Brent crude oil futures remain capped below the $80/bbl mark, as the crisis enters its second week with no clear resolution in sight. The U.S. has signaled a potential two-week window for possible military action, while still leaving room for diplomacy. Accordingly, Rystad Energy’s Global Head of Commodity Markets-Oil, Mukesh Sahdev, commented, “The U.S. granting a two-week window before deciding its course of action in the Israel-Iran conflict has injected heightened volatility into the market. The White House is weighing the use of a bunker-busting bomb against Iran’s nuclear infrastructure, while also keeping diplomatic options on the table. The coming days will be critical for market participants, who must choose between moving early or waiting to see how the situation evolves. For now, there’s no panic buying from China, which is helping to keep Brent capped below $80/bbl. But diesel markets are reacting sharply to fears of a supply crunch; with cracks in the Atlantic Basin expected to strengthen amid mounting pressure east of The Suez Canal.”

U.S. role. Rystad Energy expects the conflict between Iran and Israel to be mediated by the U.S., supported by diplomatic efforts from Middle Eastern countries, the G7, Russia and China. It remains in the collective interest of the region to keep the Strait of Hormuz open and avoid any disruption to supply. U.S. President Donald Trump left the G7 early and since then has provided a window of two weeks to join the war while continuing to point there is substantial chance of a deal. Israel is clearly sensing the hesitation from the U.S. and is continuously calling that it’s in America’s interest to support Israel. Is this a signal to keep U.S. hands clean and blame Israel in case things go out of spiral? This is not unthinkable based on recent U-turns in U.S. stands.

The U.S. call for Iran to deliver unconditional surrender is stronger than the call to join the war directly. U.S. Vice President J. D. Vance indicated that there are many ways and options to accomplish the policy goal that Iran cannot have nuclear weapons.U.S.-Russia-China discussions are possibly on without much details being available yet, and this has significant implications for other big deals the U.S. aims to score. U.S. President Trump calling for Russia to be at the G7 table demonstrates that importance.

The UK has called on the U.S. to keep the door open for diplomacy. Top diplomats from the UK, Germany, France and Italy are likely to engage in talks today in Geneva with Iranian counterparts, as Iran has shown an inclination for diplomacy while indicating no plans to seek nuclear weapons and also not surrendering either.

Meanwhile, there is an emerging signal for regime change from within, and the Iranian crown prince in exile in Oman could provide the alternative.

Damage to date. Despite Israel’s best efforts, damage to Iran’s nuclear facilities remains limited. The International Atomic Energy Agency (IAEA) has shared that it has yet to detect damage at Iran’s underground enrichment site in Fordow. There are reports suggesting Israel may attempt to proceed without U.S. bunker-busting bombs, relying instead on commando raids; a move fraught with serious risks. Also, the damage on the Israel side is also significant and real, with Israeli skies not impermeable to Iranian missiles, the latest being a strike on an Israeli hospital. While there are calls to evacuate Tehran and that is happening, there are calls to evacuate Tel Aviv and Haifa in Israel, as well.

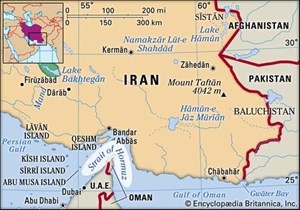

Effects on oil movement. Flows through the Strait of Hormuz are being affected, even if the major fear of a blockade is yet to be realized. The jamming of GPS signals, higher insurance premiums, and vessels being occupied and held in transit are all contributing to a reduction in flows. Fewer vessels, mostly container ships and bulk carriers, appear to be entering the Strait of Hormuz. On the other hand, oil vessel flows have increased, likely to evacuate the oil from land terminals and storage. Iran may be expediting exports, with indications of a 30–40% increase in oil shipments since the attacks began, compared to average June volumes prior to the escalation.

Overall, the signal this provides is that oil is probably the most important prize for the U.S. at the end of the escalation, and the U.S. wishes to maintain those facilities. It is possible that the U.S. may protect these via Israel, precluding any chances of self-sabotage by Iranians in desperation. Qatar has indicated for the LNG vessels to wait outside the strait until they are ready to load, signaling that a closure situation is not their base expectation.

China is relying on its substantial crude stockpiles, estimated to be near 1 Bbbl, with rising floating storage levels near its coast reinforcing this. The buildup signals that China is unlikely to rush to secure alternative supplies, capping any potential price rally that might have been driven by Chinese buying.

Diesel prices. 200,000-bpd Haifa refinery has been forced to halt operations following a missile strike. While the refinery’s closure has had only a limited immediate impact on purchases of BTC Blend and CPC Blend crude, it comes at a time when global supply is already tight, amplifying market sensitivity to disruptions. However, reduced Israeli demand for Russian vacuum gas oil (VGO) has helped ease some of that tightness, offering a small buffer in an otherwise strained supply environment.

There is a significant spike in the diesel price for Europe (EU), with imports of Middle East being impacted. Lower stockpiles in the Atlantic basin and fears of supply crunch have made the diesel market flip from bearish to bullish. Also, the potential EU ban on refined fuels produced from Russian crudes is adding fuel to the rise in cracks.

The bottom line. Our latest price view is mostly in line with current fundamentals views, bar an additional implementation of OPEC+ accelerated unwinding followed by months of cuts, based on the balance oversupply. Logic has also been applied for Iranian production and export tightness to be loosened post-war, as the global market, led by the U.S., cannot afford to lose significant medium sour volume.

Calls to fill the U.S. Strategic Petroleum Reserve (SPR) are expected to focus primarily on medium sour crude as a buffer for the exposed refining sector, reinforcing the view that the U.S. market has an interest in keeping Iranian facilities operational.

This signals that prices could slide into the mid-$60s post-war and into the summer.

While the geopolitical factors are harder to interpret for any calls on outcomes, our signal remains that oil price spiking is likely to be contained below $80/bbl until the U.S. decides. The significant disruption case with a 2-MMbpd loss could spike prices to $90/bbl. This is a case with lower probability for now. For the rest of the year, oil prices are likely to stay between June and May cases, with the 2025 average near $70/bbl.

The bottom-line is that the crisis is evolving with many unknowns, making it very hard to provide a definitive signal. Markets will need to closely monitor developments in the coming weeks, as the U.S. role could prove pivotal in shaping the trajectory of events.