Big Tech is taking the AI age to a whole new level.

When Amazon, Alphabet, Microsoft, and Meta announced earnings recently, one set of numbers stole the show: The massive projections for data center spending this year.

Though the industry’s capital expenditures — spending on property and equipment — have ramped up in recent years, 2026 is shaping up to be leaps and bounds ahead of any private-sector infrastructure spending in modern history.

The projections draw comparisons to previous transformational eras, such as the Gilded Age of the late 1800s and the Information Age of the 1990s.

Still, Wall Street questions whether it will bring a return on investment — and investors are starting to get antsy. Shares of Amazon, Microsoft, and Meta were all down as of Friday morning. Microsoft was slightly up.

“Investors needed more than promises to underwrite this story,” Bernstein analyst Mark Shmulik wrote Thursday in a research note following Amazon’s earnings call.

Amazon took the cake, pledging $200 billion

Amazon said Thursday it is planning $200 billion in capital expenditures this year, a more than 50% increase from 2025 and the largest estimated budget among Big Tech companies.

The forecast came in $50 billion above analysts’ expectations, and they were less than impressed — despite Amazon’s 14% revenue growth for the quarter compared with the same period last year.

The company’s stock dropped as much as 10% after the bell on Thursday, and was down 8% on Friday morning.

With spending this extreme, a beat on earnings should be “table-stakes,” Bernstein’s Shmulik wrote Thursday night in a research note that dripped with sarcasm.

“If we’re going to peg the share price to 2026 CapEx, maybe Amazon should have guided even higher, Shmulik wrote. “Why not at this point?”

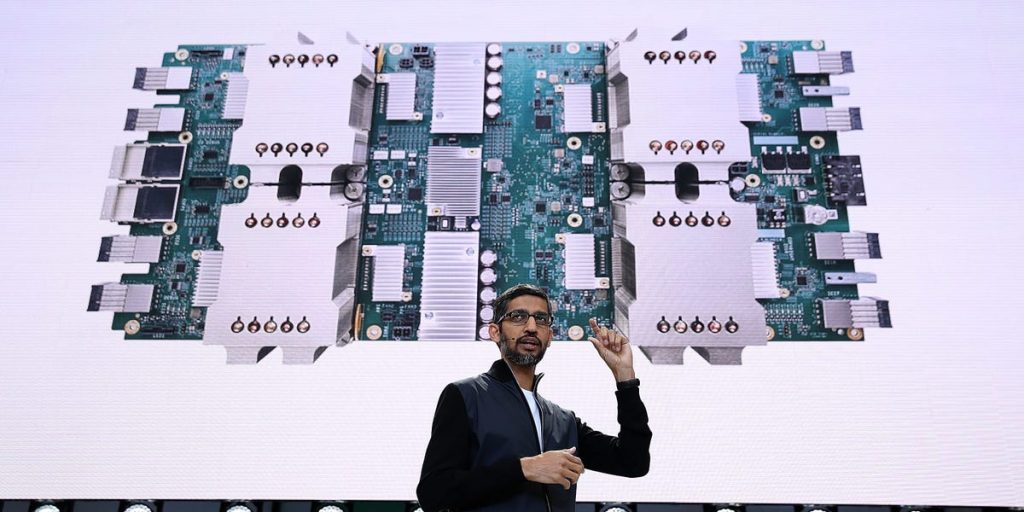

Google doubled its budget for the second year in a row

Google parent Alphabet stunned investors on Wednesday when it said it is planning $175 billion to $185 billion in capex for 2026, doubling its budget for the second year in a row.

Google, which trails behind Amazon and Microsoft in cloud services, has dramatically increased its spending as demand for its Gemini AI models grows. Gemini has surpassed 750 million monthly active users, the company said on its fourth-quarter earnings call.

Google’s stock was down about 2% Friday morning as investors digested Big Tech’s big spending plans for 2026.

One thing Google has going for it is the growing enthusiasm for Gemini.

“We believe these investments are rational, given its fast-growing backlog, supporting our view that Alphabet is among the best positioned to emerge as one of the leading, if not the leading, AI platform,” BNP Paribas analyst Nick Jones wrote Thursday in a research note.

Meta seemed to get a pass from investors — at first

Like its Big Tech peers, Meta will up the ante on AI investment in 2026. It was the only company that seemed to get a pass from investors this earnings season — at first, that is.

Meta said last week it is planning $115 billion to $135 billion in capex, close to doubling its spend from last year. Meta’s stock surged 8% on January 29, the morning after its fourth-quarter earnings call. Investors were pleased with the social media giant’s strong advertising business, which reported $58.14 billion in ad revenue that quarter. What’s more, it saw gains from its advertising AI tools.

Since then, enthusiasm has waned, and the stock has been on a downward slope this week.

Microsoft has a massive bet on OpenAI

Microsoft reported $37.5 billion in capex for the second quarter of its fiscal 2026. While the company hasn’t released full-year capex guidance, S&P last week estimated the figure could be around $97.7 billion, with some analysts projecting slightly more.

Microsoft’s cloud business heavily depends on OpenAI. The ChatGPT-maker represents 45% of its backlog, meaning Microsoft’s future cloud revenue largely depends on it. The company’s stock fell 12% on January 29, the morning after it reported earnings last week — Microsoft’s biggest decline since March 2020.

Investors seemed pleased with the 17% jump in total revenue, including a 39% spike in revenue from Azure and other cloud services.