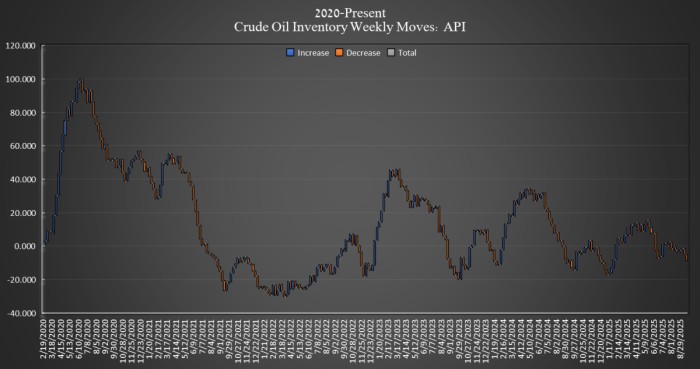

The American Petroleum Institute (API) estimated that crude oil inventories in the United States fell by 3.821 million barrels in the week ending September 19. This week’s draw follows last week’s 3.420 million barrel draw.

So far this year, crude oil inventories are up just 1.5 million barrels, according to Oilprice calculations of API data.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 300,000 barrels to 406 million barrels in the week ending September 19.

At 402 pm ET, Brent crude was trading up $1.36 (+2.04%) on the day, reaching $67.93. While up on the day, the figure is down $0.50 per barrel from this time last week. WTI was also trading up on the day, by $1.41 (+2.26%) at $63.69—a nearly $0.80 per barrel drop week over week.

Gasoline inventories fell by 1.046 million barrels in the week ending September 19, after falling by 691,000 barrels in the week prior. As of last week, gasoline inventories were already 1% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories rose again this week, adding 518,000 barrels, following the week prior’s 1.906-million-barrel gain. Distillate inventories were 8% below the five-year average as of the week ending September 12, the latest EIA data shows.

Cushing inventories grew by 72,000 barrels in the week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com