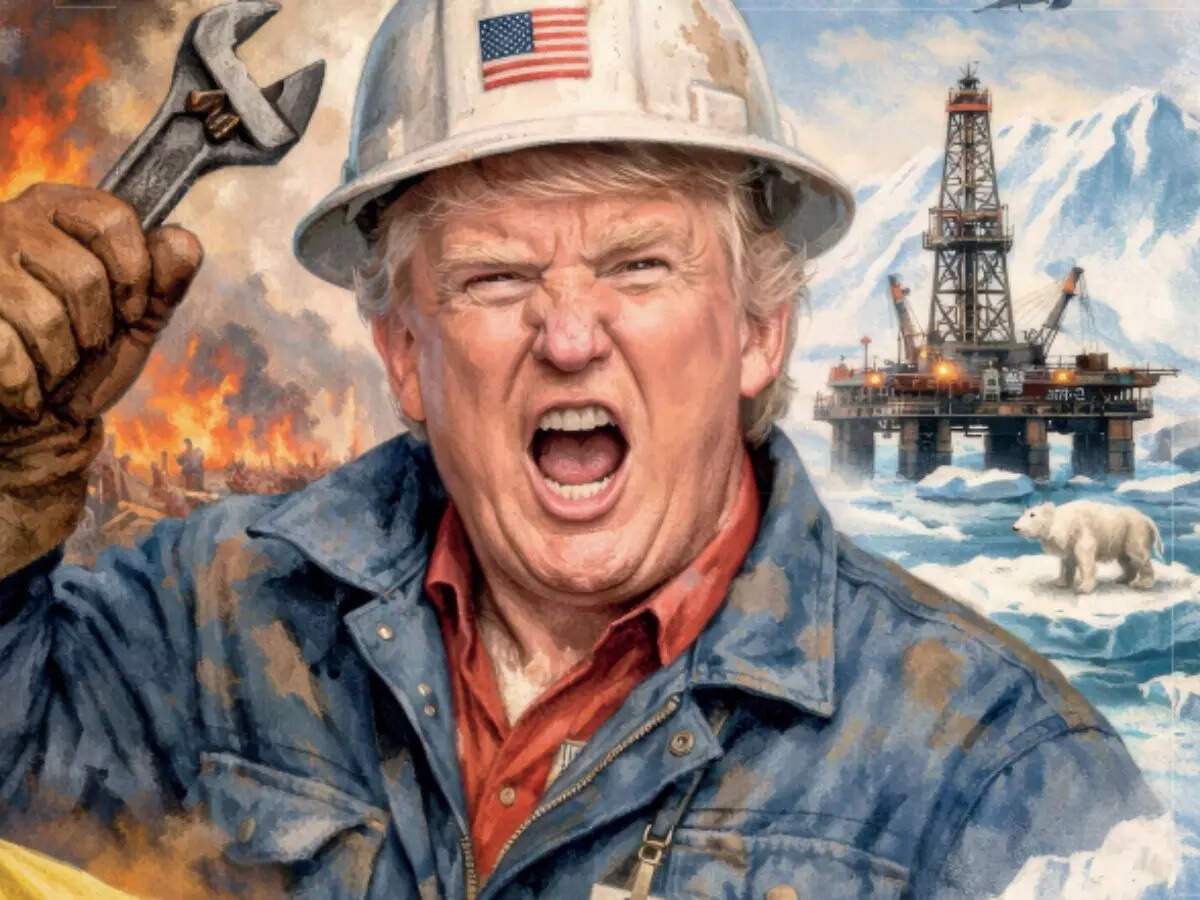

As 2026 unfolds, oil has again surged from commodity to geopolitical flashpoint — not because the demand is skyrocketing, but because global powers or power players are scrambling and flexing their muscles to control supply and territory. After decades of stagnation, Venezuela, with reportedly the largest oil reserves on earth, is back in the news. At the same time, the Arctic’s frozen frontiers, long seen as inaccessible, are being reimagined as future sites of drilling and resource control. And Greenland has been cast into the centre of that conversation. Simply put, access to oil is being reasserted by a superpower in decline. Over the last few decades, oil was priced by markets, with cartels like OPEC dictating demand, supply and a system of international diplomacy controlling market forces. But the latest moves indicate a return to an era when access to oil came from conquest.

Venezuela: Oil Swell

Despite having the largest proven oil reserves on the planet, Venezuela’s crude output has plunged from the millions of barrels a day it once produced to a fraction of that level today, squeezed by sanctions, mismanagement and a dilapidated infrastructure. Now, geopolitical dynamics have throttled this oil supply. US sanctions redirected trade flows, pushing major buyers like China into the picture and complicating Caracas’s market access.

Despite decades of decline, Venezuela still matters because it sits on the largest proven oil reserves in the world, roughly 303 billion barrels, about 17 per cent of the global total. Even though production has fallen sharply due to underinvestment and sanctions, those reserves are a strategic prize. The US intervention reflects reasserting influence over oil supply, cutting rivals like China out of lucrative export flows, and reinforcing US energy security and geopolitical leverage in Latin America

Arctic: Tapping the Untapped

The Arctic has always been the redline of restraint. It is vast, untapped, and thanks to melting ice, newly accessible. Home to an estimated 240 billion barrels of oil and gas, the region represents one of the last large hydrocarbon frontiers at a time when easy oil is running out. Today, over 90 per cent of Arctic fossil fuel production is controlled by Russia, led by mega-projects like Rosneft’s Vostok Oil, while Norway and the US race to secure their own foothold through projects such a Johan Castberg, operated by Equinor.

Complicating Arctic drilling is who owns what. The region is divided among eight countries — Canada, Greenland, Finland, Iceland, Norway, Russia, Sweden and the US. While coastal states control seabed resources within 200-mile Exclusive Economic Zones, overlapping continental shelf claims beyond that blur boundaries. For Washington, Arctic drilling is about energy security, countering Russian dominance and locking in future supply, even if each barrel costs nearly $75 to extract, far higher than conventional oil, which cost around $48.5 between 2015 and 2020. For the rest of the world, increasing Arctic oil drilling risks unleashing some of the most carbon-intensive exploration projects, risking further melting of icebergs and speeding up the climate crisis. Once too cold to matter, it’s now too strategic to ignore.

Controlling the Future

Will the ‘buy Greenland’ joke become real soon? For the US and competing nations, Greenland now represents something larger than oil alone. It is about control over trade routes, resources and strategic presence. Beneath its ice-choked seas lie significant hydrocarbon possibilities. Geological surveys estimate that offshore Greenland could hold tens of billions of barrels of oil equivalent, largely unexplored due to ice cover, cost and environmental risk.

In 2021, the Greenlandic government imposed a ban on new oil and gas exploration, citing climate concerns and the high breakeven cost of Arctic barrels. Yet, climate change is reshaping the calculus. Since the 1980s, roughly 90 per cent of the thickest, oldest Arctic sea ice has melted away according to the US National Oceanic and Atmospheric Administration, opening seasonal shipping routes that could cut Asia-Europe transit times. Simply put, control of Greenland is not just about hydrocarbons; it also sits atop critical minerals vital for clean energy supply chains, while key trade routes can open up due to melting ice. For the US and Trump, Greenland is about preempting the future. It is the same rhetoric that sought to float the idea that Canada could be the 51st state of the US.

Experts’ Take:

Amit Jain, Co-Founder, Ashika Global Family Office Services:

The US’s move to reopen the Arctic for oil drillingmarks a clear shift in priorities from climate commitments toward energy security and geopolitical leverage. The Arctic is not only an energy basin but also a strategic zone shared by the US, Canada, Russia, and increasingly watched by China. Expanding drilling strengthens US energy independence and reduces reliance on volatile regions, while intensifying competition with Russia, which already has significant Arctic exposure. At the same time, however, this decision weakens global climate credibility.

The Arctic is among the most environmentally sensitive regions, and new drilling directly conflicts with emission reduction targets under global climate frameworks. For investors, this creates policy uncertainty. Capital allocation signals become mixed, with short-term support for hydrocarbons potentially slowing momentum toward renewables and energy transition themes. The broader takeaway is a growing gap between climate ambition and geopolitical reality. Energy security is being reprioritised, and markets will increasingly price this tension into long-term energy and policy risk

Barnik Chitran Maitra, New Energy Investor & Entrepreneur:

The reality is that we are going through an era of unprecedented growth in renewable energy and its associated technology. That is true about the US as well. The lust for oil is more a short-term rhetorical phenomenon limited to a few, even within the current dispensation.

K P Nayar, foreign policy expert:

Venezuela matters to the US for two fundamental reasons. First, it is one of the very few countries in Latin America to openly challenge Washington’s long-held belief that the region is its uncontested sphere of influence, something the US has historically not tolerated under Republican leadership. After Cuba, Venezuela became the second such challenger, but unlike Cuba, it sits atop enormous strategic resources. That brings us to the second reason: oil. Venezuela holds one of the world’s largest proven oil reserves. Since Hugo Chávez declared that Caracas would no longer function within the US orbit, Venezuela has been a persistent thorn in Washington’s side, where the issue is less about democracy and more about reasserting supremacy and preventing a resource-rich country from operating outside American control.