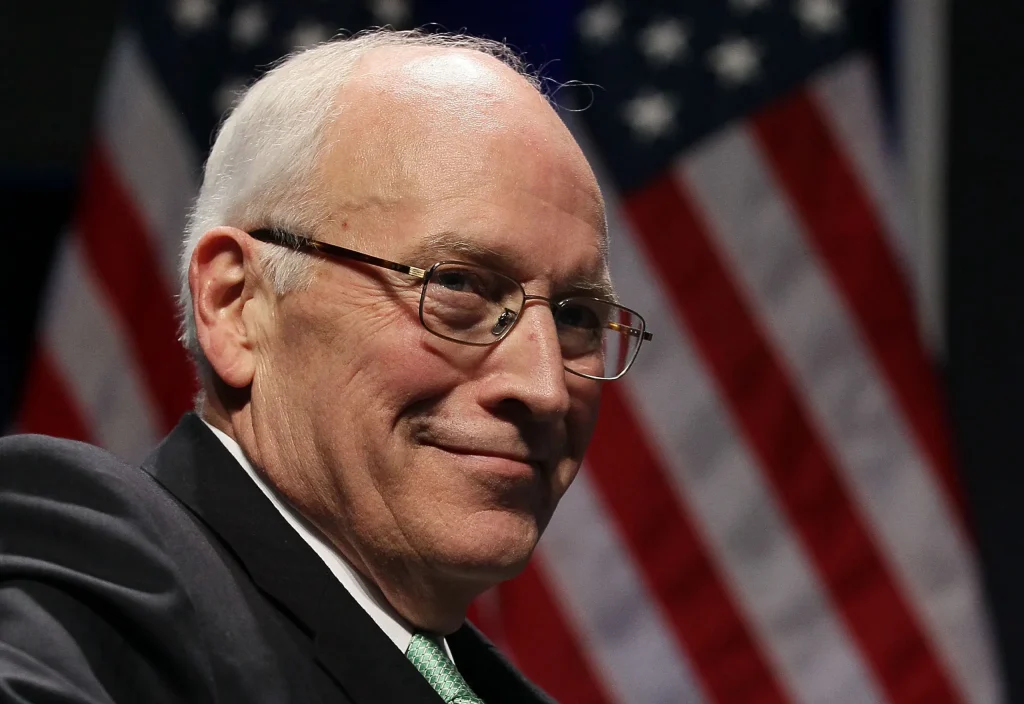

Former U.S. Vice President Dick Cheney, a towering figure in modern American politics, died at age 84 on November 3, 2025, following complications from pneumonia and chronic cardiovascular disease.

While Cheney is widely remembered for his national-security and foreign-policy influence, his impact on energy, environmental regulation, and what later became the ESG (environmental, social and governance) movement is far more nuanced. His policies undermined many early sustainability efforts — yet paradoxically helped spur some of the foundational shifts in the corporate and governance world that underpin today’s sustainability agenda.

This piece assesses how Cheney’s energy and regulatory legacy intersects with sustainability, why it mattered, and what lessons the ESG community can draw from it.

1. Cheney’s Energy & Regulatory Agenda: A Fossil-Fuel First Approach

From his position as Chair of the National Energy Policy Development Group (NEPDG) in 2001 and through his vice presidency (2001-2009), Cheney pursued an agenda heavily weighted toward fossil fuels, deregulation, and energy-security framed through traditional power structures.

The NEPDG report emphasised expanding oil, gas and coal production; unlocking new drilling rights; and reducing regulatory barriers for extractives.

Cheney’s public remarks often prioritised nuclear energy as a “clean” alternative in the sense of greenhouse-gas emissions, but the broader policy stack favoured fossil infrastructure.

On climate policy, the administration he served with withdrew from the Kyoto Protocol and de-emphasised binding federal greenhouse-gas reductions.

As Vice President, Cheney and his office were involved in shaping major changes to regulation of the energy sector, including tax incentives and subsidies largely directed at traditional energy.

In short: Cheney’s intent was not to lead a sustainability revolution, but to reinforce U.S. energy dominance through existing modes of production.

2. The Irony: How His Policies Became a Catalyst for Sustainability Structures

Although Cheney did not propose large-scale sustainability frameworks, several of his actions indirectly fostered the architecture for what would become modern ESG and clean-energy governance:

By favouring centralised fossil-fuel infrastructure and resisting aggressive federal climate mandates, he prompted state-level leadership and corporate self-regulation to fill the gap. For example, state renewable-portfolio standards and corporate disclosure initiatives gained traction in the vacuum of federal leadership.

His vocal support for nuclear energy as a low-GHG option helped re-legitimise nuclear power in climate policy discussions, influencing later bipartisan clean-energy legislation.

The focus on emissions intensity (emissions per unit of GDP) rather than absolute emissions reductions laid groundwork for corporate ESG metrics which often emphasise intensity or efficiency gains in transitional finance frameworks.

Thus, while not explicitly “sustainable,” Cheney’s tenure accelerated several structural shifts that now underpin sustainability governance.

3. A Dual Legacy: What Matters for ESG Practitioners

For those tracking sustainable business, investment, and governance (as your work with ESG News does), Cheney’s legacy is instructive in two ways:

A. What to avoid:

He exemplifies how policy can lock in fossil-fuel infrastructure and delay the transition to low-carbon systems.

Regulatory regression (or inertia) under his administration meant many environmental externalities were unpriced or under-regulated — creating stranded-asset risks later borne by investors and companies.

His tenure underscores the importance of political risk in sustainability strategies — i.e., that government policy reversal or inaction can undermine corporate sustainability claims.

B. What to salvage and build upon:

The vacuum created by federal inaction under Cheney spurred decentralised leadership (cities, states, companies) — a model now central to multi-stakeholder governance in sustainability.

The normalisation of nuclear and other non-fossil options as “part of the menu” owes something to the framing shifts that occurred in his era.

The concept of “emission intensity” as a meaningful metric emerged in that time and remains a key transitional measure in ESG reporting frameworks.

In short: while the intention was not sustainable transition, the derivative legacy is very much intertwined with how the ESG ecosystem evolved.

RELATED ARTICLE: EU plans 300-billion-euro investment to quit Russian fossil fuels

4. Key Takeaways for ESG News Readers

When assessing a public-figure or corporate legacy in sustainability, intent matters less than system impact. Cheney may not have aimed for a green transition, but his policies shaped the conditions from which parts of the sustainability ecosystem emerged.

Infrastructure decisions matter for decades. The expansion of fossil infrastructure during Cheney’s tenure increased future transition costs, which must be accounted for in sustainable finance modeling.

Multi-level governance matters. The federal pivot away from binding climate policy under his watch elevated sub-national and corporate actors — a dynamic now central to global sustainability efforts (and your focus on Africa/India/SE Asia).

Metrics and framing have longevity. The shift towards intensity-based metrics and nuclear as an acceptable “clean tool” began before the boom in ESG investing — showing that today’s frameworks are built on historical policy shifts, even unexpected ones.

5. Final Reflection

Dick Cheney’s name rarely appears in lists of sustainability pioneers. But for ESG observers, his legacy is a mirror image of what sustainability advocates strive to overcome — yet simultaneously, it is a foundation stone of the movement’s architecture.

He reminds us that sustainability progress often arises in spite of rather than because of certain power structures. And that legacy is not just about “what was done,” but “what followed.” In his case: fossil-fuel dominance that triggered counter-movements, infrastructure decisions that raised transition stakes, and policy frameworks that reshaped how companies and states respond to climate risk.

As we note his passing, there is value in studying not just his direct achievements, but their ripple-effects on the world of sustainable business, investment, regulation and governance.

Follow ESG News on LinkedIn