ADNOC Logistics & Services (ADNOC L&S) reported record-breaking financial performance for the first nine months of 2025, driven by strong third-quarter results and continued growth across all business segments.

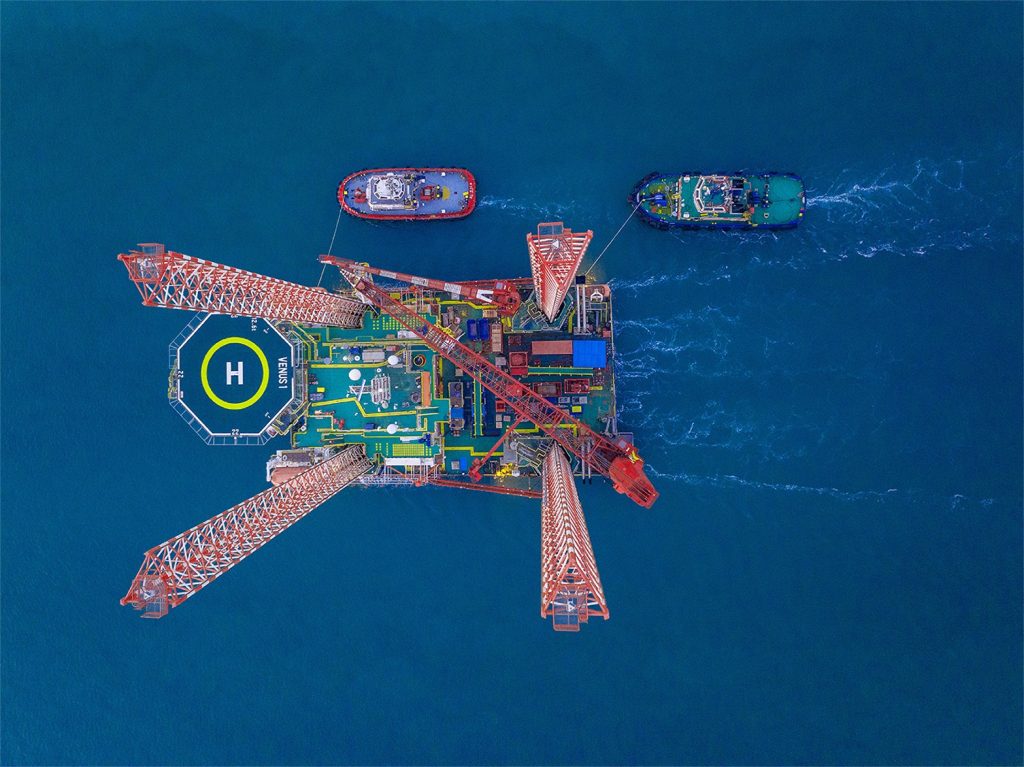

ADNOC L&S Venus jackup barge

Revenue for the nine-month period surged 39% year-on-year to $3.7 billion, while EBITDA rose 30% to $1.1 billion and net profit climbed 9% to $631 million. Third-quarter results alone saw revenue increase 36% YoY to $1.26 billion and net profit advance 20% to $211 million.

“This is our strongest nine-month performance since listing,” said Captain Abdulkareem Al Masabi, CEO of ADNOC L&S. “Our diversified platform, long-term contracts and operational excellence continue to drive sustainable growth. We are expanding capacity, capturing value-accretive opportunities and reinforcing ADNOC L&S’s position as a global leader in energy maritime logistics.”

ADNOC L&S’s performance was fueled by robust growth across integrated logistics, shipping, and services. The shipping segment nearly doubled revenue to $1.48 billion, boosted by the integration of Navig8 tanker operations, while integrated logistics rose 17% on strong demand for jack-up barge services and EPC project work.

The company also confirmed its inclusion in the MSCI Emerging Markets Index, a move expected to attract more than $200 million in passive capital inflows. ADNOC L&S will increase its 2025 full-year dividend by about 20% to $325 million, with quarterly payouts and 5% annual growth planned through 2030.

Strategic milestones this year include a 15-year, $531 million logistics contract with Borouge, a 50-year agreement to build the UAE’s first dedicated chemicals port at TA’ZIZ in Ruwais, and the delivery of new LNG and Very Large Ethane Carriers that will add $4 billion in long-term revenue.

ADNOC L&S also accelerated its digital transformation, rolling out the GCC’s first AI-powered Smart Port Solution—cutting service sourcing time from three hours to 45 seconds—and new cargo-handling innovations that improved vessel utilization by 40%.