Brazil’s state development bank to invest R$10 billion ($950 million) in variable income by 2025, half directed to sustainable projects.

Up to R$30 billion in total green financing expected through private capital mobilization.

Strategic focus shifts from “national champions” to climate, innovation, and transparency.

Brazil’s national development bank, BNDES, has launched one of its largest public investment initiatives in nearly a decade, committing R$10 billion in variable income through 2025. Of this, R$5 billion will be directly allocated to companies advancing decarbonization, innovation, and ecological transition projects, with the remaining R$5 billion channeled through investment funds.

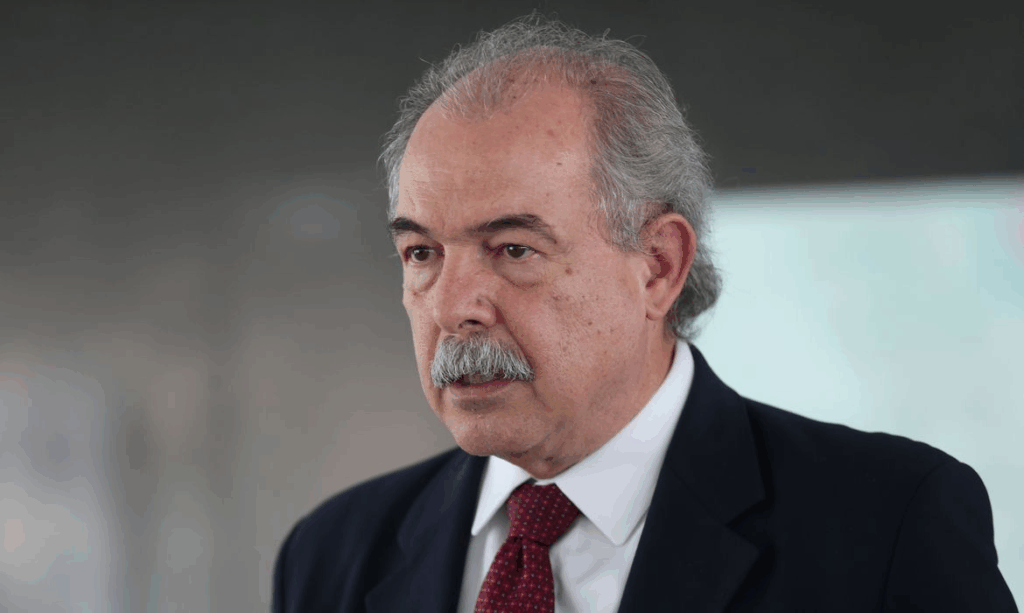

BNDES CEO Aloizio Mercadante emphasized the shift in approach: “The new strategy places sustainability, innovation, and competitiveness at the center of our investment decisions, ensuring public resources have a multiplier effect on Brazil’s ecological transition.”

A Dual Investment Structure

The program will split financing between direct equity injections in companies and investments via funds, with calls open until December 2025. The Climate Call—expected to be launched during COP-30 in Belém—will select funds focused on energy transition, nature-based solutions, and low-carbon technologies.

By combining public capital with private sector participation, BNDES expects to leverage up to three times its initial contribution, potentially mobilizing more than R$30 billion for the green economy by 2026.

RELATED ARTICLE: IDB, Banco do Brasil, CAIXA and BNDES Announce Development of Amazon Rainforest ETF

New Criteria for a Green Economy

The bank will prioritize firms that demonstrate solid financial viability, clear emissions reduction commitments, and scalable innovation. This marks a departure from past practices criticized for supporting a small set of “national champions.”

“This is about diversifying, innovating, and building a transparent, impact-driven capital market in Brazil,” Mercadante said.

Strengthening Brazil’s Green Leadership

BNDESPar, the bank’s investment arm, already participates in 53 active funds, representing R$8 billion in commitments and mobilizing R$27 billion from private investors. The latest initiative significantly scales that footprint, with green investments at its core.

If successful, Brazil could establish one of Latin America’s largest sustainability financing programs, fueling sectors from renewable energy and clean transportation to sustainable agribusiness and the bioeconomy.

Follow ESG News on LinkedIn