(Bloomberg) — France’s TotalEnergies SE is in talks with at least two suitors who have submitted bids for its shale oil assets in Argentina, according to people familiar with the matter.

Progress with the divestment comes after CEO Patrick Pouyanne said earlier this year that he’d be willing to offload stakes in the fields at the right price.

Total declined to comment.

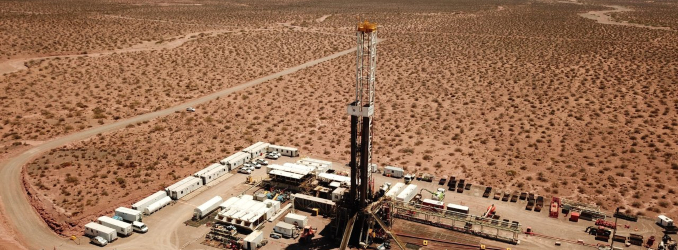

Crude production in the Vaca Muerta shale formation is growing, topping 442,000 barrels a day in April, 22% more than a year earlier. But much of that is being pumped by homegrown companies.

Global players like Exxon Mobil Corp., Malaysia’s Petronas and Total are exiting as libertarian President Javier Milei’s reforms, including looser capital controls, boost valuations for shale acreage. That’s opening a window of opportunity for them to sell and reallocate the capital to priority assets elsewhere.

The oil fields, called La Escalonada and Rincon La Ceniza, lie in an underdeveloped corner of the formation with huge potential, north of the main production hub. Total owns 45% of each field and Shell Plc 45%; the remaining 10% belongs to provincial oil company GyP del Neuquen.

Total’s Argentine shale gas assets aren’t currently up for sale and the company is even spearheading efforts to turn Argentina into a noteworthy supplier of the fuel to neighboring Brazil.