Aker BP has reported strong operational and financial performance in its latest quarterly results, underscoring stable production, disciplined cost management, and a breakthrough exploration success on the Norwegian Continental Shelf (NCS).

Production averaged 414,000 boed, maintaining high uptime and efficiency across the company’s offshore portfolio. Supported by minimal unplanned downtime and robust field performance, Aker BP has raised its full-year guidance to between 410,000 and 425,000 boed, up from its previous forecast of 400,000–410,000 boed.

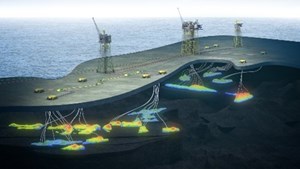

The company achieved a significant exploration milestone during the quarter with the Omega Alfa oil discovery in the Yggdrasil area—estimated at 96–134 million barrels of oil equivalent (mmboe) recoverable. The find ranks among the largest oil discoveries on the Norwegian Continental Shelf in the past decade and materially expands the Yggdrasil resource base.

“The Omega Alfa discovery was a clear highlight this quarter,” said Karl Johnny Hersvik, CEO of Aker BP. “It underscores the strength of our exploration strategy and significantly supports our long-term production ambitions.”

Operational and project highlights

Aker BP advanced several key developments during the period, including the Yggdrasil, Valhall PWP-Fenris, Skarv Satellites, and Utsira High projects—all of which remain on schedule. The Jotun FPSO at the Balder field and the Johan Castberg field reached plateau production in September, marking major steps forward in Norway’s offshore expansion.

Operational costs remained among the industry’s lowest at $7.6 per barrel of oil equivalent, reflecting planned maintenance activities. The company also maintained industry-leading low emissions, recording a greenhouse gas intensity of just 2.9 kg CO₂e per boe (scope 1 and 2).

Financial performance and outlook

Total income was $2.6 billion, while cash flow from operations surged to $2 billion, supporting continued investment in long-term growth. Aker BP’s robust balance sheet includes $3.6 billion in available liquidity, and the company reaffirmed its 2025 dividend target of $2.52 per share, following a $0.63 per share payout in the third quarter.

“Our financial position remains solid,” Hersvik added. “Strong cash flow and disciplined capital allocation allow us to invest in growth, advance major field developments, and deliver attractive returns to shareholders.”

With major developments progressing and exploration success reinforcing its resource base, Aker BP said it remains on track to sustain production between 350,000 and 400,000 boed toward 2030 and beyond.