Oil edged lower on signs that the US and Iran have made progress in nuclear talks, eroding a risk premium in benchmark futures prices.

West Texas Intermediate fell to settle near $62 a barrel after Iranian Foreign Minister Abbas Araghchi said that the two countries reached a “general agreement” on the basis of a potential nuclear deal that would lift sanctions on Tehran and ease the risk of war in the Middle East. Tehran’s negotiators are scheduled to return with a new proposal in two weeks, a US official said Tuesday.

Success in the talks could pave the way for a lasting removal of a geopolitical risk premium that has kept prices elevated since the start of the year amid rising global oil supplies.

The development erased earlier gains after Iran said it would shut parts of the Strait of Hormuz for several hours due to military drills, though traders were skeptical of a meaningful disruption to the waterway that ships about a fifth of the world’s barrels. The US has also sent a second aircraft carrier to the region.

The two sides will each draft and exchange texts for a deal before setting a date for a third round of talks, Araghchi said, cautioning that the next stage would be “more difficult and detailed.”

US Vice President JD Vance said Tuesday that negotiations with Iran went well but the country has not yet acknowledged President Donald Trump’s red lines.

What Bloomberg Strategists say:

“Agreeing on guiding principles to begin drafting text is not the same as resolving enrichment limits, inspection protocols or sequencing of sanctions relief. The market seems to understand that distinction. Implied volatility has eased from recent highs, yet spot prices remain comfortably above $60 a barrel. That resilience speaks to lingering skepticism that diplomacy will translate into anything meaningful.”

— Brendan Fagan, Macro Strategist, Markets Live.

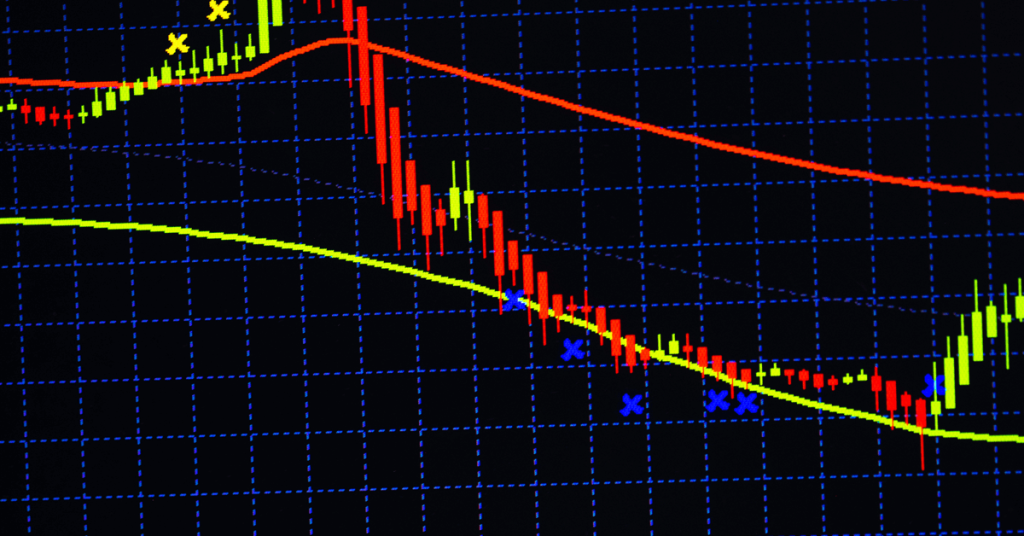

Trend-following commodity trading advisers positioned in WTI breached several sell triggers near $62 a barrel, accelerating the price slide, according to data from Kpler’s Bridgeton Research Group. The robot traders liquidated long positions to sit at 27% short in WTI on Tuesday, compared with 45% at the start of the session, the firm said.

Negotiations are also scheduled between Russia and Ukraine in Geneva over the next two days. However, the prospects of a speedy end to the almost four-year-old conflict and the return of Russian barrels look slim.

Crude is up almost 10% so far this year thanks to a combination of supply disruptions, geopolitical risk and a buildup of sanctioned barrels. While futures have settled in a band between $61 and $65 for most of this month, the outcome of the flurry of diplomatic efforts in the coming days and hours could dictate the path forward for prices.

Oil Prices

WTI settled at $62.33 a barrel in New York.

There was no settlement on Monday because of the Presidents’ Day holiday.

Brent for April settlement was down 1.8% to settle at $67.42 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

element

var scriptTag = document.createElement(‘script’);

scriptTag.src = url;

scriptTag.async = true;

scriptTag.onload = implementationCode;

scriptTag.onreadystatechange = implementationCode;

location.appendChild(scriptTag);

};

var div = document.getElementById(‘rigzonelogo’);

div.innerHTML += ” +

‘‘ +

”;

var initJobSearch = function () {

////console.log(“call back”);

}

var addMetaPixel = function () {

if (-1 > -1 || -1 > -1) {

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

} else if (0 > -1 && 62 > -1)

{

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

}

}

// function gtmFunctionForLayout()

// {

//loadJS(“https://www.googletagmanager.com/gtag/js?id=G-K6ZDLWV6VX”, initJobSearch, document.body);

//}

// window.onload = (e => {

// setTimeout(

// function () {

// document.addEventListener(“DOMContentLoaded”, function () {

// // Select all anchor elements with class ‘ui-tabs-anchor’

// const anchors = document.querySelectorAll(‘a .ui-tabs-anchor’);

// // Loop through each anchor and remove the role attribute if it is set to “presentation”

// anchors.forEach(anchor => {

// if (anchor.getAttribute(‘role’) === ‘presentation’) {

// anchor.removeAttribute(‘role’);

// }

// });

// });

// }

// , 200);

//});