• Germany will contribute €1 billion ($1.15 billion) over ten years to Brazil’s Tropical Forest Forever Facility, a new global mechanism aimed at reducing deforestation.

• The fund rewards countries for maintaining intact forest cover and imposes financial penalties for forest loss, supported by satellite-based monitoring.

• The initiative strengthens international efforts to protect climate-critical tropical forests and expands resources for Indigenous and traditional communities.

Germany Backs Brazil’s New Global Forest Facility

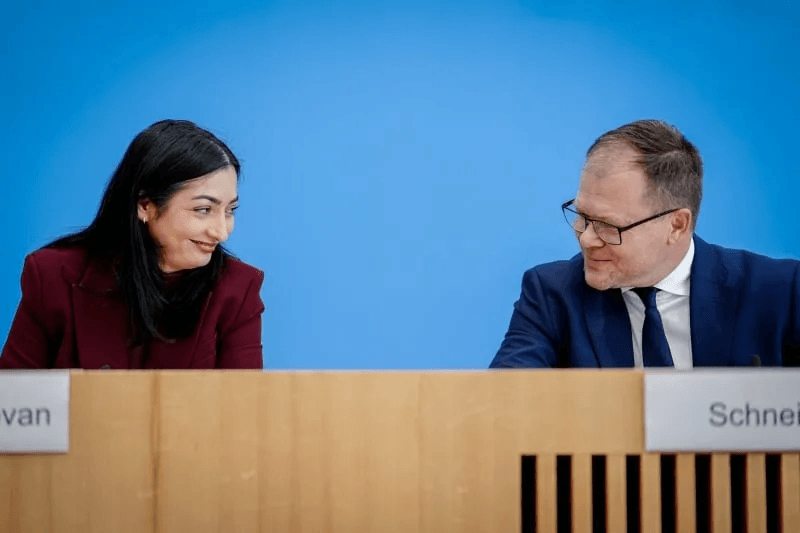

Germany has pledged €1 billion over the next decade to Brazil’s Tropical Forest Forever Facility (TFFF), a new global fund designed to reward forest conservation and sanction deforestation. The commitment was announced by German Environment Minister Carsten Schneider and Development Minister Reem Alabali Radovan during the UN Climate Change Conference in Belém, providing one of the largest single-country contributions to Brazil’s emerging forest governance architecture.

“This is about protecting the tropical rainforests as our planet’s lungs,” Schneider and Alabali Radovan said, framing the contribution as core to Germany’s climate diplomacy and its broader development policy in forested regions. Their joint statement reinforced Germany’s view that international climate progress hinges on financial structures that can incentivise performance rather than rely only on voluntary pledges.

Brazilian Environment Minister Marina Silva confirmed Germany’s role earlier in the day, calling the funding a decisive boost for a mechanism built to operate beyond Brazil’s borders. The TFFF, developed under President Luiz Inácio Lula da Silva’s administration, invites all countries with tropical forests to participate in a model that binds financial rewards and penalties directly to environmental outcomes.

A New Model: Reward Preservation, Penalise Destruction

The TFFF’s framework is intentionally stringent. Countries that keep rainforest areas intact receive payments. Those that increase deforestation face fines calculated per hectare lost. Satellite-based monitoring will verify forest cover, allowing for annual assessments and limiting disputes over data.

For policymakers, the mechanism aims to resolve two long-standing issues: the lack of predictable, long-term climate finance and the absence of penalties for non-compliance in forest agreements. By combining incentives and fines in a single model, Brazil is positioning the TFFF as a governance instrument that could support global climate frameworks, including Nationally Determined Contributions and biodiversity pledges.

“Tropical rainforests store vast amounts of carbon and cool regional climates through water evaporation. They are also home to an extraordinary range of species,” Schneider said earlier in the conference. The ministers reiterated that continued forest loss contributes directly to global instability, from climate risks to biodiversity collapse to economic disruption in forest-dependent communities.

Brazil’s Strategy for Global Forest Leadership

Silva has spent the past year building diplomatic momentum around a new forest economy that aligns financial flows with conservation outcomes. In Belém, she stressed that Germany’s support strengthens Brazil’s case for a system with global reach rather than a regional pilot.

Germany’s contribution, spread over ten years, sends a signal to other donor governments that the mechanism will have long-term financing rather than short-term climate project funding. Officials in Belém highlighted that the TFFF sits alongside Brazil’s Amazon Fund but operates with broader eligibility and a more rules-based structure.

The Lula administration argues that the world cannot meet the 1.5°C target without stabilising tropical forest loss and that predictable finance is central to any credible plan. Silva emphasised that protecting forests is not solely an environmental action but a governance priority with implications for security, economic development and Indigenous rights.

RELATED ARTICLE: Germany to Reinstate Sustainable Finance Beirat, Ministry Confirms

Implications for Investors, C-Suite Leaders and Policymakers

For investors and corporate leaders, the TFFF’s monitoring and sanctioning model will shape the trajectory of global forest-risk regulation and voluntary market standards. As satellite verification becomes a core component of the fund, companies with exposure to commodities linked to deforestation will face rising expectations to align supply chains with the emerging governance framework.

For policymakers, Germany’s multi-year commitment provides needed stability for long-term planning. It also expands the architecture supporting South-South and North-South cooperation on forests, especially for countries that lack sufficient domestic resources to monitor or enforce conservation policies.

C-suite executives in sectors such as agriculture, mining, finance and consumer goods will be watching closely. The TFFF’s visibility at COP30 places forests at the centre of climate negotiations and raises pressure for clearer corporate disclosure on forest impacts.

A Step Toward Global Forest Governance

As talks in Belém continue, Germany’s contribution gives the TFFF early credibility and global political weight. The facility aligns climate finance with measurable outcomes and presents a structured approach to protecting areas that regulate the planet’s temperatures, rainfall cycles and biodiversity stability.

Brazilian officials reiterated that the initiative will direct finance to Indigenous and traditional communities whose stewardship of forest areas remains critical to preventing further degradation.

By anchoring the fund within a performance-based architecture, Brazil and Germany are pushing the global system toward clearer rules on conservation, deforestation and financial responsibility. As negotiations move toward implementation, the TFFF is emerging as one of the most closely watched proposals shaping the future of tropical forest protection worldwide.

Follow ESG News on LinkedIn