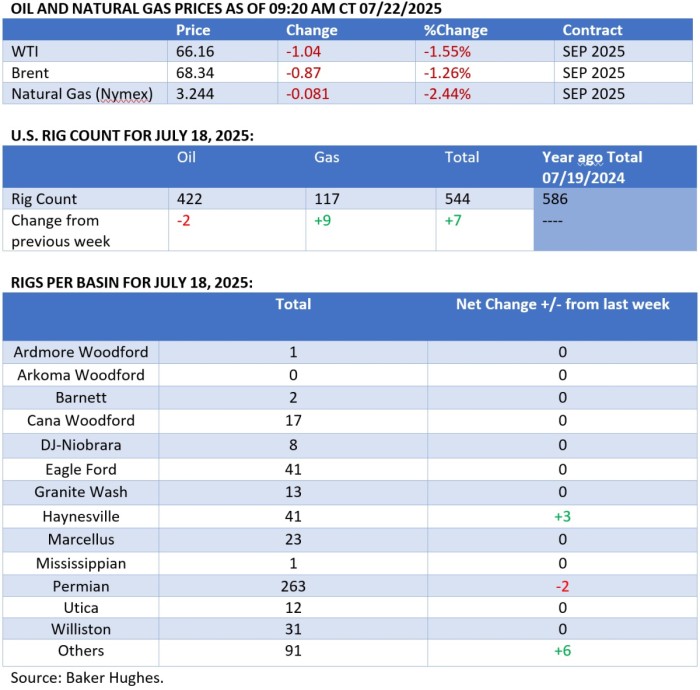

Brent crude remains stuck below $70 per barrel as top EU officials doubt the probability of a trade deal being concluded.

Diesel’s Bullish Run Continues as Gasoline Summer Boom Totters

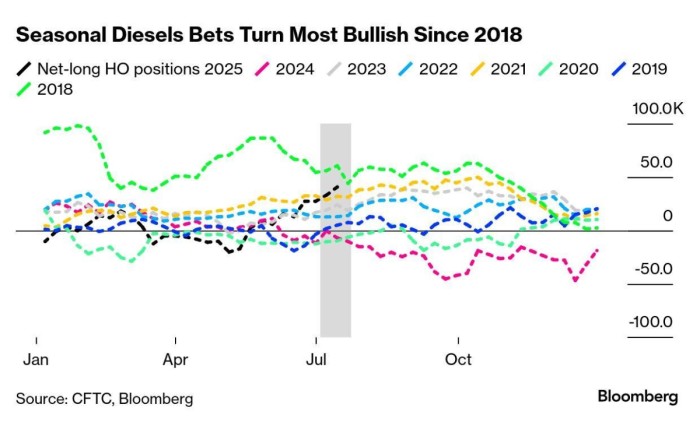

– Proving most of industry watchers wrong, diesel continues to strengthen in July, contradicting usual commodity cycles that should place the premium on more seasonal products such as gasoline and defying expectations that Donald Trump’s tariff warfare would primarily weaken middle distillates.

– US diesel stocks have been below the 5-year range since May, falling to their lowest since 1996 for this time of the year, exactly at a time when the transatlantic trade to Europe is the most profitable in years.

– In stark contrast to previous years, the usual summer craze in gasoline markets failed to materialize, keeping bullish bets on gasoline at an 8-year seasonal low, whilst hedge funds and other money managers are the most bullish on diesel since 2018.

– European politics have added a new twist to diesel cracks after Brussels imposed an import ban on refined products made from Russian crude, impacting Turkish and Indian refiners and leaving the Old Continent’s middle distillate short even more exposed.

– Europe’s benchmark ICE gasoil crack soared to $28 per barrel this week whilst US diesel traded even higher at $34 per barrel, an almost $10 per barrel premium over next year’s August 2027 diesel crack futures contract.

Market Movers

– UK oil major BP (NYSE:BP) named Albert Manifold as its new chairman, replacing the outgoing Helge Lund with a chief executive that has had no previous experience in the energy sector.

– Simultaneously to its board moves, BP has agreed to sell its US onshore wind business to US-based developer LS Power as part of CEO Murray Auchincloss’ target of divesting $3-4 billion this year.

– Norway’s state energy company Equinor (NYSE:EQNR) inked a 10-year natural gas supply deal with German industrial giant BASF (ETR:BAS), locking in direct deliveries in a paradigm shift for European manufacturers.

– Portuguese oil firm Galp Energia (ELI:GALP) is reportedly seeking to close a deal to divest part of its 80% stake in Namibia’s giant 10-billion-barrel Mopane discovery by the end of this year, seeking to bring in an ‘experienced operator’.

Tuesday, July 22, 2025

Oil prices have been capped by non-cessant speculation that the Trump administration might run out of yet another deadline, this time failing to post any notable success stories in bilateral trade talks ahead of the August 1 deadline. In fact, the fallout between Europe and the United States might deteriorate over the upcoming days as this week has seen top EU officials doubt the probability of a trade deal being concluded. Waiting for the next big move, ICE Brent is currently trading around $69 per barrel.

Europe Starts Drawing Up US Retaliation Plans. According to media reports, the probability of the US and the EU finding common ground on tariffs before August 1 is limited, prompting several countries incl. Germany to draft ‘anti-coercion’ measures, stoking fears of a trade war escalation.

Beijing’s Giant Hydro Project Buoys China Believers. China announced the construction of what would become the world’s largest hydropower dam in the east of the Tibetan Plateau at an estimated cost of $170 billion and capacity of 300 billion KWh/year, boosting Chinese construction stocks.

UK and EU Agree to New Oil Price Cap. The United Kingdom has joined the European Union in setting the new price cap on Russian oil at $47.60 per barrel, to be adjusted automatically depending on future price movements, all the while price caps for refined products are kept unchanged.

Related: CNOOC Starts Heavy Crude Production at China’s Largest Shallow Oil Field

Antimony Supply Plunges Despite Rare Earth Deal. China’s exports of antimony were down 88% in June compared to January, similarly to germanium that collapsed by 95%, as the resumption of China-US rare earth exports seem to have excluded two key minerals used in weapons production.

Turkey Eyes Full Energy Reset with Iraq. The Turkish government announced the end of a decades-old agreement covering the transportation of oil along the Kirkuk-Ceyhan pipeline, submitting a draft proposal to Baghdad to renew and expand cooperation in the oil and gas sectors.

Cheaper LNG Weakens Coal in East Asia. One of the stalwarts of coal demand in Asia, the Philippines is set to record its first annual decline in coal-fired electricity output since 2008 as a 5.2% year-over-year increase in LNG consumption, reaching 10.4 TWh in H1 2025, affirmed the gas pivot.

UK Embattled Refinery to Close for Good. The United Kingdom’s 110,000 b/d Lindsey refinery that fell into insolvency late June following the bankruptcy of its operator Prax will be permanently shut down after no buyers were found for the plant, leaving Britain with only four operational refineries.

California Plans U-Turn on Oil Drilling. California governor Gavin Newsom is reportedly working with state legislators to ‘stabilize’ oil production in the Golden State after output collapsed to just 285,000 b/d in 2024, halving from a decade ago, seeking to expedite the permitting of new oil wells.

Trump Wants US Energy Involved in Syria. US energy firms Baker Hughes (NASDAQ:BKR), Hunt Energy and Argent LNG will jointly develop a masterplan for rebuilding Syria’s embattled energy sector, seeking to counter Qatar’s $7 billion investment to boost Syrian power generation.

Mining Giant Quits Tanzania Project. Australia’s mining giant BHP (NYSE:BHP) has decided to divest its interest in Tanzania’s $1 billion Kabanga nickel project, according to operator Lifezone Metals (NYSE:LZM), with the decision probably driven by an uncertain nickel market outlook.

Zinc Is Set for a Stellar July Rally. Benchmark LME three-month zinc futures rose to their highest since March, surging past $2,840 per metric tonne, as more than half of the 118,225 tonnes held in LME-registered warehouses had been earmarked for delivery, drastically curbing availability.

Beijing Protests Against Canada’s Steel Tariffs. Chinese authorities expressed their indignation over Canada’s 25% tariff on steel imports from all countries containing steel melted in China, saying the move violates WTO rules and damages the two states’ June agreement to improve trade relations.

Blackouts Boost Gas Use in Spain. Spanish power generators doubled down on gas for electricity generation after a major blackout paralyzed the country on April 28, seeing a 6% year-over-year increase in gas consumption in H1 2025, primarily led by a 40% increase in power demand.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com