New Delhi: ExxonMobil, BP and Shell, three of the world’s largest oil companies, have held preliminary discussions with Oil and Natural Gas Corp (ONGC) for a potential partnership in the Indian state-run firm’s $5-billion deep-sea project in the KG basin, according to people familiar with the matter.

ONGC’s KG-DWN-98/2 block off India’s eastern coast has faced prolonged delays and underperformance, prompting the PSU to seek partners with advanced capabilities to navigate the basin’s complex geology, the people said. The KG Block comprises several discoveries grouped into three clusters, with only Cluster 2 currently producing.

Drilling Cost

The KG Block comprises several discoveries grouped into three clusters, with only Cluster 2 currently producing.The foreign majors are exploring a partnership specifically for Cluster 2.

Exxon, BP, Shell and ONGC declined to comment.

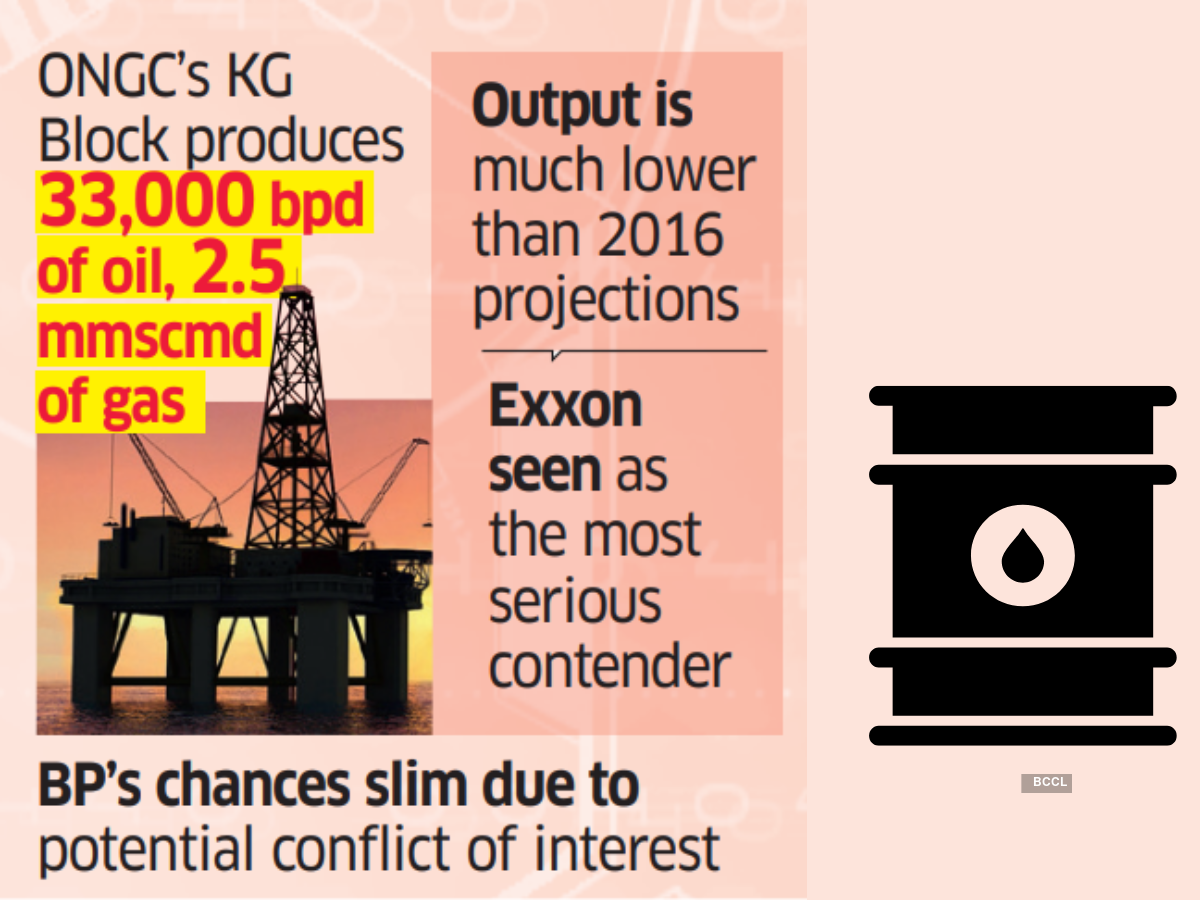

Exxon, with deep experience in deepwater drilling, is seen as the most serious contender. Its global CEO Darren Woods visited New Delhi in February — the first such visit by an Exxon CEO in a decade — and met oil minister Hardeep Puri, ministry officials and ONGC executives.

Last year, Shell expressed initial interest in partnering with ONGC on its flagship Mumbai High field but did not submit a final bid. ONGC instead selected BP, the sole bidder, as the technical services provider for Mumbai High. Under the arrangement, BP will receive a fixed fee for the first two years and a share of incremental output over the next decade, without being required to make any capital investment.

A similar model is unlikely for the KG project, as the basin is “far too capital-intensive” compared to the western offshore, the people cited earlier said. The cost of drilling a single well in the KG block could be more than 10 times that of one in Mumbai High.

“A foreign partner can’t come in just as a technical advisor. It must have skin in the game,” one person said. If a capex plan drawn up by an advisor were to fail, the financial burden would be huge and fall entirely on ONGC, the person added.

Selling a participating interest is also fraught with complications, particularly given ONGC’s state-owned status. “Valuation can be questioned now or years later, with multiple state agencies getting involved,” the person said.

A new partnership structure will likely need to be devised — one that enables risk-sharing while offering adequate safeguards for the state company to proceed, the person said.

BP’s chances appear slim due to a potential conflict of interest. BP and its partner Reliance Industries operate an adjacent KG block and have been in a prolonged legal dispute with the government following ONGC’s 2014 accusation that the partners extracted gas that had migrated from ONGC’s block.

ONGC’s KG block currently produces about 33,000 barrels per day (bpd) of oil and 2.5 million metric standard cubic meters per day (mmscmd) of gas. Production began last year, with peak output targets set at 45,000 bpd of oil and 10 mmscmd of gas — significantly lower than the 2016 projections of 70,000 bpd and 16.3 mmscmd.