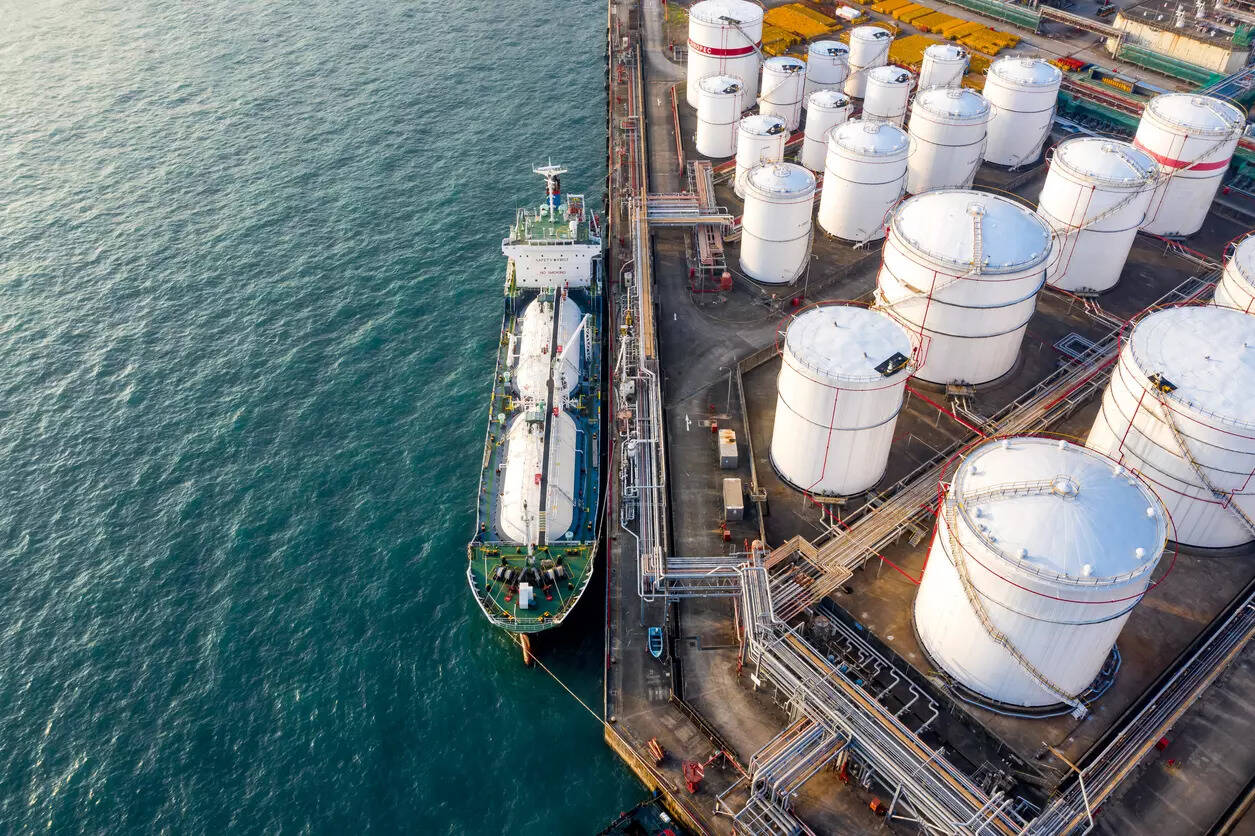

India’s crude oil imports from Russia are expected to have risen slightly in October from a month earlier, according to preliminary ship-tracking data from Kpler and OilX, in spite of pressure from Washington to cut purchases.

India’s Russian oil imports rose to about 1.48 million barrels per day (bpd) in October from 1.44 million bpd in September, Kpler data showed. OilX pegged October imports at the same level and said September imports were 1.43 million bpd. The data excluded oil from Kazakhstan that was exported from Russia.

But India’s Russian oil shipments are expected to slow starting in November after the U.S. sanctioned two major suppliers last month in an effort to end Moscow’s war in Ukraine. This prompted Indian refiners to pause new orders and look for alternatives in spot markets.

India’s Reliance Industries, Mangalore Refineries and Petrochemicals and HPCL-Mittal Energy have stopped purchases of Russian oil, while other refiners are considering buying oil produced by non-sanctioned Russian producers.

“Russian oil imports will not fall until November 21, but definitely after that,” Kpler analyst Sumit Ritolia said.

Fresh U.S. sanctions targeted Russia’s two top oil producers, Lukoil and Rosneft. The U.S. has given companies until November 21 to stop their transactions with these Russian oil producers.

“We see higher imports in the first three weeks (of November),” Ritolia said.

Reliance has bought millions of barrels from the spot markets since the U.S. sanctions were introduced.

Mangalore Refineries and Petrochemicals bought 2 million barrels of Abu Dhabi Murban crude from Glencore via a tender to replace Russian supply in December, sources said.

Indian Oil has invited initial bids for 24 million barrels of oil from the Americas for the first quarter of 2026, according to a document reviewed by Reuters on Thursday.

India emerged as the largest buyer of seaborne Russian crude after Moscow’s invasion of Ukraine in 2022, importing 1.9 million bpd in the first nine months of 2025, or around 40 per cent of Russia’s total exports, according to the International Energy Agency.