To help navigate the uncertainty, we have framed five possible scenarios, detailed below, that outline plausible pathways, from diplomatic normalization to severe destabilization, and assess their consequences for geopolitics and global oil markets. Only a week ago, the balance of risks appeared tilted towards military action. More recently, intensified diplomatic engagement and signalling from both Washington and Tehran have shifted expectations toward a less confrontational path. That said, developments can unfold quickly, and the probability distribution across scenarios remains highly fluid.

Scenario 1: US forces new nuclear deal

Under this scenario, diplomatic pressure, economic incentives and the credible threat of escalation succeed in bringing Iran back into a formal nuclear agreement without direct military confrontation. Washington prioritizes containment and de-escalation, while Iran’s leadership concludes that economic stabilization and regime survival are best served through compromise rather than resistance. Sanctions are lifted in stages, contingent on compliance, allowing Iran to re-engage with global trade and financial systems.

From a geopolitical perspective, this scenario leads to a gradual reduction in regional tensions. The immediate nuclear threat recedes, lowering the likelihood of unilateral Israeli military action and reducing the need for a sustained US military presence in the Persian Gulf. Relations between Iran and Gulf Cooperation Council (GCC) countries stabilize, with backchannel diplomacy intensifying, particularly with Saudi Arabia and the UAE. Iran shifts focus inward, prioritizing economic recovery and social stability over regional power projection.

For oil markets, the impact is gradual and muted rather than disruptive. Oil prices decrease by around $5 per barrel on the news. Years of sanctions on Iran have eroded upstream capabilities, damaged reservoirs and constrained access to technology and investment. Hence, production and exports recover slowly – likely over several months – limiting the immediate downside for prices. Iran’s crude production increases from 3.2 million barrels per day (bpd) in January this year to around 3.6 million bpd at the end of 2027.

Additionally, the rest of OPEC+ would partially absorb the incremental supply through quota management, while still allowing for the group to regain market share as part of the strengthened diplomatic relations between Iran and GCC countries, particularly Saudi Arabia and the UAE. The disappearance of the geopolitical risk premium, together with the additional supply from Iran, only partially offset by OPEC+, would exert modest downward pressure on prices.

For Israel, a renewed nuclear deal reduces the immediate case for unilateral military action, even if long-term concerns about Iran remain. US security guarantees and enhanced monitoring lower the near-term risk of escalation, allowing Israel to step back from direct confrontation.

At the same time, the Abraham Accords gain further traction. Improved ties between Israel and key Gulf states, particularly the UAE and Bahrain, deepen as shared security priorities shift from crisis management to containment. Stronger regional coordination helps stabilize the security environment and further erodes the geopolitical risk premium in oil markets.

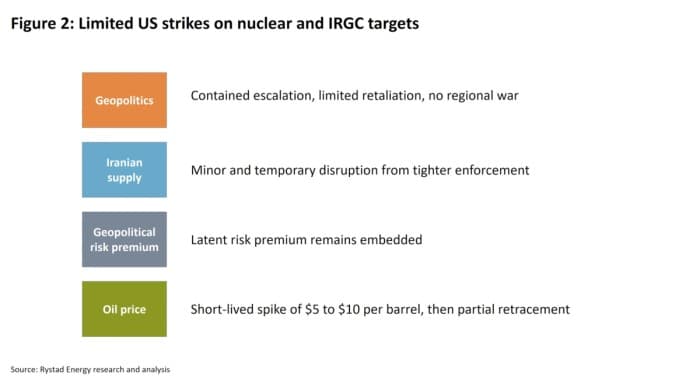

Scenario 2: Limited US strikes on nuclear and IRGC targets

In this scenario, similar to the 12-day war last year, the US conducts targeted strikes aimed at further degrading Iran’s nuclear infrastructure and signalling deterrence, while deliberately avoiding actions that would trigger regime change or all-out war. The strikes are designed to be limited in duration and scope, with clear signalling intended to prevent miscalculation. Washington seeks to reassert red lines without committing to a prolonged conflict.

Iran’s response is calculated and asymmetric, designed to preserve escalation leverage without crossing thresholds that would justify broader US or allied retaliation. A limited and telegraphed attack on US military assets in the region serves primarily as a domestic signalling tool, allowing the leadership in Tehran to demonstrate strength while avoiding uncontrollable escalation. As a result, internal anti-government protests rapidly turn into nationalist demonstrations, temporarily consolidating regime support and reducing internal political pressure. GCC countries avoid taking a strong stance to preserve regional stability.

As in the 12-day war, oil markets respond primarily through sentiment rather than physical disruption. Oil prices briefly increase by between $5 and $10 per barrel. Iranian exports decline only marginally and temporarily as sanctions enforcement tightens and compliance risks increase. However, broader regional supply continues to flow, and the Strait of Hormuz remains open. Oil prices spike initially but retrace as markets assess the limited scope and duration of the conflict. Given the rather limited impact on actual supply, OPEC+ does not react.

The lasting effect is a latent geopolitical risk premium, reflecting heightened uncertainty rather than sustained supply losses. Tensions between Israel and Iran become regular and the threat of additional military escalation remains.

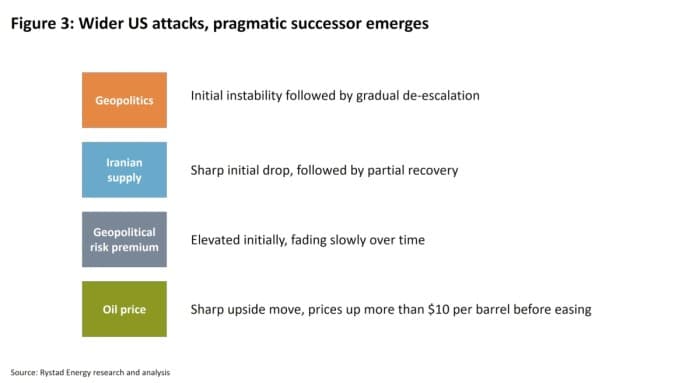

Scenario 3: Wider US attacks, Khamenei killed – pragmatic successor emerges

This scenario assumes a major escalation in which US military action results in the death of the Supreme Leader, Ayatollah Khamenei, fundamentally altering Iran’s political landscape. The immediate aftermath is marked by institutional shock, uncertainty around succession and intense internal power struggles involving the Islamic Revolutionary Guard Corps (IRGC), clerical elites and political factions. Initial anti-government protests rapidly morph into nationalist demonstrations as external pressure reshapes domestic narratives.

From a geopolitical standpoint, Iran seeks to reassert deterrence by briefly disrupting maritime traffic through the Strait of Hormuz, signalling that even under extreme pressure it retains the ability to affect global energy markets. Tensions with GCC countries escalate and the region is on the edge of a regional war. However, the absence of a prolonged closure reflects internal recognition that sustained escalation would threaten regime survival. A pragmatic leadership consolidates power, prioritizing economic recovery, sanctions relief and international reintegration over ideological confrontation. This scenario somewhat echoes recent developments in Venezuela, where leadership pragmatism led to partial normalization after prolonged isolation. Diplomatic channels reopen and, following lengthy negotiations, a new nuclear agreement is secured. Sanctions are gradually relieved, and Iran repositions itself as a transactional rather than confrontational regional actor. Tensions with GCC countries gradually de-escalate.

Oil markets experience a sharp, fear-driven price spike, followed by supply outages due to operational disruption, attacks on energy infrastructure and strict sanctions enforcement. Possible attacks (or direct threats) on oil facilities in GCC countries add a significant geopolitical risk premium. Oil prices increase by more than $10 per barrel as Iranian crude supply initially falls to 2.8 million bpd. However, as the new leadership becomes less confrontational, sanctions enforcement weakens and production gradually recovers. The geopolitical risk premium fades slowly rather than abruptly.

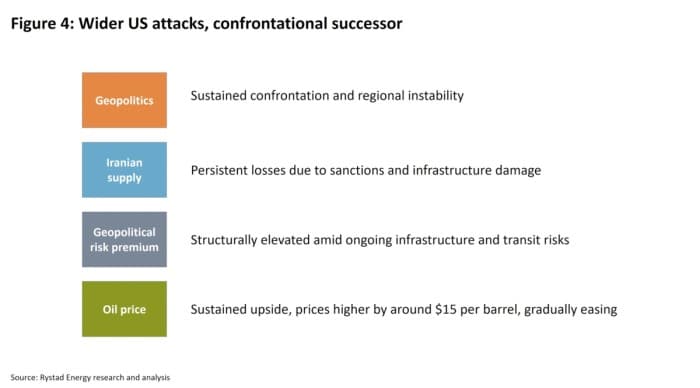

Scenario 4: Wider US attacks, Khamenei killed – confrontational successor

In this scenario, severe US attacks target nuclear and energy assets and result in the death of the Supreme Leader, but leadership change does not produce moderation. Instead, a hardline successor consolidates power by embracing confrontation, portraying resistance as central to the regime’s legitimacy. This leadership relies heavily on the IRGC and adopts a more aggressive regional posture.

Geopolitically, Iran escalates through direct and indirect attacks on US military assets, Israel and GCC energy infrastructure. Maritime threats intensify, with repeated disruption or threats to shipping through the Strait of Hormuz. Diplomatic engagement collapses entirely, and Iran becomes increasingly isolated, relying more heavily on informal ties with Russia, China and non-state actors. Sanctions enforcement becomes strict, coordinated and long-lasting.

The oil market impact is more enduring and structurally bullish. Oil prices initially rise by around $15 per barrel as Iranian exports remain heavily constrained, not only because of sanctions but also due to infrastructure damage, elevated operational risk and a lack of investment. Iranian production falls to 2.6 million bpd by the middle of this year. More importantly, the persistent threat to Gulf infrastructure and transit routes embeds a long-term geopolitical risk premium into oil prices. OPEC+ partially offsets lost Iranian barrels with additional supply, adding some downside price pressure, but sporadic attacks on GCC oil infrastructure limit the group’s ability to fully compensate. Current high levels of crude on water and global crude stocks gradually reduce the price spike.

In this scenario, Israel becomes a central actor rather than a background risk. A confrontational Iranian leadership, combined with sustained attacks on Israeli territory and assets, pushes Israel into a more assertive and sustained military posture. The likelihood of direct Israeli strikes on Iranian and Iran-aligned targets increases, particularly against Hezbollah infrastructure and Iranian assets in Syria and Lebanon. This raises the risk of a multi-front conflict, further entrenching regional instability and reinforcing the structural geopolitical risk premium embedded in oil prices.

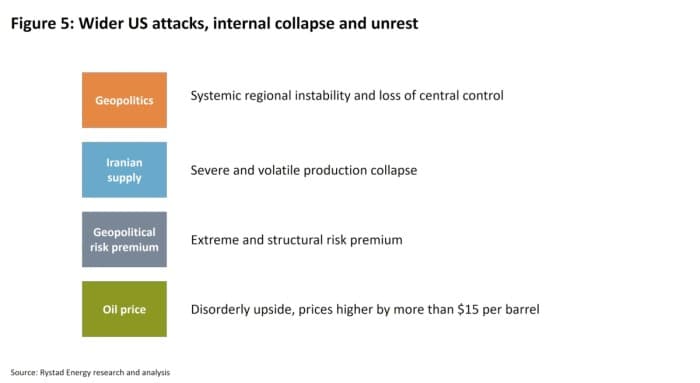

Scenario 5: Wider US attacks, Khamenei killed – internal collapse and civil unrest

The most severe scenario sees US military action trigger a collapse of centralized authority in Iran. The death of the Supreme Leader creates a prolonged power vacuum, with competing factions — including the IRGC, clerical networks, regional elites, and local power brokers — vying for control. Governance fragments rapidly, protests escalate and persist, and the state’s ability to maintain internal order and coherent foreign policy deteriorates sharply. Decision-making becomes decentralized and unpredictable, increasing the risk of uncoordinated or opportunistic escalation.

Geopolitically, Iran transitions from a state-based actor to a source of systemic regional instability. As central command weakens, attacks on US and GCC assets increase in frequency and unpredictability, with limited ability to enforce restraint. Iranian or Iran-aligned actors target GCC oil infrastructure, including production facilities, export terminals and processing hubs, either deliberately or opportunistically. These attacks severely reduce effective OPEC+ spare capacity, undermining the group’s ability to stabilize markets during the crisis. At the same time, prolonged and repeated disruption to shipping through the Strait of Hormuz turn a tactical chokepoint risk into a structural constraint on global energy flows.

For oil markets, this represents an extreme tail risk, with prices increasing by more than $15 per barrel initially. Iranian production collapses to 2.2 million bpd and becomes volatile, but the dominant concern shifts to a multi-layered supply shock affecting both production and spare capacity across the Gulf, potentially pushing the global oil market into deficit. While OPEC+ attempts to offset lost Iranian barrels to stabilize the market, the reduction in spare capacity removes the market’s primary shock absorber, amplifying price responses to even minor disruptions. High level of crude on water and global stocks marginally calm the market. But panic pricing emerges as markets struggle to assess the scale, duration and geographic spread of outages. Insurance and freight costs surge, inventories are rapidly drawn down and spare capacity is repriced aggressively. In this environment, geopolitical risk becomes a persistent and dominant feature of oil pricing rather than a temporary premium.

Geopolitical risk skewed to the upside

Across all five scenarios, Iran’s significance within oil markets extends well beyond its own production profile. The country’s geopolitical weight is rooted in its strategic location, its influence over regional security dynamics, and its capacity to disrupt critical energy infrastructure and transit routes. Even scenarios involving limited military action or gradual diplomatic normalization have meaningful implications for price formation through changes in risk premium, volatility and market confidence. As a result, oil markets are likely to remain highly sensitive to developments in Iran, with headline-driven moves amplified by uncertainty over escalation pathways rather than immediate physical supply losses.

The more severe scenarios highlight the asymmetric risks facing the oil market. While additional Iranian supply under a renewed nuclear deal would exert only modest and gradual downward pressure on oil prices, escalation scenarios carry the potential for sharp, non-linear price responses. In particular, outcomes involving prolonged instability, disruption to the Strait of Hormuz or damage to GCC oil infrastructure would fundamentally alter the market’s ability to absorb shocks by eroding OPEC+ spare capacity. In such environments, geopolitical risk becomes structural rather than transitory, embedding higher prices, greater volatility and increased fragility into the global oil market outlook.

From an oil price perspective, the scenario analysis highlights a clear asymmetry. Downside risks appear limited and gradual, with a renewed nuclear deal likely shaving around $5 per barrel as additional Iranian supply and a fading risk premium. By contrast, escalation scenarios imply larger and faster upside moves. Limited military action could support a short-lived risk premium of between $5 and $10 per barrel, while wider conflict scenarios point to rapid price increases of at least $10 and more than $15 per barrel, driven by immediate supply losses and by threats to transit routes, infrastructure and lost spare capacity.

Disclaimer: The opinions expressed in this article are solely those of the author, and do not necessarily represent the views or beliefs of Rystad Energy.

By Rystad Energy

More Top Reads From Oilprice.com