WASHINGTON (AP) — President Donald Trump is adjusting his messaging strategy to win over voters who are worried about the cost of living with plans to emphasize new tax breaks and show progress on fighting inflation.

The messaging is centered around affordability, and the push comes after inflation emerged as a major vulnerability for Trump and Republicans in Tuesday’s elections, in which voters overwhelmingly said the economy was their biggest concern.

Democrats took advantage of concerns about affordability to run up huge margins in the New Jersey and Virginia governor races, flipping what had been a strength for Trump in the 2024 presidential election into a vulnerability going into next year’s midterm elections.

White House officials and others familiar with their thinking requested anonymity to speak for this article in order to not get ahead of the president’s actions. They stressed that affordability has always been a priority for Trump, but the president plans to talk about it more, as he did Thursday when he announced that Eli Lilly and Novo Nordisk would reduce the price of their anti-obesity drugs.

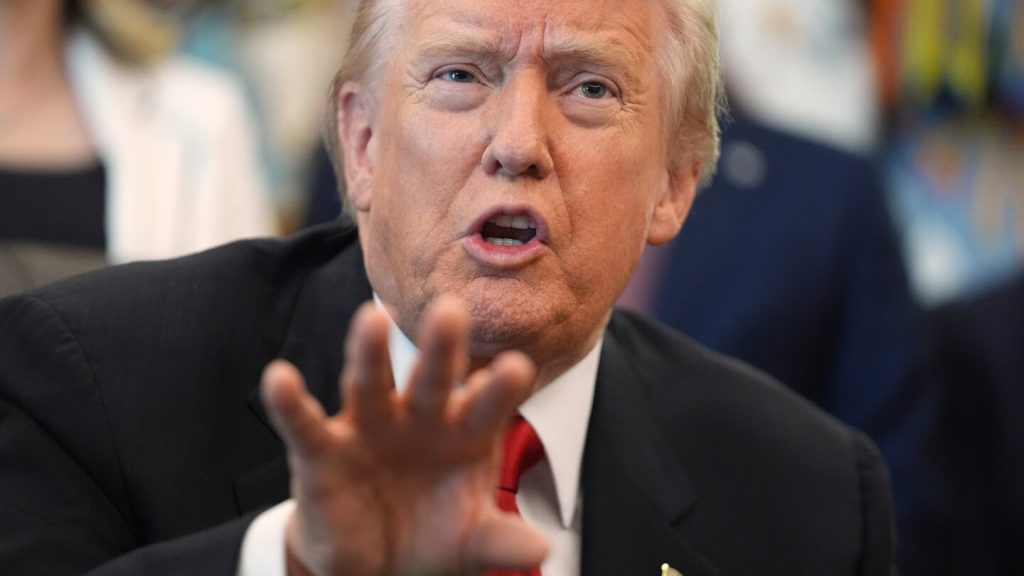

“We are the ones that have done a great job on affordability, not the Democrats,” Trump said at an event in the Oval Office to announce the deal. “We just lost an election, they said, based on affordability. It’s a con job by the Democrats.”

The outlook for inflation is unclear

As of now, the inflation outlook has worsened under Trump. Consumer prices in September increased at an annual rate of 3%, up from 2.3% in April, when the president first began to roll out substantial tariff hikes that suddenly burdened the economy with uncertainty. The AP Voter Poll showed the economy was the leading issue in Tuesday’s elections in New Jersey, Virginia, New York City and California.

Grocery prices continue to climb, and recently, electricity bills have emerged as a new worry. At the same time, the pace of job gains has slowed, plunging 23% from the pace a year ago.

The White House maintains a list of talking points about the economy, noting that the stock market has hit record highs multiple times and that the president is attracting foreign investment. Trump has emphasized that gasoline prices are coming down, and maintained that gasoline is averaging $2 a gallon, but AAA reported Thursday that the national average was $3.08, about two cents lower than a year ago.

“Americans are paying less for essentials like gas and eggs, and today the Administration inked yet another drug pricing deal to deliver unprecedented health care savings for everyday Americans,” said White House spokesman Kush Desai.

Trump gets briefed about the economy by Treasury Secretary Scott Bessent and other officials at least once a week and there are often daily discussions on tariffs, a senior White House official said, noting Trump is expected to do more domestic travel next year to make his case that he’s fixing affordability.

The White House is keeping up a steady drumbeat of posts on social media about prices and deals for Thanksgiving dinner staples at retailers like Walmart, Lidl, Aldi and Target.

“Affordability is much better with the Republicans,” Trump said Thursday night. “The only problem is the Republicans don’t talk about it.

But critics say it will be hard for Trump to turn around public perceptions on affordability.

“He’s in real trouble and I think it’s bigger than just cost of living,” said Lindsay Owens, executive director of Groundwork Collaborative, a liberal economic advocacy group.

Owens noted that Trump has “lost his strength” as voters are increasingly doubtful about Trump’s economic leadership compared to Democrats, adding that the president doesn’t have the time to turn around public perceptions of him as he continues to pursue broad tariffs.

New hype about income tax cuts ahead of April

There will be new policies rolled out on affordability, a person familiar with the White House thinking said, declining to comment on what those would be. Trump on Thursday indicated there will be more deals coming on drug prices. Two other White House officials said messaging would change — but not policy.

A big part of the administration’s response on affordability will be educating people ahead of tax season about the role of Trump’s income tax cuts in any refunds they receive in April, the person familiar with planning said. Those cuts were part of the sprawling bill Republicans muscled through Congress in July.

This individual stressed that the key challenge is bringing prices down while simultaneously having wages increase, so that people can feel and see any progress.

There’s also a bet that the economy will be in a healthier place in six months. With Federal Reserve Chair Jerome Powell’s term ending in May, the White House anticipates the start of consistent cuts to the Fed’s benchmark interest rate. They expect inflation rates to cool and declines in the federal budget deficit to boost sentiment in the financial markets.

But the U.S. economy seldom cooperates with a president’s intentions, a lesson learned most recently by Trump’s predecessor, Democrat Joe Biden, who saw his popularity slump after inflation spiked to a four-decade high in June 2022.

The Trump administration maintains it’s simply working through an inflation challenge inherited from Biden, but new economic research indicates Trump has created his own inflation challenge through tariffs.

Since April, Harvard University economist Alberto Cavallo and his colleagues, Northwestern University’s Paola Llama and Universidad de San Andres’ Franco Vazquez, have been tracking the impact of the import taxes on consumer prices.

In an October paper, the economists found that the inflation rate would have been drastically lower at 2.2%, had it not been for Trump’s tariffs.

The administration maintains that tariffs have not contributed to inflation. They plan to make the case that the import taxes are helping the economy and dismiss criticisms of the import taxes as contributing to inflation as Democratic talking points.

The fate of Trump’s country-by-country tariffs is currently being decided by the Supreme Court, where justices at a Wednesday hearing seemed dubious over the administration’s claims that tariffs were essentially regulations and could be levied by a president without congressional approval. Trump has maintained at times that foreign countries pay the tariffs and not U.S. citizens, a claim he backed away from slightly Thursday.

“They might be paying something,” he said. “But when you take the overall impact, the Americans are gaining tremendously.”

_____

Associated Press writers Will Weissert and Michelle L. Price contributed to this report.