• The Federal Reserve, FDIC, and OCC have jointly rescinded the 2023 climate risk management principles for large financial institutions.

• Regulators said existing safety and soundness standards sufficiently address all material risks, including those related to climate.

• The decision marks a significant reversal from prior U.S. policy efforts to integrate climate risk into financial supervision.

Washington Pulls Back Climate Oversight for Financial Sector

The U.S. Federal Reserve, Federal Deposit Insurance Corporation (FDIC), and Office of the Comptroller of the Currency (OCC) have formally withdrawn the Principles for Climate-Related Financial Risk Management for Large Financial Institutions, dissolving a framework introduced less than two years ago to help major banks assess climate-related threats to their balance sheets.

The rescission, effective immediately following publication in the Federal Register, eliminates joint guidance that had applied to institutions with over $100 billion in total assets. The principles, established in October 2023, were intended to guide banks in integrating climate considerations into governance, scenario analysis, and risk management.

In their joint statement, the agencies said they “do not believe principles for managing climate-related financial risk are necessary,” arguing that existing safety and soundness standards already require financial institutions to identify and address all material risks within their operating environments, including emerging ones.

Regulators Cite Duplication and Distraction

Officials maintained that climate risk frameworks could distract banks from other prudential obligations. “The Climate Principles may be distracting large financial institutions from the management of material financial risks,” the Federal Reserve said in an internal memo. The agencies emphasized that all supervised institutions must remain resilient to a wide range of potential risks—without the need for dedicated climate-specific oversight.

The withdrawal follows the OCC’s earlier decision to remove its participation from the principles and reflects a growing pivot within U.S. financial regulation away from climate-focused measures.

Political Reversal and Policy Context

The move comes amid broader policy realignments since the start of the Trump administration, which has taken steps to reverse climate-related commitments made under previous leadership. Shortly after the presidential inauguration, the Federal Reserve withdrew from the Network for Greening the Financial System (NGFS)—a global coalition of central banks and supervisors coordinating on climate and green finance issues.

In a speech at the United Nations in September, President Trump described climate change as “the greatest con job ever perpetrated on the world,” setting the tone for a regulatory environment that deprioritizes climate integration in financial oversight.

The withdrawal of the climate principles effectively ends federal interagency coordination on climate financial risk, removing what had been one of the most structured attempts to standardize climate-related governance across U.S. banks.

RELATED ARTICLE: Fed to Launch Climate Risk Resilience Tests with Six of Nation’s Largest Banks

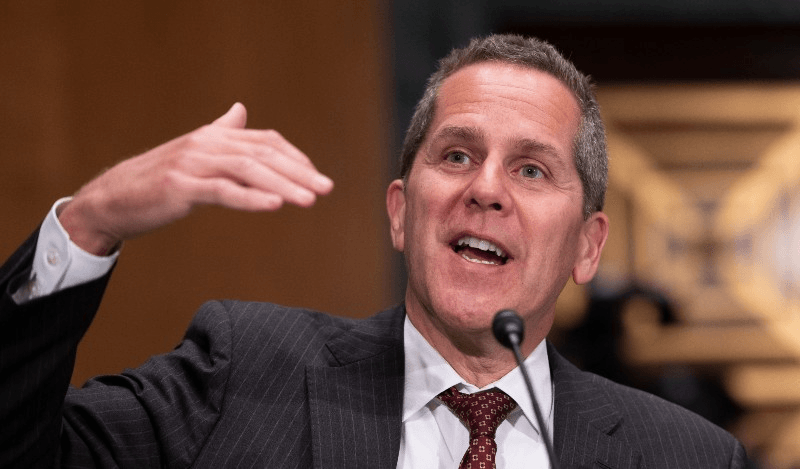

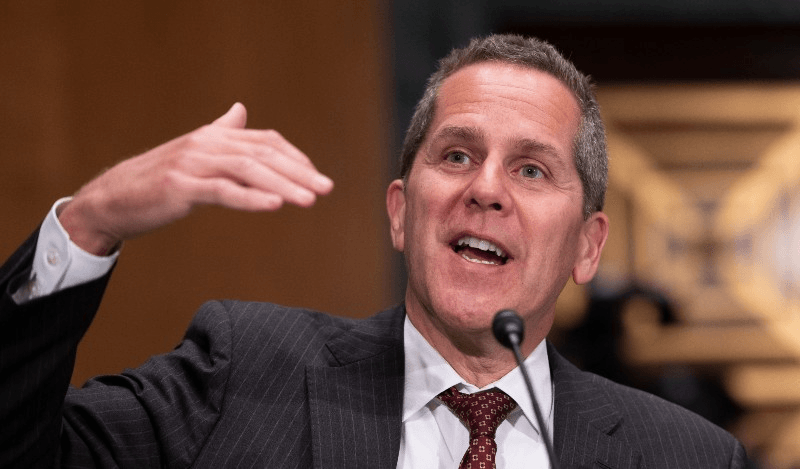

Dissent Within the Federal Reserve

The Fed Board voted 5–2 in favor of rescission. Governor Michael Barr, who opposed the withdrawal, criticized the decision as unjustified. “Revoking the principles as climate-related financial risks increase defies logic and sound risk management practices,” Barr said in a statement following the vote.

He added that the agencies provided “literally no evidence to support taking this step only two years after putting the principles into effect,” arguing that financial regulators “owe the public a rational, evidence-based explanation for our actions.”

Implications for Financial Institutions and Global Investors

For large banks, the immediate impact is regulatory uncertainty. While institutions remain bound by traditional prudential risk management rules, the absence of climate-specific expectations could complicate efforts to align with global disclosure and governance standards, such as those from the International Sustainability Standards Board (ISSB) and the Task Force on Climate-related Financial Disclosures (TCFD).

Global investors are also likely to view the move as further evidence of divergence between U.S. and international regulatory regimes on sustainable finance. European and Asian regulators continue to tighten climate risk disclosure and capital requirements, while the U.S. now shifts focus back toward conventional safety-and-soundness oversight.

A Step Back in Global Climate Finance Alignment

The decision widens the policy gap between Washington and jurisdictions integrating climate considerations into systemic financial stability frameworks. Without coordinated climate-risk oversight, U.S. banks operating internationally may face mismatched compliance obligations and reputational risk in global markets increasingly defined by ESG alignment.

For climate-focused investors and policymakers, the rescission marks a step back in embedding climate accountability into financial governance—an area that many international regulators consider fundamental to safeguarding long-term economic resilience.

As the agencies reaffirm traditional prudential oversight, questions remain over how the U.S. financial system will adapt to intensifying physical and transition risks driven by a changing climate—without a dedicated supervisory framework to measure and manage them.

Follow ESG News on LinkedIn