Oil markets are focused on Venezuela tensions and the suspension of crude oil loadings at Kazakhstan’s CPC terminal.

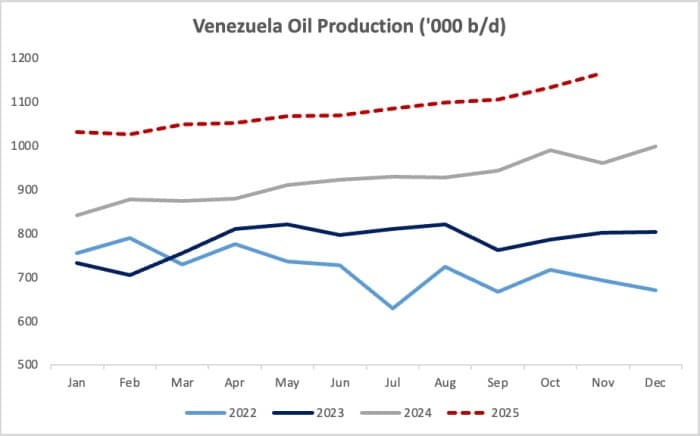

Venezuela Starts Cutting Production as Trump Ratchets Up His Strangling Strategy

– Donald Trump’s maximum pressure strategy on Venezuela is finally starting to impact Venezuela’s oil production, with state oil company PDVSA beginning to shut down wells in the Orinoco Belt amidst swelling inventories and ongoing tanker seizures.

– Venezuela’s oil production has been continuously growing in 2025, with the November average of 1.165 million b/d representing a 20% year-over-year increase.

– According to Bloomberg, PDVSA plans to reduce output in the Orinoco Belt by at least 25% to 500,000 b/d, which could shave some 15% off Venezuela’s total liquids production.

– Venezuela will curb production at its heaviest wells first, with extra-heavy Junin becoming the first basin to be slashed, keeping lighter fields that require less diluents operational for as long as possible.

– Despite ongoing VLCC seizures, flows of diluents to Venezuela have not fully stopped, with Russian suppliers delivering four tankers of naphtha in December to date, however storing the upgraded bituminous crude is becoming a deal-breaker for PDVSA.

Market Movers

– Australia’s top energy producer Woodside Energy (ASX:WDS) signed a 9-year term LNG supply deal starting from 2030 to deliver around 5.8 billion m3 of liquefied gas from its Louisiana LNG project.

– US oil major Chevron (NYSE:CVX) has reported first oil from its South N’dola project offshore Angola, aiming to produce 25,000 b/d of crude and 50 MMCf/d of natural gas once the field reaches peak output.

– Russia’s government has extended its deadline to sell ExxonMobil’s (NYSE:XOM) 30% stake in the Sakhalin-I project by another year, potentially indicating Moscow’s readiness to re-integrate the US oil major into Sakhalin’s new shareholding structure after the Russia-Ukraine conflict ends.

Tuesday, December 30, 2025

In the relatively uneventful period between Christmas and New Year, Russia-Ukraine peace talks were the main geopolitical driver. Ukraine’s alleged targeting of Putin’s residence and Moscow’s pledge to change its negotiating strategy brought yet another wave of disappointment to those eyeing a resolution to the four-year-long conflict, capping ICE Brent at $62 per barrel. An all-out-war in Yemen could provide a new geopolitical risk to oil, however, the physical impact thereof remains questionable.

Saudi Arabia Mulls Extending Price Cuts. Saudi Arabia’s national oil firm Saudi Aramco (TADAWUL:2222) is expected to cut its formula prices for February-loading cargoes going to Asia by up to 30 cents per barrel, slashing prices further despite dipping to a 5-year low last month.

China Launches 2026 Crude Import Season. China’s Commerce Ministry has issued its first batch of crude oil import quotas for 2026, allocating 206 million metric tonnes or 4.14 million b/d to qualified refineries, putting the overall allocation some 8% higher than a year ago as new private refiners boost runs.

India Seeks Billions from Key Upstream Players. The government of India is seeking more than $30 billion in compensation from a consortium comprising Reliance Industries and BP (NYSE:BP), claiming they failed to produce promised volumes from two deepwater fields, D1 and D3.

Kazakhstan Curbs Output on CPC Damage. Oil production in Kazakhstan dropped by 6% month-on-month in December to 1.93 million b/d, following a November 29 drone attack on the CPC terminal on Russia’s Black Sea Coast, with curbs mostly coming from the Chevron-operated Tengiz field.

Nigeria Eyes Asset Divestments to Boost Coffers. Nigeria’s state oil company NNPC is reportedly planning to sell stakes in some of its oil and gas assets, offering potential bidders to disclose their interest by January 10 despite ongoing protests from the African country’s powerful trade unions.

Russia Extends Gasoline and Diesel Export Ban. Russia’s government has extended its temporary ban on gasoline exports until 28 February 2026 as a precautionary measure vis-à-vis Ukrainian drone strikes, having already halved exports of the transportation fuel to 50,000 b/d in 2025.

Ghana Restarts Its Key Refinery After 5-Year Hiatus. Ghana’s state-owned 45,000 b/d Tema refinery has resumed operations this week after a 5-year hiatus as a means to combat soaring imports of petroleum products from Nigeria’s 650,000 b/d Dangote refinery that sent 30,000 b/d of fuel in 2025.

LNG Canada Still Not Flowing the Way It Should. Canada’s first LNG export plant, Shell-operated (LON:SHEL) LNG Canada, struggles to make good on initial promises as there has been no cargo loading LNG in Kitimat in three weeks despite the operator claiming both liquefaction trains were up and running.

Beijing to Limit Copper and Alumina Smelting Capacities. China’s ‘anti-involution’ campaign to combat overcapacity will extend into the country’s copper and alumina industries as Beijing vowed to tighten oversight over the metal industry, with both copper and alumina hitting all-time highs in 2025.

Petrobras’ Strike Might Spin Out of Control. Brazil’s Superior Labour Court has mandated that staffing levels remain at a minimum of 80% across all Petrobras (NYSE:PBR) facilities as the Brazilian state oil firm’s largest trade union rejected its latest proposal to end the ongoing three-week strike.

Syria Starts Exploration Campaign for More Gas. Syria’s Petroleum Company announced that the war-torn country will resume exploration drilling to boost domestic gas production in Q1 2026, planning to drill four wells around the capital city of Damascus.

US Exporters Boost Pre-Christmas Exports. Delayed weekly data from the US Energy Information Administration show that American exports of petroleum products soared to a new all-time high of 7.8 million b/d in the week ending December 19, taking the usual year-end destocking to a new level.

Market Expects Lithium Slump in Early 2026. China’s passenger car association expects demand for lithium batteries to slump by at least 30% as Beijing’s tax incentives for EV purchases are gradually phased out, capping lithium’s stellar 35% rally in December as lithium carbonate rose to $16,850/mt.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com