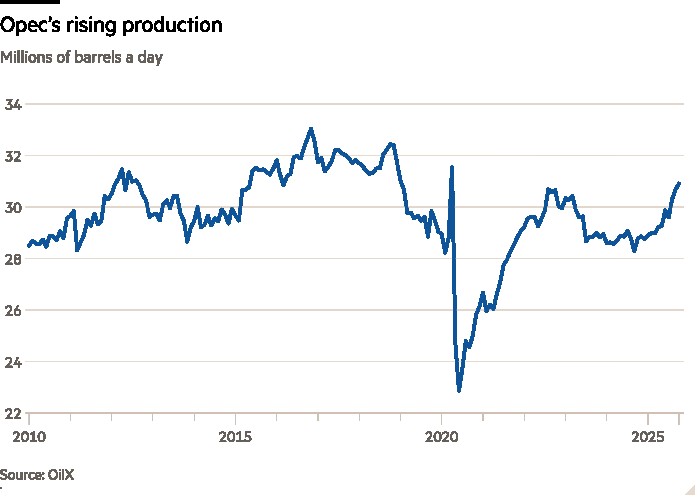

OPEC+ has failed to spark an oil price rally with its commitment to halt production hikes in the first quarter of 2026, as fears of a supply glut continue to weigh on both Brent and WTI.

– OPEC+ surprised oil markets by announcing a pause in its scheduled return of voluntary cuts throughout Q1 2026, having agreed on a minor 137,000 b/d increase for December 2025.

– According to media reports, Russia was the largest proponent of the temporary supply hike pause, giving OPEC+ more time to assess the impact of sanctions on Russian crude production.

– Whilst Saudi Arabia was the main driver behind triple monthly increases earlier this year, it supported Russia’s motion for 2026, arguing that Q1 will see notable inventory builds across the globe and there would be little incentive to worsen the glut.

– OPEC+ countries have collectively boosted their quotas by 2.9 million b/d this year to date, half of the oil group’s total 5.85 million b/d voluntary cuts.

– In real terms, however, OPEC+ boosted production by only 70-75% of their respective targets as many analysts argue these volumes were already in the market, largely unaccounted for.

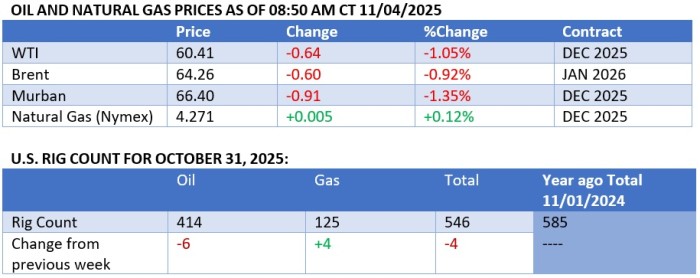

Market Movers

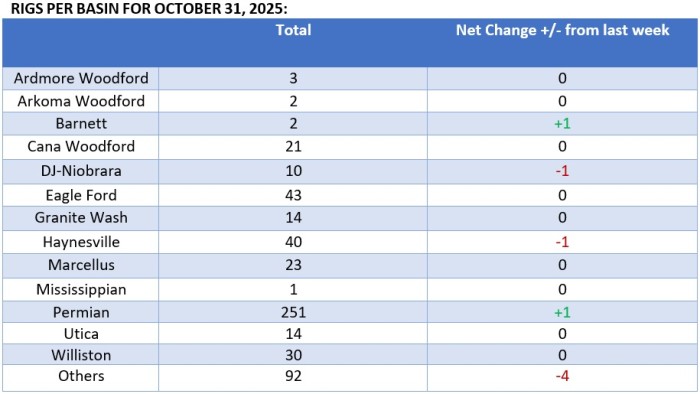

– UK oil major BP (NYSE:BP) has agreed to sell minority stakes in its US onshore pipeline assets in the Permian and Eagle Ford basins to investment firm Sixth Street for $1.5 billion, under pressure from activist investors to divest.

– US oil major Chevron (NYSE:CVX) has signed a deal with Guinea Bissau to explore two offshore blocks in the African country’s offshore sector, taking a 90% working interest in both with national oil company Petroguin holding the remaining 10%.

– Latin America-focused upstream firm Geopark (NYSE:GPRK) has rejected an unsolicited acquisition proposal from peer producer Parex Resources in a deal worth almost $1 billion, building up an 11.8% position in the company before.

– Italy’s energy major ENI (BIT:ENI) has signed a deal to assess five offshore oil and gas blocks in Sierra Leone, a West African country that is still yet to see a commercially viable discovery despite its proximity to Ivory Coast and Ghana.

– Libya’s National Oil Company announced a new oil discovery in the Ghadames Basin in the northwestern part of the country, with its H1-NC4 exploration well producing almost 5,000 b/d.

Tuesday, November 04, 2025

OPEC+ paying heed to 2026 oversupply concerns did relatively little to wake up crude oil prices from their week-long slumber, seeing ICE Brent flat around $65 per barrel. Top oil executives meeting in Abu Dhabi this week tried to boost market sentiment, repeating all over that next year’s oil glut will not be as bad as thought, however an upside rally is only likely to materialize if the US-Venezuela tensions escalate into military action.

OPEC+ to Halt Output Hikes in 2026. Eight members of OPEC+ agreed to increase collective output targets in December by another 137,000 b/d, as well as to pause the monthly hikes in the first quarter of 2026, citing ‘seasonality’ in stock builds and a weak demand outlook in the short term.

ADNOC and SLB Roll Out AI System to Optimize Oil Production. ADNOC has partnered with SLB and Cognite to deploy AiPSO, an AI-powered platform designed to optimize oil production across all 25 of its fields by 2027. Already active at eight sites, the system integrates SLB’s Lumi platform and Cognite Data Fusion to analyze millions of real-time data points, enabling engineers to diagnose and optimize wells in minutes.

Argentina Boosts Its LNG Portfolio. Argentina’s state oil firm YPF (NYSE:YPF) signed a deal with Italy’s ENI and ADNOC’s investment arm XRG to build a 12 mtpa LNG export facility at a port in the Patagonian province of Rio Negro, with gas to be sourced from the Vaca Muerta shale play.

Brazil Production Hits a New Record. Brazil’s pre-salt crude production is booming, as confirmed by September output statistics from the country’s regulator ANP that show production at 3.91 million b/d last month, up 13% from a year prior, with the Tupi field producing a whopping 820,000 b/d.

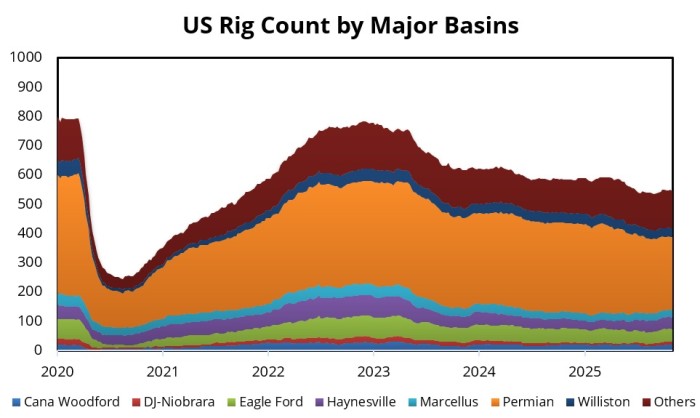

Permian Consolidation Is Still Not Over. US shale producers SM Energy (NYSE:SM) and Civitas Resources (NYSE:CIVI) agreed to a $12.8 billion merger to create one of the largest Permian-focused independent upstream firms in the country, holding a total of 823,000 net acres across the US.

Qatar Flaunts 2026 Expansion Start. The chief executive of QatarEnergy Saad al-Kaabi announced that the company’s large-scale North Field expansion project will produce its first LNG in the second half of 2026, adding 49 mtpa of liquefaction capacity to the country’s currently operational 77 mtpa.

Ukraine Strikes Russia’s Black Sea Port. Ukraine drone strikes have damaged oil terminal infrastructure in Russia’s Black Sea port of Tuapse, loading on average 240-250,000 b/d of refined products, with an oil product tanker docked in the port also catching fire from falling debris.

Venezuelan Exports Shrink on Diluent Dearth. Venezuela’s oil exports dipped by 26% month-over-month to 808,000 b/d in October as shrinking inventories of much-needed diluents restricted heavy crude upgrading, with Chevron shipping 16% of total outflows (equivalent to 128,000 b/d).

Glencore Shuts Canada’s Key Smelter. Mining giant Glencore (LON:GLEN) is planning to shutter its Horne smelter, Canada’s largest copper-producing plant, due to a long-standing lawsuit over arsenic emissions in Quebec and more than $200 million required to modernize it to keep it operational.

Ørsted Divests Key Asset. Denmark’s embattled wind developer Ørsted (COP:ORSTED) sold a 50% stake in Britain’s Hornsea 3 offshore wind farm to US investment firm Apollo Global Management for $6.1 billion, a record sum for a wind project, seeking to avoid a crippling credit rating downgrade.

Pakistan Cuts Down on LNG Deals. Pakistan has agreed to cancel 21 LNG cargoes in 2026-2027 under its long-term deal with Italy’s ENI (BIT:ENI), also launching talks with QatarEnergy to defer term cargoes or potentially even resell them as gas demand continues to plunge in the country.

Iraq Bans Fuel Imports. Iraqi Prime Minister Mohammed al-Sudani has signed a decree suspending the country’s gasoline, diesel and kerosene imports as domestic refining production is now exceeding local consumption, having imported only 20,000 b/d of gasoline in October 2025.

LNG Freight Rates Soar Again. Tight availability of LNG carriers in the Atlantic Basin has pushed daily freight rates in the region to their highest since August 2024, trending around $61,500 per day, whilst ample supplies across the Asian markets kept freight there much lower, at $42,250 per day.

Stakeholders Urge Rio to Derail Teck-Anglo Merger. Activist fund Pallister Capital has urged Australia’s mining giant Rio Tinto (NYSE:RIO) to challenge Teck’s 53 billion merger with Anglo American, with one month left until the Anglo Teck shareholder vote planned for December 9.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com