San Francisco goes by many names. There are the basics: SF, San Fran, and even Frisco. Now, as AI takes hold of the city, some have taken to calling it Cerebral Valley.

For Julian Windeck, the 23-year-old founder of Attention Engineering, San Francisco these days evokes an earlier era where creativity was its own currency.

“What Florence was in the Renaissance, SF is in the age of AI,” Windeck told Business Insider.

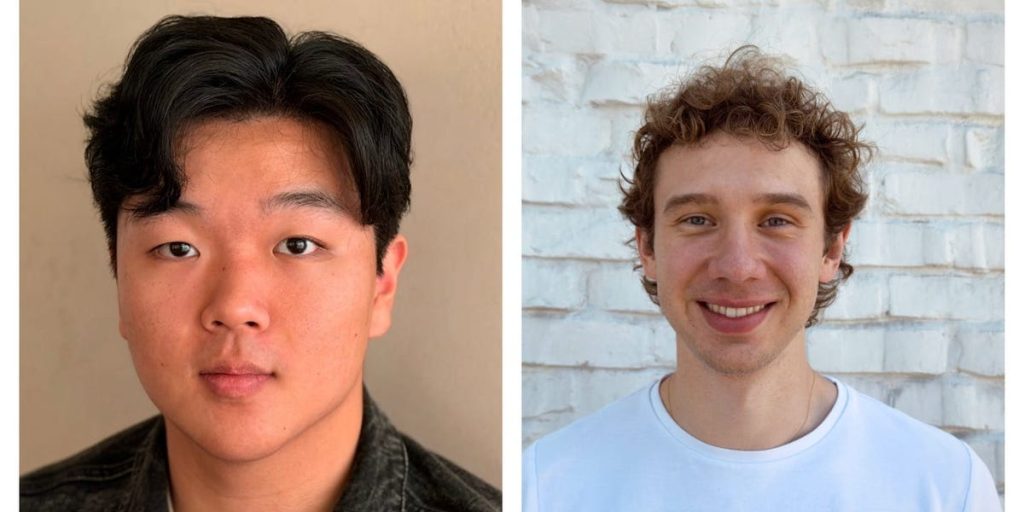

Windeck and Aidan Guo, 19, launched Attention Engineering earlier this year to build a next-generation desktop assistant powered by AI.

“It’s not exactly a desktop assistant, but kind of becomes one: ambient, proactive, and personally understands you,” Guo said. “It can surface a lot of insights like how you use your time,” he said. In the coming months, the tool will be able to automate everything you do on your computer, like a “cursor for everything,” he said.

Guo, originally from Vancouver, who said he’s on his “second gap year” from college, decided to forgo Carnegie Mellon to move to the Bay Area. He joined programs like Z Fellows and Emergent Ventures, and quickly found mentors who encouraged him to build, he said.

“People are generous with their time, especially if you’re young,” he said.

Windeck, from Germany, took a more traditional path. He studied computer science in Germany and at Cambridge University, and then conducted AI research at MIT before deciding academia wasn’t for him. “I didn’t want to be some cog in the machine,” he said.

The two said they met through mutual friends, Silas Alberti, the cofounder of Cognition, and Marvin von Hagen, the cofounder of The Interaction Company of California.

Guo and Windeck began working on a few small projects, and once they realized they worked well together, they went on to found Attention Engineering this year.

Related stories

The startup has five employees and has raised $1.25 million in pre-seed funding from backers like Lukas Haas, a product manager at Google DeepMind and scout for Sequoia Capital; Marvin von Hagen and Felix Schlegal, the cofounders of Interaction; Bryan Pellegrino, the cofounder of LayerZero; and venture capital firms Village Global and Liquid 2 Ventures.

“Everything in the Bay is built on trust. There’s basically no governance — you can kind of do whatever you want,” Guo said. So you need to “get people to trust you, with capital again and again,” he said.

The two founders shared with Business Insider their top five tips for landing funding.

BI’s Young Geniuses series spotlights the next generation of founders, innovators, and thinkers who are trying to reshape industries and solve global challenges. See more stories from the series here, or reach out to editor Jess Orwig to share your story.

1) It’s about ‘slope,’ not perfection

“You just have to show slope in some way,” Guo said.

Slope is just another word for progress. Potential backers want to see how much — and how quickly — a company is improving, Guo said. They’re less invested in how perfect or technically precise an idea is at any given moment, he added.

“Usually, the first idea you’ll have won’t be a good one, right. You actually want to cycle through a lot of ideas,” Windeck said. In the end, people “invest in you because they see a lot of potential.”

2) Be personal with cold outreach

Starting a company means sending a lot of cold emails. The trick is figuring out how to make people hit reply.

“You have to be really, really personalized with cold reach-outs,” Guo said. He said he remembers reading several old cold emails that worked — like the one some 18-year-old sent to Evan from Snapchat in 2016. It was just “three bullet points, and it got him a job. It’s just taking that energy and applying it to reaching out to founders.”

3) Keep up the momentum

In short: Don’t wait.

“Momentum is important when you’re raising,” Guo said. “It would be easier for us to raise more capital at better terms in the first week than it would have been if we had waited.”

4) Move to San Francisco

The action is all in the Bay Area, according to Guo and Windeck. It’s easier to network, find mentors, investors, and learn from other builders in the city.

“Everyone should come here to the Bay,” Windeck said. You “want to be surrounded by other people — even if you’re not working with them directly.” You’ll feel more accountable when you see others making progress, he added.

5) Be someone others want to work with

Their final piece of advice is to be professional — from the very beginning, even before you have a fleshed-out idea or a business plan.

“It’s not just, like, how good are you technically? How sound are you, how great is your idea,” Guo said. “It’s about showing up on time, saying the right things.”