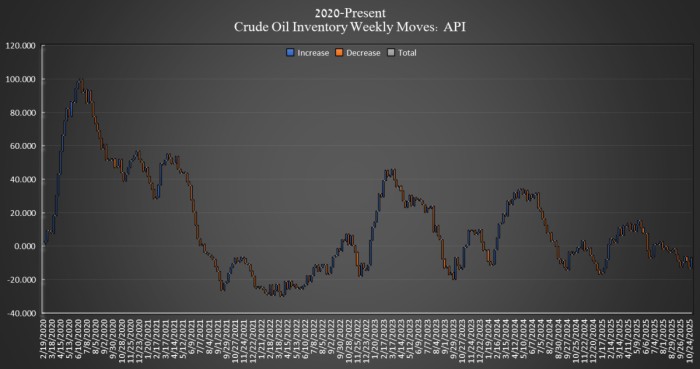

The American Petroleum Institute (API) estimated that crude oil inventories in the United States saw a build of 1.3 million barrels in the week ending November 7, after analysts anticipated a 1.7 million barrel build. Crude oil inventories gained 6.5 million barrels in the week prior.

Crude oil inventories in the United States are so far showing a net gain of 4.9 million barrels for the year, according to Oilprice calculations of API data.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) have risen by 1 million barrels to 410.4 million barrels in the week ending November 7 as the government attempts to replenish the nation’s oil stockpile that shrank during the Biden Administration.

US production rose during the week of October 31, to 13.651 million bpd, according to the EIA. This is 116,000 bpd more than the beginning of the year levels, and a new record based on EIA reported weekly data.

At 3:22 pm ET, Brent crude was trading down, by $2.53 (-3.88%) on the day, sinking to $62.63 after OPEC published its latest MOMR that showed it no longer expected the oil markets to be in a deficit next year. Current prices are a $2 per barrel loss week over week. WTI was also trading down on the day, by $2.66 (-4.36%) at $58.38.

Gasoline inventories saw a decrease of 1.4 million barrels in the week ending November 7, after losing 5.653 million barrels in the week prior. As of last week, gasoline inventories were 5% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories rose in the reporting period, gaining 944,000 barrels, compared to the week prior’s 2.459-million-barrel drawdown. Distillate inventories were already 9% below the five-year average as of the week ending October 31, the latest EIA data shows.

Cushing inventory—the inventory kept at the delivery hub for the WTI Crude futures contract—dipped slightly by 43,000 barrels, after rising by 364,000 barrels in the prior week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com