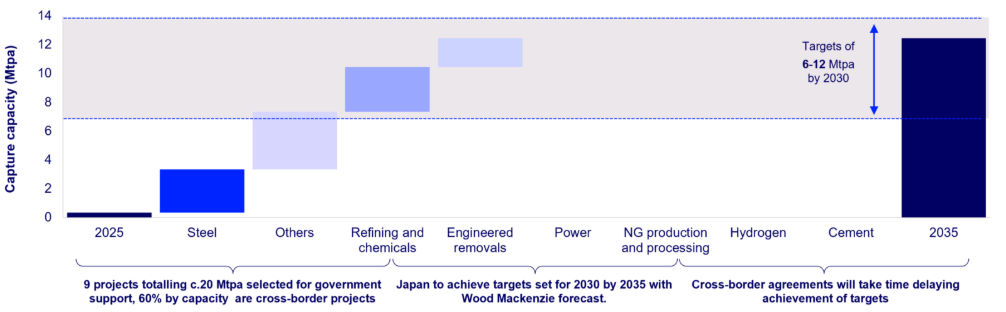

Japan’s CCUS sector is entering a rapid expansion phase, with capacity projected to surge from current demonstration levels of 0.3 Mtpa to nearly 12.5 Mtpa by 2035, according to Wood Mackenzie. This 30-fold increase positions Japan at the forefront of Asia-Pacific’s industrial decarbonisation efforts.

However, achieving full government targets will require accelerated development of cross-border storage partnerships. Wood Mackenzie forecasts Japan will reach its 2030 targets by 2035, with cross-border agreements requiring additional time to finalise.

Japan’s capture capacity build up

Source: Wood Mackenzie Lens Carbon

Note: Engineered removals predominantly include Direct Air Capture (DAC) and Bioenergy and carbon capture, utilisation and storage (BECCS) today. Others include projects covered under sectors like paper and pulp, ethanol and other industrial sectors to name a few.

Cross-border collaboration key to Japan’s CCUS ambitions

Japan’s CCUS development is increasingly driven by industrial applications, particularly in hard-to-abate sectors like steel, petrochemicals. Among the nine advanced Carbon Capture and Storage (CCS) projects shortlisted by the government, totalling over 20 million tons per year (Mtpa) of potential capacity, nearly 60% of this capacity relies on international cross-border storage partnerships.

“Cross-border collaboration is not just an option, but a necessity, even though 2035,” said Hetal Gandhi, Lead – CCUS, Asia Pacific at Wood Mackenzie. “While there are countries well positioned in terms of storage policy and project pipeline, costs challenges remain for cross border carbon transport. For instance, transporting captured emissions from Japan domestically versus to Australia could cost 7–9 times more. However, early movers securing the right storage fields and partnerships could limit overall cost increases to around 15–20%. Bilateral agreements will be a critical area to watch as nations race to achieve competitive advantage.”

Policy framework strengthens commercial viability

Japan now ranks second in Asia Pacific for CCUS policy readiness, trailing only Australia, according to Wood Mackenzie’s Policy Readiness Index. The country scores particularly strongly on two key parameters: the quantum and specificity of CCUS targets, and access to low-cost funding.

Japan’s legislated net-zero targets and robust storage regulatory regime position it alongside global leaders. The transition of Japan’s GX ETS from voluntary to mandatory status, combined with fuel tax levy implementation, is creating stronger economic incentives for CCUS adoption across industrial sectors.

Cross-border transport is the next frontier

The emergence of cross-border CO2 transport represents a transformative trend, particularly relevant for Japan’s island geography. Wood Mackenzie has developed a new assessment framework evaluating country readiness for cross-border CO2 transport across six parameters, from CCUS infrastructure foundations to regionally traded carbon pricing. The analysis shows Japan is well-positioned to lead this emerging market segment, with potential storage partnerships under discussion with Australia, Indonesia, and Malaysia.

However, cost challenges remain significant. Transport costs from Japan to Australia could be 7-9 times higher than domestic transport. Early-mover advantages and strategic partnerships could limit overall cost increases to 15-20%, but bilateral agreements will be critical to establishing competitive frameworks.

Gandhi added “multiple storage hubs in the Asia-Pacific region are developing capabilities specifically designed for cross-border services. Japan’s early-mover positioning in bilateral agreements and strategic partnerships will be critical to securing advantaged storage access.”

Investment requirements and government support

According to Wood Mackenzie, Japan will require at least USD 10 billion in government support for CCUS implementation through 2050, assuming carbon prices reach USD 69 per unit by mid-century. This support is essential given the current profitability landscape for CCUS projects globally.

Analysis of 200 CCUS projects across multiple geographies shows that even best-in-class incentives and emissions trading system (ETS) revenues often fall short of covering full project costs when considered individually. Successful project economics require “stacking” multiple support mechanisms: combining capital and operational grants, tax incentives, ETS revenues, and potential product premiums for low-carbon materials. Focus on lowering cost is also important.

“Japan’s focus on high-value industrial applications and technology development will need to create pathways to commercial viability that go beyond basic carbon pricing,” Gandhi concluded. “The integration of domestic innovation with strategic cross-border partnerships will be key to optimize the value equation.”