$450 million Series A led by Bessemer Venture Partners targets commercialization of fusion energy based on National Ignition Facility physics

Investment focuses on grid scale infrastructure including the Thunderwall laser system and a mass-manufacturing pipeline for fusion fuel targets

Signals rising private capital confidence in fusion as governments and utilities seek long term zero carbon baseload power

Commercial Fusion Moves From Lab Milestones to Market Strategy

Fusion startup Inertia has secured $450 million in Series A funding to accelerate commercialization of inertial confinement fusion, positioning itself as one of the most closely watched entrants in the race to deliver grid scale clean energy. The round was led by Bessemer Venture Partners, with participation from GV, Modern Capital, Threshold Ventures, and other investors seeking exposure to next-generation power infrastructure.

Founded in 2024, the company aims to translate scientific breakthroughs achieved at the National Ignition Facility at Lawrence Livermore National Laboratory into commercial energy systems. The funding will advance development of Thunderwall, a high-power laser platform designed to underpin Inertia’s first pilot plant, alongside plans to build a manufacturing line capable of producing fusion fuel targets at industrial scale.

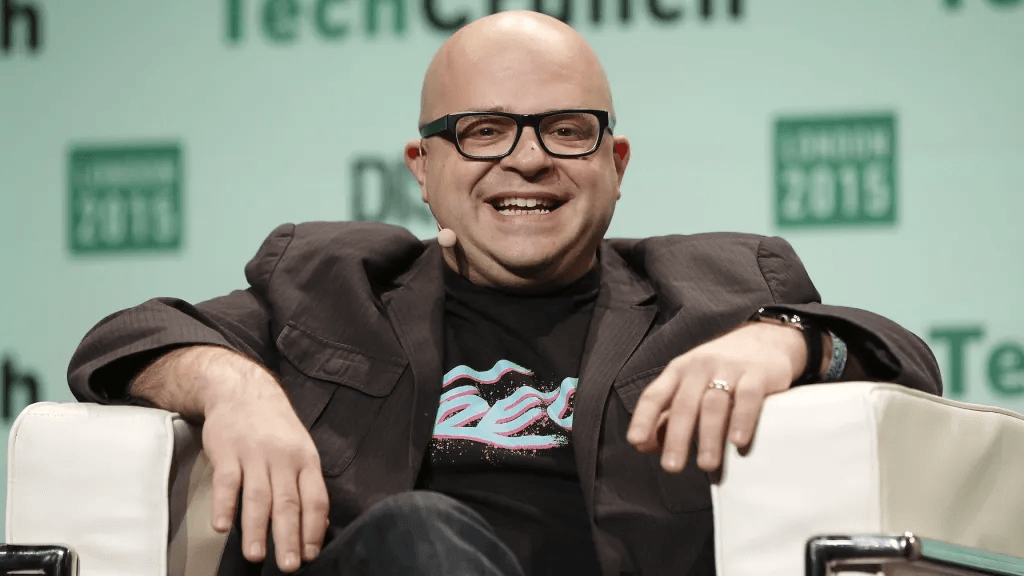

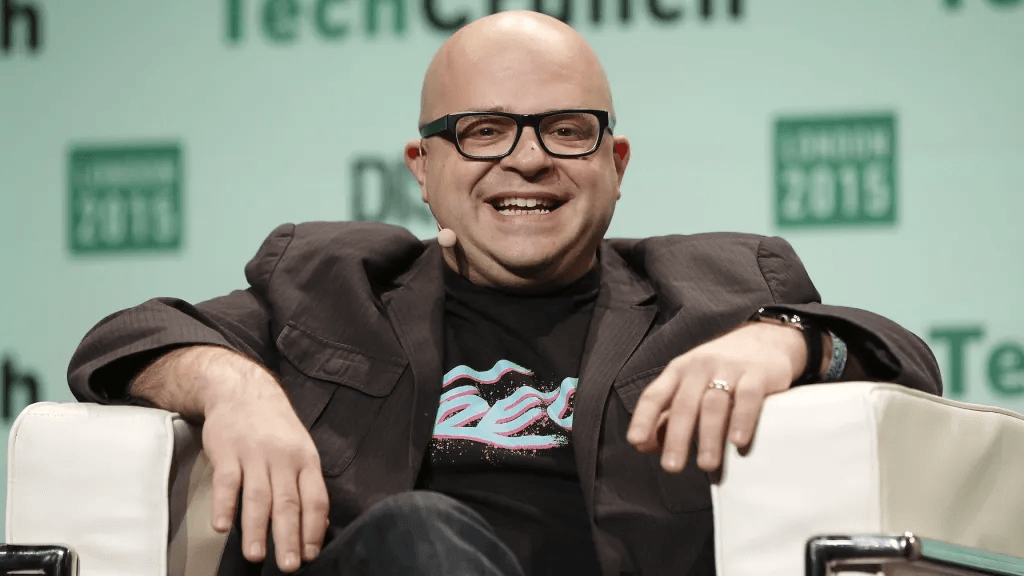

“Inertia is building on decades of science and billions of dollars invested to reach the ignition milestone that proved the science,” said Jeff Lawson, co-founder and CEO of Inertia. “Our plan is clear: build on proven science to develop the technology and supply chain required to deliver the world’s highest average power laser, the first fusion target assembly plant, and the first gigawatt, utility-scale fusion power plant to the grid. Inertia is building the team, partnerships, and capabilities to make this real within the next decade.”

Investors Bet on Proven Physics and Commercial Pathways

The company’s strategy centers on a phased commercialization roadmap built around the only fusion approach that has demonstrated net energy gain in a controlled experiment. In December 2022, scientists at NIF achieved a landmark result, generating more energy from fusion than was delivered to the fuel target, a moment that shifted investor sentiment toward fusion’s commercial potential.

Inertia’s leadership team reflects deep ties to that scientific milestone. Co-founder Dr. Annie Kritcher, who continues to serve as Chief Scientist while maintaining her role at LLNL under a first-of-its-kind agreement, helped lead the design of the Hybrid-E inertial confinement fusion system that enabled the ignition experiments.

“In just three years, we’ve gone from the first experiment to ever produce more fusion energy than was delivered to the target, to repeating that result many times and pushing the target gain higher. We’re now focused on translating physics we know works into a pathway toward commercial-scale fusion energy, and the real benefits it can deliver for people and the planet,” said Kritcher.

For investors, the presence of proven laboratory results reduces technical uncertainty at a time when energy markets are seeking dispatchable zero-carbon power sources capable of complementing renewables. Venture capital interest in fusion has grown as policymakers explore long-term energy security strategies that combine electrification, nuclear innovation, and industrial decarbonization.

RELATED ARTICLE: Proxima Fusion Secures €130M to Accelerate World’s First Stellarator Fusion Power Plant

Engineering the Infrastructure for Grid-Scale Fusion

At the center of Inertia’s commercial design is Thunderwall, a semiconductor diode laser beamline engineered to deliver a 10 kilojoule beam ten times per second with improved efficiency. According to the company, the system could operate at average power levels far beyond previous laser technologies, forming the backbone of a future gigawatt-scale fusion power plant.

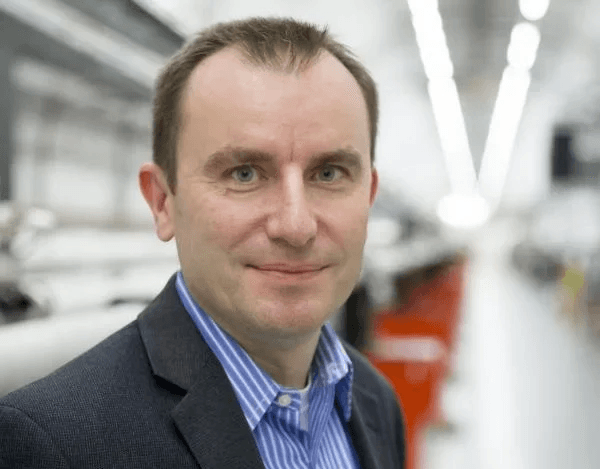

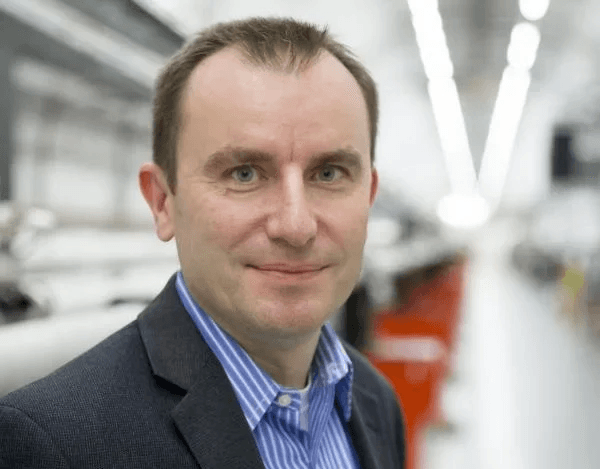

Chief Technology Officer Prof. Mike Dunne, formerly of Stanford University and SLAC National Accelerator Laboratory, brings experience from leading large-scale research infrastructure projects. His prior work included directing an industry-validated fusion power plant design effort involving utilities, vendors, and national laboratories.

“For the first time, the fusion industry is seeing the alignment of three elements crucial to commercialization: proven physics, public sector partnerships, and private sector investment at the scale needed to deliver,” said Dunne. “It’s our job to capitalize on these elements to build fusion energy that works at grid scale.”

The engineering challenge extends beyond physics to supply chains and manufacturing. Inertia’s roadmap includes a dedicated production line for fusion fuel targets, designed to feed laser-driven reaction chambers at rapid intervals. Scaling these systems represents one of the largest hurdles between experimental success and commercial deployment.

Strategic Implications for Energy Investors and Policymakers

Fusion’s appeal to governments and energy majors lies in its promise of continuous, carbon-free electricity without long-lived radioactive waste associated with traditional nuclear reactors. While commercialization timelines remain uncertain, large private funding rounds indicate growing confidence that fusion could become a cornerstone of long-term climate strategies.

Byron Deeter, partner at Bessemer Venture Partners, framed the investment as a response to a maturing industry landscape. “Inertia represents our first investment into the direct fusion market, because it is the first company that we’ve seen with a clear roadmap to commercial energy that’s compelled us to act,” he said. “With a combination of frontier physics expertise and proven company-building experience, Inertia is unique. We’re thrilled to partner with them as they work to deliver abundant, safe, and clean energy.”

For C-suite leaders and investors, the funding highlights a shift in fusion from speculative research toward infrastructure-scale development. As governments tighten climate targets and utilities seek reliable baseload alternatives, the race to commercialize fusion is increasingly defined by capital intensity, regulatory collaboration, and industrial execution. The trajectory of companies like Inertia will shape whether fusion evolves into a viable pillar of the global energy transition or remains confined to the laboratory.

Follow ESG News on LinkedIn