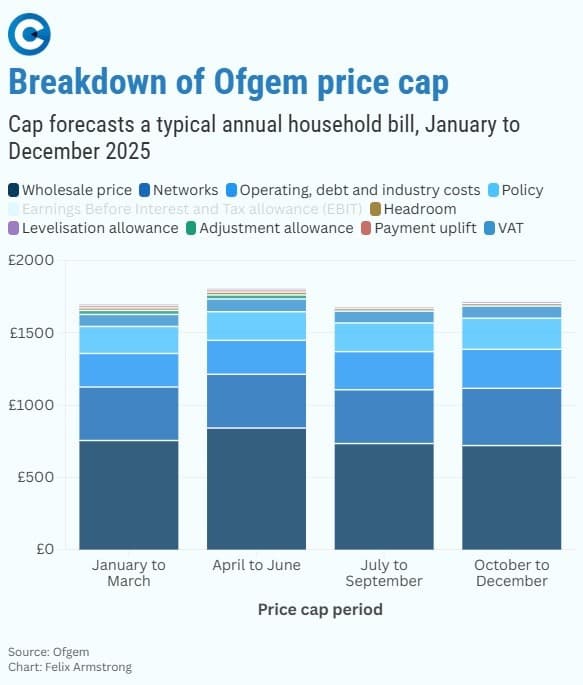

Ofgem, the energy regulator, set the maximum annual rate for an average household for gas and electricity at £1,755 until the end of the year.

The cap is now over £600 higher than when it was first introduced in 2019.

Under the cap, the average price of gas is significantly cheaper than electricity at 6.3p per kilowatt hour (p/kWh) compared to 25.7p/kWh.

New data on Tuesday also showed that the industrial electricity price paid for UK industry was the highest in the developed world. It was 63 per cent higher than France and 27 per cent higher than Germany.

Manufacturing output has been on a downward spiral for months, with the cement and metals industries claiming that the UK is relying more on imports.

British Steel’s operations were taken over by the government after blast furnaces in Scunthorpe were nearly turned off due to soaring energy prices.

With leading industry bodies calling for the government to reduce energy costs on firms via emphatic tax reform – and Labour’s opponents at Reform and the Conservatives calling for a radical change to the entire energy system – there may be no more draining issue facing Keir Starmer at this time.

What do political parties say?

Before coming to power, Labour pledged to accelerate the net zero transition. One of its central missions is still to “make Britain a clean energy superpower” and take greater control of volatile energy prices.

It wants at least 95 per cent of electricity generation to come from clean power by 2030.

The manifesto stated that it would establish a new state-owned company to invest in clean power, deploy dozens of mini nuclear power stations, ban new licences for oil exploration in the North Sea, permanently prohibit fracking, and subsidise insulation, solar panels, heat pumps, wind power, and other net-zero technologies.

Labour has argued its dash for net zero will reduce energy costs in the long term as the UK becomes less reliant on international gas prices, but opponents believe the government should expand drilling in the UK to keep electricity bills down in the short term.

The development of nuclear power stations has been praised as expanding supply, but plants at Sizewell C and other mini sites will take years before they begin to generate electricity and cost tens of billions of pounds to build.

Meanwhile, Kemi Badenoch has taken a harder line on energy policy, pledging to scrap legally binding net-zero targets and instead focus on lowering energy bills.

She also pledged to “maximise” oil and gas extraction, claiming that net zero measures are to blame for high energy bills

On the more radical end, Reform UK leader Nigel Farage said last month that he would scrap Labour’s “harmful, wasteful” net zero policies. Reform has also suggested taxing renewable energy and scrapping net zero targets.

Amid calls for “energy abundance” to boost growth in the UK economy and criticisms of Labour’s net zero policies, high energy bills is now one of the most urgent problems hindering the government’s growth mission.

How are energy prices set?

A mix of volatile prices in international gas markets, energy costs and other taxes – including to fund the drive to net zero – are keeping energy prices high.

Researchers and critics have also debated the extent to which poor infrastructure in the national grid, a reliance on imports for oil and gas, and the UK’s energy strategy have contributed to prices in the UK.

Gas tends to set the base price of energy in the UK, accounting for around 45 per cent of the bill. This is due to a system called “marginal cost pricing”, by which prices are set according to the most expensive source available.

Although renewables usually represent cheaper energy generation, gas almost always sets prices because it is the last to sell at the auctions, which occur every half an hour.

Prices are set according to gas 98 per cent of the time in the UK, analysis by researchers has shown. Gas sets energy prices for an average of 39 per cent of the time across the EU, and as low as one per cent of the time in Norway.

The system incentivises energy producers to offer lower prices while getting paid for more expensive energy generated by another source. However, it is argued that this system means consumers do not see the benefits of cheaper renewable energy.

Is there an alternative to marginal cost pricing?

The other option put forward by energy supplier Octopus – but later rejected by the government after a review – was to change the market system to zonal energy pricing, where electricity prices would be different according to different areas. Proponents of the idea said energy prices would be cheaper at sites near renewable energy sources.

They argue that the taxpayer would pay less on wind farms, having to turn off for curtailment costs when the grid is at capacity. Data from Wasted Wind suggests that the UK has already paid £1bn on wasted wind power this year.

Energy from wind farms – such as the Viking plant on the Shetland Islands – is also often unable to reach areas of the country.

A report by Renewable UK claimed that wind farms accounted for 24 per cent of constraint costs between April 2024 and January 2025, and the payments more often concern gas plants.

Several critics of zonal pricing say it would lead to a “postcode lottery” system and undermine investor confidence at a critical time for the government’s energy transition.

The government decided “a single national wholesale price is the right way to deliver a fair, affordable, secure, and efficient electricity system”.

Are gas prices solely responsible for high energy prices?

Gas prices are not solely responsible for high energy prices.

UK gas prices increased following the Covid pandemic, and spiked further following Russia’s full-scale invasion of Ukraine in February 2022. This resulted in a 54 per cent price-cap increase in April 2022.

While the price of gas has fallen in the following years, it is still over 40 per cent higher than at the end of 2021.

While wholesale gas prices have fallen over the year, electricity prices have been generally stable.

However, beyond the market cost of energy, electricity prices also comprise network costs, energy supplier costs, subsidies for green energy, VAT, and suppliers’ profits.

These taxes and other cost components make up more than half of the bill, meaning gas prices are not solely responsible for an uptick in prices.

Is net zero inflating energy prices?

Net zero is partly making energy prices more expensive.

Given that gas prices do not cover a significant portion of energy costs, there are growing concerns over whether net zero levies and limits on North Sea expansions have made bills disproportionately expensive.

The rate of taxes varies depending on the energy source and whether households or businesses incur expenses.

Levies are mainly used to fund subsidies for renewable energy, national grid upgrades and carbon capture, as well as various other energy projects.