(Bloomberg) – The International Energy Agency said there’s “considerable downside risk” to its outlook for Russian crude production from US sanctions, but held back from estimating the impact until it sees more details on enforcement.

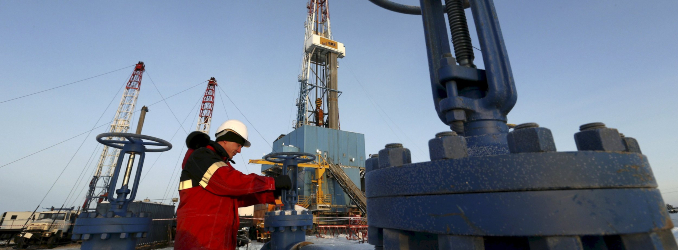

The US imposed its toughest ever energy sanctions on Moscow last month, blacklisting state-run Rosneft PJSC and privately owned Lukoil PJSC, the top two Russian oil producers. The restrictions are intended to reduce the Kremlin’s export revenue and bring President Vladimir Putin into the negotiations to end the war in Ukraine.

The move “may have the most far-reaching impact yet on global oil markets,” the IEA said in its monthly oil market report on Thursday. “While crude flows from Russia remain largely unchanged for now, the unwinding of Rosneft’s and Lukoil’s global value chains poses risks that extend well beyond Russia’s borders.”

For now, the Paris-based agency maintained its estimate for Russia to pump 9.3 million barrels a day of crude on average this quarter and next year. It said it will keep this outlook “until further details on enforcement and potential workarounds become apparent.”

Russian authorities, including Putin himself, have said the new sanctions will have only a marginal effect on the nation’s economy and oil trade, as the country will adopt to the restrictions quickly.

Indeed, Russia has been “demonstrating its ability to rapidly form new oil shipping companies and move more volumes via its sanctioned fleet,” according to the IEA report. Last month, three new firms, which have been operating only since May and are not on any sanctions list, exported around 1 million barrels a day of Russian crude oil and products, it said.

Given this flexibility, Russia’s oil supplies to the global market will depend on “enforcement and sourcing decisions from the main buyers,” according to the report.

So far, Russian oil exports continue “largely unabated”, although barrels on the water are growing as established buyers are assessing potential risks, the IEA said. Still, the latest US restrictions “appear to have more teeth” than the previous rounds, which is demonstrated by a decline in Russian supplies to India, according to the report.

In October, Russia exported a total of 7.4 million barrels a day of crude oil and petroleum products, slightly below the level a month before, according to the IEA. Lower prices for Russian barrels have pushed the nation’s total oil-export revenue down to $13.1 billion, a five-month low, it said.

Lower prices for Russian crude are a significant issue for the Kremlin, which relies on oil and gas taxes for around a quarter of its total revenue. The government in Moscow already expects the 2025 tax flows from the industry to be the lowest since the pandemic.

With Putin showing no intentions of curtailing war spending, Russia’s budget deficit is projected to reach a record 5.7 trillion rubles ($70.3 billion), or about 2.6% of gross domestic product this year.