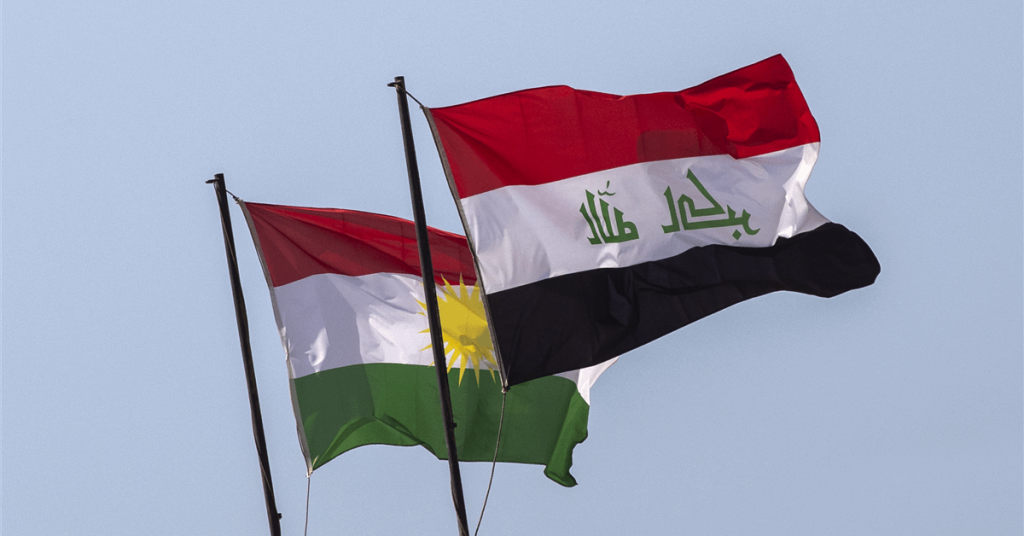

Iraq, the regional government of Kurdistan and international companies agreed terms to resume oil exports that have been halted for over two years over a payment dispute, adding supply to a market that’s widely expected to move into a heavy surplus.

The agreement, which is still awaiting signatures by all the parties involved, will resolve the last remaining issue that has kept a pipeline from the Kurdish region to Turkey’s Mediterranean coast. A resumption would likely bring about 230,000 barrels a day of crude to international markets, according to people familiar with the matter.

The signed final deal is expected as soon as this week, with exports soon after, they said, asking not to the identified before a formal announcement. An official in Turkey said that Iraq has notified its neighbor that flows will resume in the coming days. Iraq and Kurdistan government’s oil ministries didn’t respond to requests for comments.

The saga started in March 2023 after Turkey halted the pipeline following an arbitration court’s order to pay Iraq $1.5 billion in compensation. Ankara had claimed the link was shut because it needed repairs after two massive earthquakes in February that year, but later put the onus on Baghdad to restart operations. But financial and legal disagreements had held back the restart.

Turkey would pose no obstacles to the flow of oil once the parties in Iraq have reached an agreement, an official said. The country had said in July that it would seek a new deal with Iraq for the pipeline when the current arrangement comes up for renewal in July next year. The plan for renegotiation wouldn’t hold up flows through the link, the official said.

The pipeline was transporting about half a million barrels a day of crude before it was halted. The returning supply will add to concerns over a global surplus as the Organization of Petroleum Exporting Countries and its allies continue to revive output while strong summer demand begins to wane.

In July, in a key step toward resuming shipments from Kurdistan, Iraq’s federal government approved a plan for the semi-autonomous region to transfer at least 230,000 barrels a day of oil to state marketer SOMO, while 50,000 barrels a day for domestic use. In return, Baghdad would release funds for salaries of Kurdistan government employees.

For Iraq, the return of exports would likely to be a boon for its economy. The halted exports over the last two years have cost the country billions of dollars in lost revenue, according to Foreign Minister Fuad Hussein.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

element

var scriptTag = document.createElement(‘script’);

scriptTag.src = url;

scriptTag.async = true;

scriptTag.onload = implementationCode;

scriptTag.onreadystatechange = implementationCode;

location.appendChild(scriptTag);

};

var div = document.getElementById(‘rigzonelogo’);

div.innerHTML += ” +

‘‘ +

”;

var initJobSearch = function () {

//console.log(“call back”);

}

var addMetaPixel = function () {

if (-1 > -1 || -1 > -1) {

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

} else if (0 > -1 && 79 > -1)

{

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

}

}

// function gtmFunctionForLayout()

// {

//loadJS(“https://www.googletagmanager.com/gtag/js?id=G-K6ZDLWV6VX”, initJobSearch, document.body);

//}

// window.onload = (e => {

// setTimeout(

// function () {

// document.addEventListener(“DOMContentLoaded”, function () {

// // Select all anchor elements with class ‘ui-tabs-anchor’

// const anchors = document.querySelectorAll(‘a .ui-tabs-anchor’);

// // Loop through each anchor and remove the role attribute if it is set to “presentation”

// anchors.forEach(anchor => {

// if (anchor.getAttribute(‘role’) === ‘presentation’) {

// anchor.removeAttribute(‘role’);

// }

// });

// });

// }

// , 200);

//});