Global Energy Alliance for People and Planet aims to raise $100 million by 2028 to modernise India’s electricity grids.

Digitisation supports India’s 500 GW non-fossil capacity goal and emissions-intensity reduction target.

Multilateral lenders and philanthropies see grid modernisation as a critical investable pathway for clean energy scale-up.

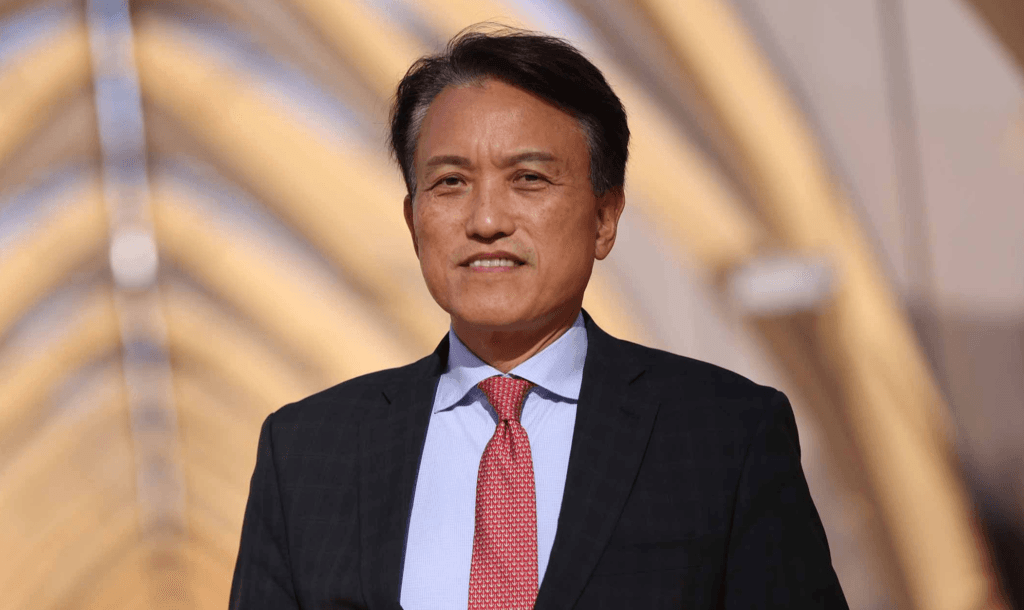

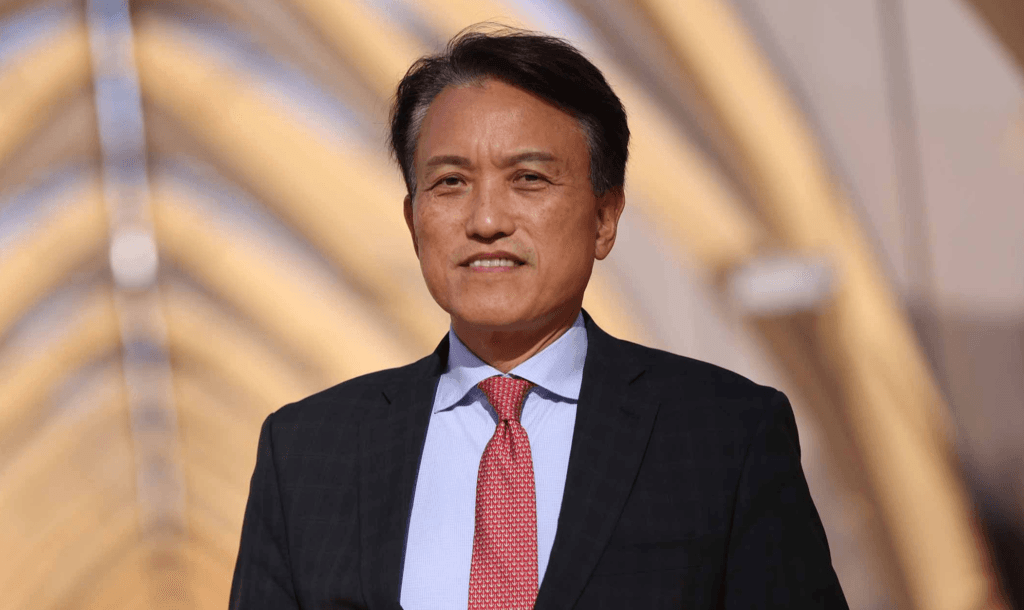

The Global Energy Alliance for People and Planet (GEAPP) plans to raise approximately $100 million by 2028 to finance the digitisation of India’s electricity grids, Chief Executive Woochong Um said at Mumbai Climate Week. The alliance intends to approach development finance institutions including the World Bank and the Asian Development Bank to anchor the fund.

Backed by The Rockefeller Foundation, IKEA Foundation and the Bezos Earth Fund, GEAPP is positioning grid digitalisation as a foundational investment required to support India’s clean energy transition and improve system resilience.

The proposed financing vehicle follows an initial $25 million deployment to digitise electricity networks in Rajasthan and Delhi. The next phase aims to scale the model nationally.

Why Grid Digitisation Matters for India’s Energy Transition

Grid digitalisation transforms traditional electricity networks into automated systems using artificial intelligence, sensors and real-time data analytics. These upgrades improve reliability, enable large-scale renewable integration and optimise power distribution, lowering operational costs and emissions.

India’s electricity demand is rising rapidly alongside economic expansion, placing strain on legacy infrastructure. Modernising grid operations is increasingly viewed as essential to prevent outages, reduce transmission losses and manage variable renewable generation.

New Delhi’s climate action plan targets a 45 percent reduction in emissions intensity by 2030 compared with 2005 levels, alongside a net-zero goal by 2070. Achieving those targets while sustaining high growth rates presents complex technical and financial challenges.

Supporting India’s 500 GW Clean Energy Ambition

India has committed to reaching 500 GW of non-fossil fuel-based power capacity by 2030 and aims for 50 percent of cumulative electric power capacity to come from non-fossil sources. Grid modernisation is expected to play a central role in achieving these targets by enabling intermittent solar and wind power to be integrated safely and efficiently.

Without smarter networks, renewable expansion risks congestion, curtailment and instability, particularly in fast-growing urban and industrial regions.

RELATED ARTICLE: Bitgreen Partners with GEAPP and Sewa Energy Resources to Build a $110 Million Hydroelectric Facility

Building Bankable Infrastructure for Climate Finance

GEAPP’s initiative reflects a broader effort to convert climate ambition into investable infrastructure projects. Multilateral lenders and philanthropic investors are increasingly focused on grid upgrades, energy storage and transmission as high-impact enablers of decarbonisation.

“There are plenty of concepts, but not enough bankable projects,” Um said.

By developing replicable digital grid solutions, GEAPP aims to reduce perceived risk and attract blended finance from development banks, institutional investors and climate funds.

Expansion Across Utilities by 2028

The alliance plans to prioritise Delhi and Rajasthan before expanding to at least 15 utilities nationwide by 2028. A phased rollout allows technical validation, regulatory alignment and workforce training while building investor confidence.

India’s federal structure and varied utility performance levels make scalable solutions essential. Digitisation can improve billing efficiency, reduce power theft and enhance demand forecasting, strengthening utility balance sheets and creditworthiness.

What Executives and Investors Should Watch

Grid modernisation is emerging as a strategic frontier for climate finance, particularly in fast-growing economies where renewable deployment is accelerating.

For investors, digitised grids represent enabling infrastructure that unlocks renewable energy pipelines and stabilises returns. For policymakers, they provide a pathway to align economic growth with emissions reductions. For utilities, they offer operational transparency and financial resilience.

If successfully scaled, GEAPP’s initiative could demonstrate how philanthropic capital and development finance can catalyse infrastructure upgrades essential for meeting global climate targets.

India’s energy transition will depend not only on building renewable capacity but on ensuring the grid can carry it. Digitisation is becoming the connective tissue between climate ambition and reliable power delivery.

Follow ESG News on LinkedIn