China’s refiners, all but cut off from Venezuelan crude in the past week as the US positions itself for access to the world’s largest oil reserves, are eying a pricier alternative source — Canada.

Chinese inquiries around Canadian supply have increased since the snatching of President Nicolas Maduro at the weekend, traders said, with processors considering the country’s grades seen as among the best replacements for Venezuela’s Merey crude.

The traders did not specify which firms had been among the first movers, but said regular buyers of Venezuela crude — including Shandong Chambroad Petrochemicals Co., Shandong Dongming Petroleum & Chemical Group and Sinochem Hongrun Petrochemical Co. — would need to find new supplies.

China, the top buyer of crude from Venezuela, has benefited from sanctioned cargoes sold at a deep discount over recent years. Private and state-owned refiners have taken cargoes via Chinese equity in oil fields, through oil-for-loans arrangements, as well as with one-off purchases in the spot market, using Chinese yuan and so-called dark fleet tankers in order to sidestep US restrictions.

The Trump administration’s maneuvers over the past few weeks have brought an end to those flows, with an intensifying oil blockade and increasing pressure on Venezuela’s government. This week, the US demanded the country reduce ties with China, Russia, Iran and Cuba, ABC News reported, and partner instead with the US on oil production and sales.

Venezuela’s crude is dubbed heavy-sour, a quality that is viscous and high in sulfur — much like Canadian oil sands crude. The grades yield a lot of oil-products like bitumen when distilled, making them attractive to developing nations such as China.

As of early this week, about 22 million barrels of Venezuela oil were available and floating in vessels off Malaysia and China, providing a buffer for those in need of prompt feedstock. That supply cushion, however, is only estimated to meet China’s demand for up to two months. From the second quarter of the year, buyers will need Canadian crude or other alternatives, traders said.

China bought just under 40 per cent of Canada’s seaborne crude exports in 2025, according to Kpler data. Still, Canadian crude is far more expensive than Merey — it currently costs around $8 to $9 a barrel more — which may deter some processors. That price difference may narrow as more refiners bid up the northern alternatives and Venezuelan flows return to the mainstream.

Canadian grades which load from Vancouver in British Columbia, take about 17 days to reach Qingdao in China. That’s far shorter than the 57-day voyage from Amuay Bay in Venezuela and means the oil can be transported on a variety of tankers from smaller Aframaxes through to very large crude carriers, giving buyers more freight options.

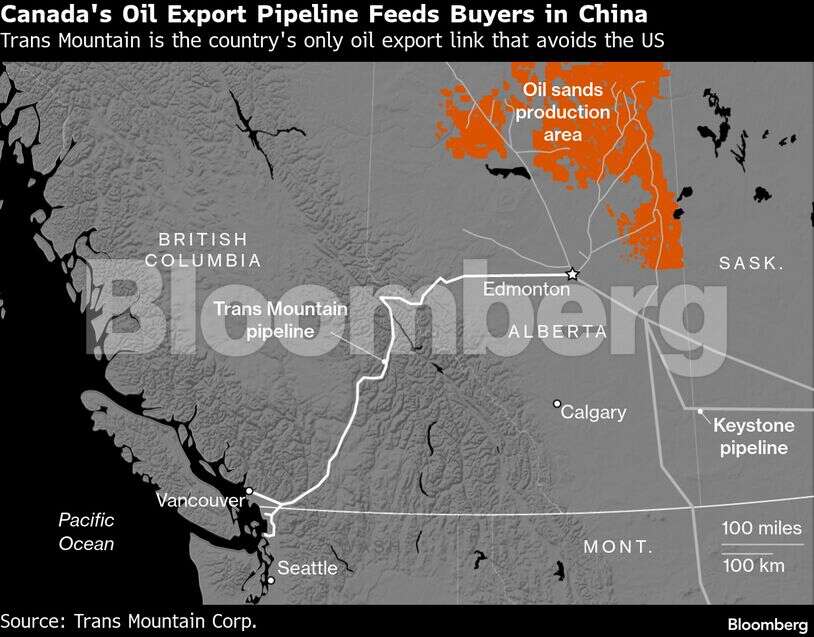

Canada-to-China flows have increased since the successful expansion of the Trans Mountain Pipeline in 2024, which enabled producers to send more oil to the west coast for export to Asia. Some early cargoes were sold to Chinese state-run Sinochem and Sinopec, while private refiner Zhejiang Petroleum & Chemical Co. took more shipments over time. The companies also have representative offices in places such as Calgary.

Apart from Canadian crude, other possible substitutes for Venezuelan oil include fuel oil and heavy crude from Brazil, though the South American country is already supplying much of its production to China.