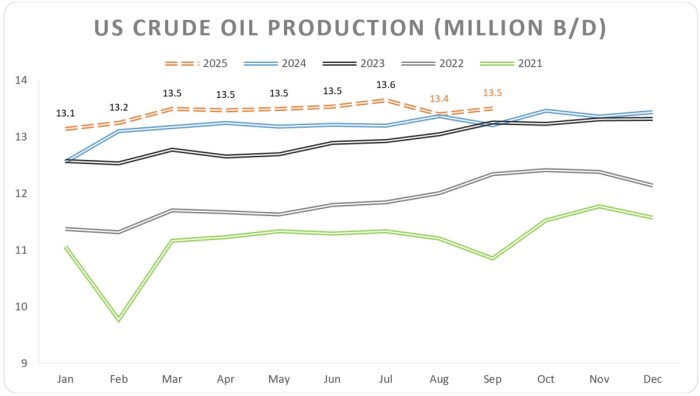

A growing glut of oil and fear of a global economic slowdown have pushed U.S. crude prices to their lowest point in five years.

Friday, October 17, 2025

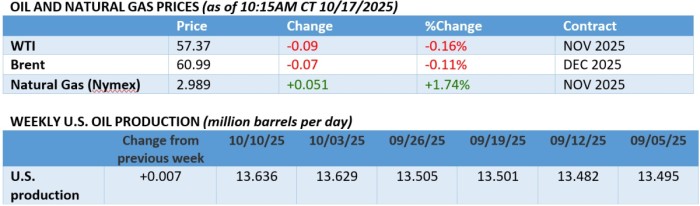

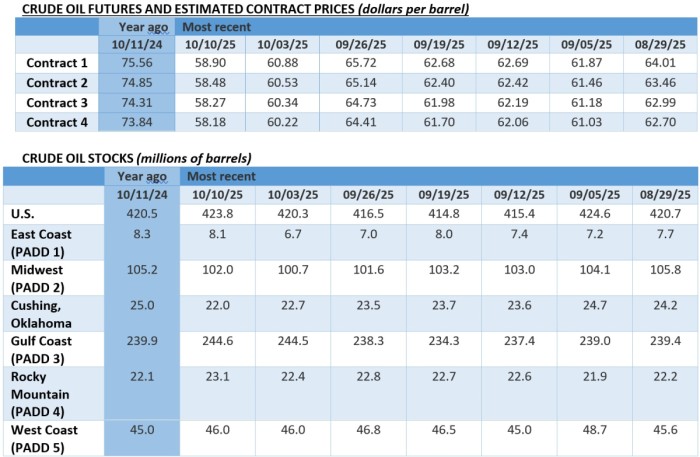

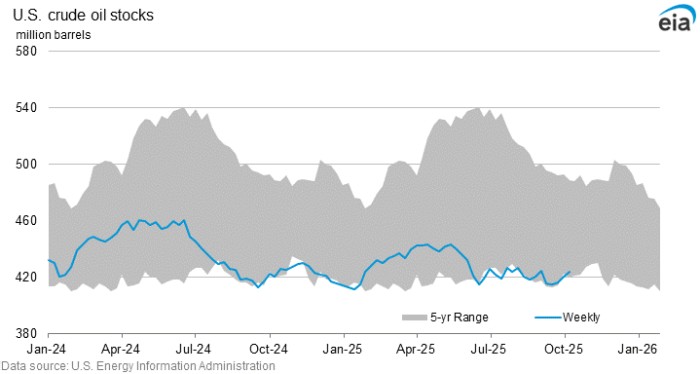

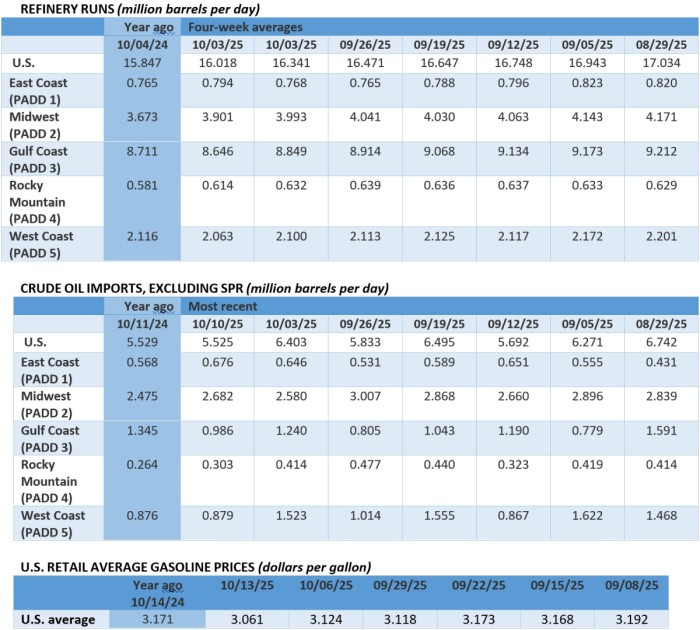

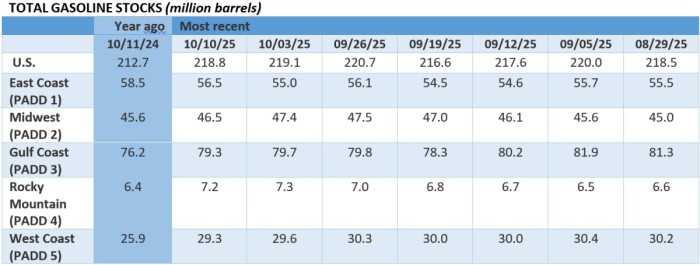

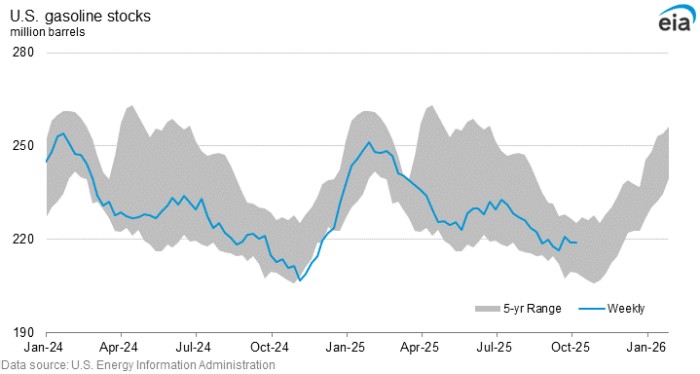

The re-imposition of US import tariffs on China and the concurrent promise of a Trump-Putin summit in Budapest have further depressed oil sentiment, sending ICE Brent to 61 per barrel as most of the past years’ geopolitical risk premium has dissipated. Higher-than-expected US oil inventory builds have added to fears of there being more crude than 2025 levels of demand would require, implying that oil below $60 per barrel might not be that far away.

OPEC Launches Capacity Rethink. OPEC is contracting independent upstream-focused consultants to gauge the output capacity of all member states, seeking to depart from the tradition of self-reported capacity levels ahead of tough 2026 quota negotiations.

US States Sue Trump over Solar Halt. 25 US states are suing the Trump administration over its cancellation of a $7 billion grant program for solar energy projects, demanding the payment of money damages and the immediate reinstatement of the program.

India Progresses with Mongolia’s First Refinery. Mongolia’s first-ever refinery, the 30,000 b/d Dornogovi plant, is expected to start operations by 2028 as India has extended a $1.7 billion credit line to facilitate Indian engineering and construction contracts.

US Slaps Sanctions on Chinese Cooking Oil. US President Trump declared that China not buying American soybeans was an ‘economically hostile act’, with last deliveries seen in May, threatening to slap sanctions on imports of Chinese cooking oil, a business worth $1.1 billion in 2024.

Qatar Threatens a European Shutout Again. Qatar’s Energy Minister Saad al-Kaabi warned that the Middle Eastern country will not be able to do LNG business with Europe if Brussels doesn’t change its current EU corporate sustainability rules, currently supplying 13% of the continent’s LNG needs.

UK Slaps New Sanctions on Russia. The British government targeted Russia’s two largest oil companies Rosneft and Lukoil in its latest package of sanctions, along with 44 designated shadow fleet tankers and India’s majority Russian-owned Nayara refinery, however failing to elicit any market reaction.

Citgo Endgame Is Around the Corner. As the auction for 807,000 b/d refiner Citgo Petroleum intensifies, media reports show that Elliott-backer Ambert Energy wants to cut costs and streamline operations whilst the refiner’s other top bidder Gold Reserve seeks to maintain the status quo without layoffs.

India Warms Up to US Propane. As Indian officials negotiate a new trade deal with the Trump administration, New Delhi pledged to source around 10% of its LPG needs from the US from 2026, up from 6% currently with the aim of curbing its long-standing dependence on the Middle East.

Iranian Tankers Emerge from the Dark. Most tankers historically used for carrying Iranian oil (111 out of 170) have turned on their transponders in recent days after years of sailing in the dark, coming only days after the UN sanctions snapback on Tehran and potentially signaling a shift in export strategies.

Copper Is Going to Blow Up Soon. The world’s largest copper miner, Chiles’s state-owned Codelco, has set the 2026 premium for copper deliveries to Europe at a record high of $325 per tonne, a 40% jump from 2025, citing the impact of Congolese and Indonesian supply disruptions.

Suriname Scraps Wealth Distribution Plans. Suriname’s government cancelled its plan to share $450 million worth of royalties amongst the country’s 600,000 people as TotalEnergies’ Gran Morgu project starts up in 2028, citing insufficient state income and vowing to invest in new technologies instead.

Egypt Lifts Fuel Prices to Boost Revenue. Egypt has lifted nationwide prices of transportation fuels by 11-12%, the second time this year after a 15% hike earlier in April, seeking to make good on its promise vis-à-vis the IMF and cut energy subsidies, even if pledging to freeze current prices for a year.

Australia Suffers Another Gas Setback. Sending its stock lower by 4% this week, Australia’s top gas producer Santos (ASX:STO) lowered its production guidance for this year after software issues halted production for 2 weeks at its recently launched $5.6 billion Barossa project, leading to a slower ramp-up.

France’s National Tradition Continues. Union strikes at France’s Fos Cavaou and Tonkin LNG terminals have been extended until 21 October, being completely offline since October 13, as nationwide industrial action for better wages entered its 2nd month.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com: