In the aftermath of the deterioration of ties with Pakistan, Afghanistan is seeking to diversify its economic linkages. Due to tensions, both the countries have closed trade via land since October 2025.

Earlier this month, Afghanistan’s national flag carrier — Ariana Airlines–– announced that it would be slashing cargo tariffs significantly for trade with India. This decision could give a strong fillip to bilateral trade between the countries. Trade between both countries was estimated at $1billion in 2024. Before the Taliban took over Afghanistan in 2021, bilateral trade between the countries was estimated at $1.8 billion. While Afghanistan’s key exports to India include agricultural goods and minerals, India’s main exports to Afghanistan include textiles, pharmaceuticals, sugar, tea and rice.

Visit of the Afghan Minister of Industry and Commerce to India

The Minister of Industry and Commerce in the Taliban administration, Alhaj Nooruddin Azizi during his five-day visit to India, which began on November 19 2025, flagged the need for greater trade relations between both countries saying that the current level of trade was well below potential. During his visit, which comes a month after that of Afghan Foreign Minister Mawlawi Amir Khan Muttaqi, Alhaj Nooruddin Azizi has met with senior Indian officials, including India’s External Affairs Minister S. Jaishankar, Minister of State for Commerce and Industry, Jatin Prasad and Piyush Goyal – India’s Commerce Minister on November 24, 2025. The Alhaj Nooruddin Azizi also had interactions with several Indian businessmen.

The Chabahar Port and India-Afghanistan trade

The Afghan Minister urged India to expand operations of the Chabahar Port (Iran) and to launch regular shipping lines via Chabahar with the aim of expanding trade between both countries via Chabahar.

The Trump Administration, which has imposed several sanctions against Iran, has issued a six-month waiver to India, effective October 29, 2025, in connection with the Chabahar Port.

The Chabahar Port project is India’s gateway to both Afghanistan and Central Asia, and is important for two reasons. First, Pakistan has consistently blocked land connectivity between India and Afghanistan. Several commentators and analysts have viewed Chabahar as India’s counter to the Gwadar Port, an important component of the China-Pakistan Economic Corridor (CPEC).

In 2024, India signed a 10-year agreement with Iran for the management of Shahid Behesti terminal of the Chabahar Port. India has been seeking to promote greater trilateral connectivity between India, Afghanistan and Iran via Chabahar and a trilateral agreement was signed in 2016. New Delhi has been developing the Chabahar Port since 2018.

The Port has been used to transport relief materials to Afghanistan. India is also keen that it becomes part of the INSTC (International North South Transport Corridor) via which India would strengthen trade relations with Russia and beyond.

Greater air connectivity between India and Afghanistan

Apart from connectivity via the Chabahar Port, both New Delhi and Kabul realise the need for greater air connectivity between the two countries. India announced the start of the air freight corridor on the Delhi-Kabul and Amritsar-Kabul routes and the resumption of air cargo flights (this had been agreed upon during the visit of the Afghan Foreign Minister, Mawlawi Amir Khan Muttaqi). Both sides also announced that they would be appointing trade attaches in Delhi and Kabul, respectively.

Giving a push to trade relations

Some of the other logistical issues the Afghan Minister flagged were: making issuance of visas to Afghan traders more smooth and easing out cargo processing at Nhava Sheva port (near Mumbai).

Haj Nooruddin Azizi also highlighted some of the steps the Taliban Administration has taken to attract foreign investors. The priority areas identified by him were: cement, rice, textiles, pharmaceuticals, and mining.

While speaking at an event at the PHD Chamber of Commerce, the senior Afghan official said: “There’s a huge opportunity for investments in Afghanistan across sectors such as mining, agriculture, health and IT. We have created an enabling environment for traders, and we will fully support the investors.”

Some of the important steps taken by the government to attract investors were also highlighted. This includes: a 1 per cent tariff on raw materials and machinery, a reliable power supply and proposed five-year tax exemptions for new industries.

The importance of visits by senior Afghan officials

There are multiple angles to the recent visits of Afghan officials. Visits of two senior officials clearly indicate that both India and Afghanistan want to upgrade their ties in a complex geopolitical landscape. Second, while trade can be given a push, it is important to address logistical issues and bring all stakeholders on board, including businesses.

Third, while the Chabahar Port is important in the context of India-Afghan economic ties, it remains to be seen if the US extends the waiver issued in October.

Fourth, the Kabul-Amritsar flights could come as a reprieve for Punjab’s traders, since the state has taken an economic hit due to tensions between Pakistan and India and the closure of trade, via the Wagah-Attari land-crossing — in August 2019. Even land trade with Afghanistan via the Wagah-Attari land crossing seems tough for now, given the state of Afghanistan-Pakistan ties. Trade linkages between the border city of Amritsar (Punjab, India) and Afghanistan and beyond, which got disrupted after 1947, continued to suffer due to the strained ties with Pakistan and the overall geopolitical environment of the region. Direct air connectivity with Kabul could thus benefit traders, and ultimately even farmers, from Punjab – especially Amritsar.

In conclusion, recent developments in the context of Afghanistan-India ties are important, but several of the complex logistical and geopolitical obstacles need to be addressed. It is also important to have realistic expectations. It remains to be seen whether the US waiver on the Chabahar Port is extended – as discussed earlier, both countries have been seeking to increase trade via Chabahar.

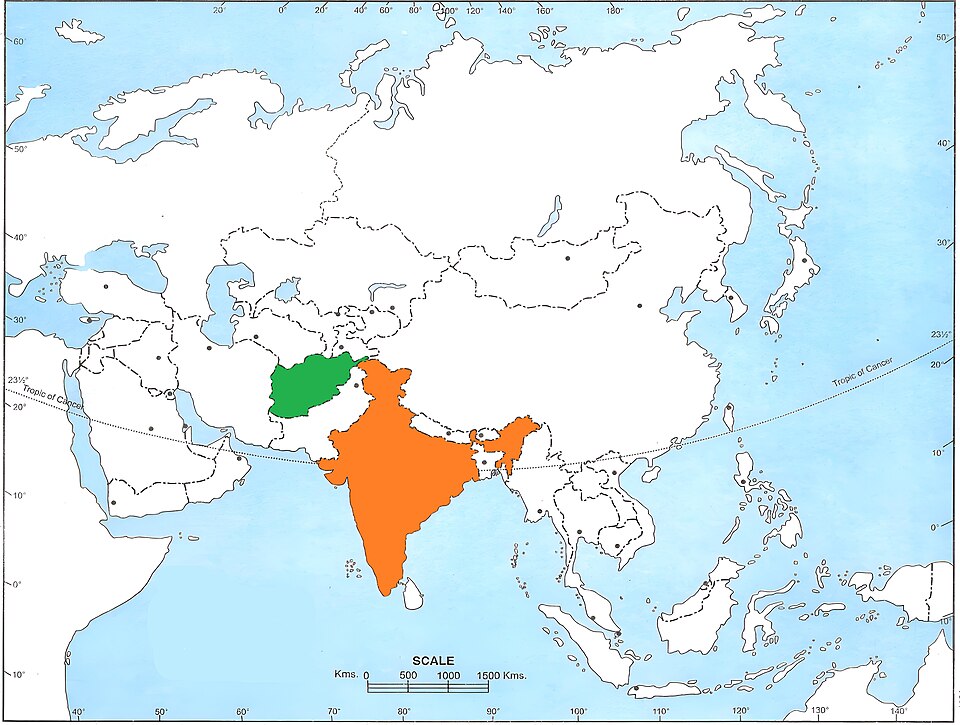

[Photo by INDIAN PATRIOT05, CC BY-SA 4.0, via Wikimedia Commons]

The views and opinions expressed in this article are those of the author.

Tridivesh Singh Maini is a New Delhi based analyst interested in Punjab-Punjab linkages as well as Partition Studies. Maini co-authored ‘Humanity Amidst Insanity: Hope During and After the Indo-Pak Partition’ (New Delhi: UBSPD, 2008) with Tahir Malik and Ali Farooq Malik. He can be reached at tridivesh80@hotmail.com.