IFC and BTG Pactual target up to $1 billion in joint investments by 2028.

Focus areas include conservation, Amazon bioeconomy, and nature-based solutions.

Partnership combines IFC’s development finance expertise with BTG’s regional reach.

The International Finance Corporation (IFC) and BTG Pactual have formed a strategic partnership to accelerate sustainability and development initiatives in Brazil and across Latin America. The collaboration, announced this week, could mobilize up to $1 billion in joint investments and private capital by the end of 2028.

The agreement outlines co-financing of social and environmental initiatives, equity participation in portfolio companies, and investments in infrastructure, private equity funds, and projects tied to nature-based solutions and the Amazon bioeconomy. Both organizations will also exchange best practices, including IFC’s Environmental and Social Performance Standards.

BTG Pactual CEO Roberto Sallouti said the partnership will help scale impactful projects: “The allocation of these resources will be done carefully, adhering to technical and financial criteria, so that the investments to be made available by IFC will be used to promote the changes we need for a more sustainable economy.”

RELATED ARTICLE: Meta Signs Long-Term Deal with BTG Pactual for Up to 3.9 Million Carbon Offset Credits to Support Net Zero Goals by 2030

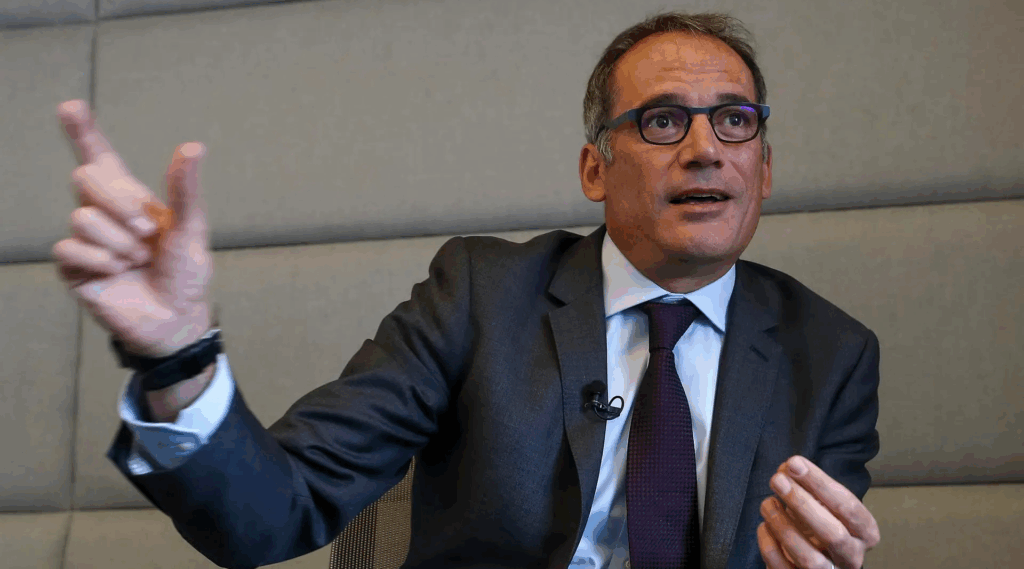

IFC will provide financial and technical expertise, while BTG Pactual will source investment opportunities across the region. According to Alfonso García Mora, IFC Regional Vice President for Europe, Latin America and the Caribbean, “This partnership with BTG Pactual is a testament to our commitment to fostering sustainable private sector development and job creation in Latin America. The private sector can and should be a critical player in advancing the climate agenda and driving transformative initiatives that improve lives and promote economic growth.”

The collaboration builds on IFC’s long-standing role in Brazil’s private sector, where it has invested since 1957 to address development challenges ranging from urbanization and social inclusion to competitiveness and natural resource management.

Follow ESG News on LinkedIn