• $30 million facility marks ADB’s first sustainability-linked loan in Bangladesh, advancing green finance in the garment sector.

• Funds will expand Envoy’s energy-efficient spinning operations and integrate 3.5 MWp of rooftop solar generation.

• Loan structure ties repayment conditions to sustainability performance targets, reinforcing industrial decarbonization goals.

A new model for Bangladesh’s textile finance

The Asian Development Bank (ADB) has signed a $30 million sustainability-linked loan (SLL) with Envoy Textiles Limited, the country’s largest denim fabric producer, in a move designed to embed climate-linked performance targets into Bangladesh’s export manufacturing sector.

The facility, ADB’s first SLL in Bangladesh, links the loan’s terms to the company’s progress on predefined environmental metrics, including rooftop solar capacity and greenhouse gas emissions reductions. It follows ADB’s earlier financing of Envoy’s textile expansion in 2022, marking an evolution from project-based lending toward outcome-driven sustainability finance.

Envoy will use the proceeds to construct a new automated spinning unit at its Jamirdia plant, expand annual yarn production by 4,550 tons, and install 3.5 megawatts peak (MWp) of rooftop solar panels. Part of the funds will also refinance short-term local working capital loans, freeing capacity for longer-term green investment.

Supporting a cornerstone of Bangladesh’s economy

Bangladesh’s ready-made garment (RMG) industry generates more than 80% of national export earnings, making it a vital testing ground for climate-aligned industrial finance. Denim production, in particular, is both energy-intensive and emblematic of the environmental pressures facing global apparel supply chains.

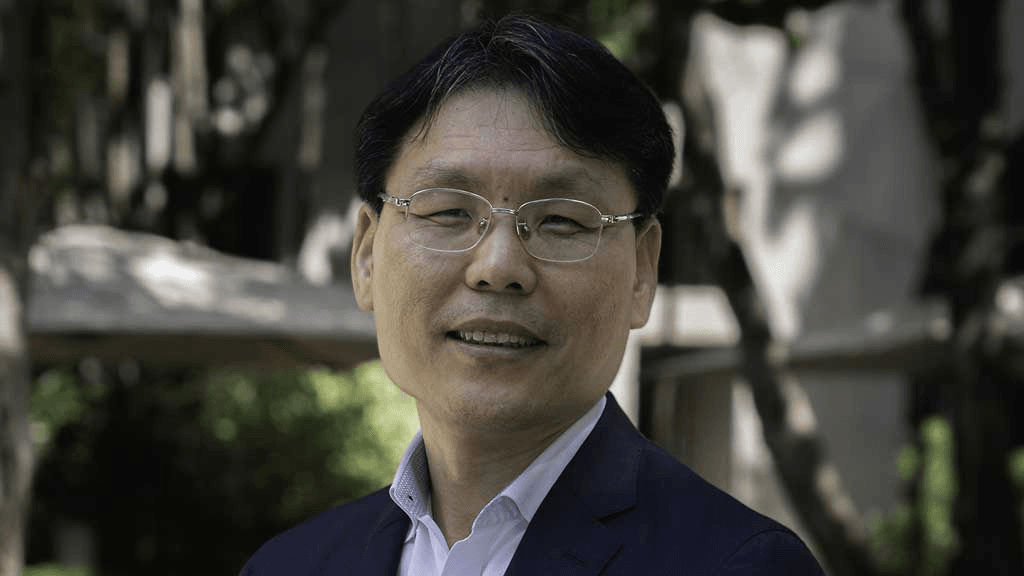

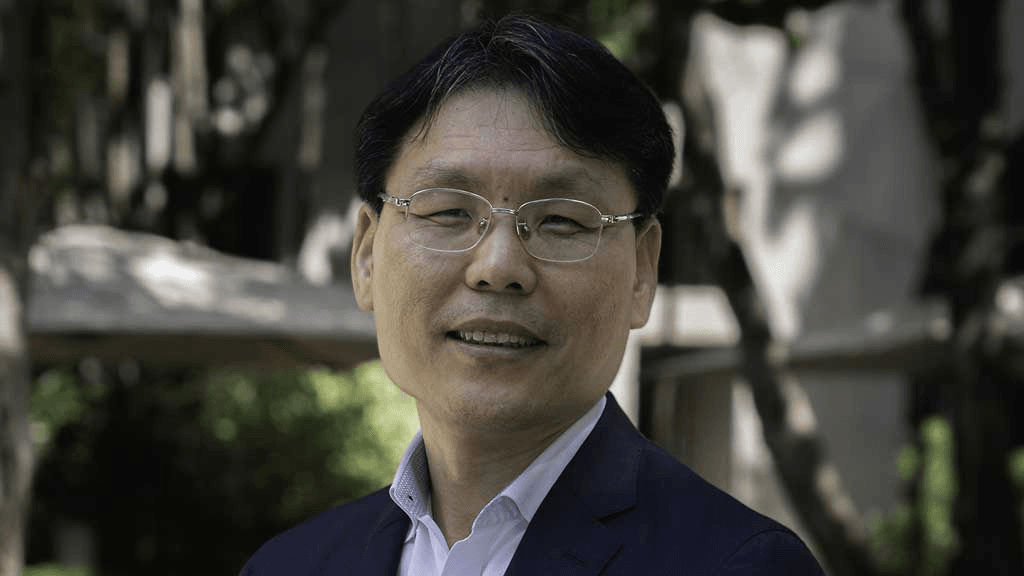

“The ready-made garment industry is a key driver of Bangladesh’s economy, and Envoy is the leading denim fabric manufacturer,” said ADB Country Director for Bangladesh Hoe Yun Jeong. “ADB is pleased to support Envoy with its first sustainability-linked loan in Bangladesh. This partnership advances environmental sustainability and industrial modernization, setting a new standard for the garment sector.”

The new spinning unit will be fully automated and more energy-efficient, integrating solar power into its operations and reducing reliance on fossil-fuel-based electricity. The factory’s enhanced efficiency and renewable energy capacity are expected to cut production-related emissions while strengthening the competitiveness of Bangladesh’s textile exports amid tightening global sustainability standards.

Tying finance to measurable climate outcomes

Unlike traditional project finance, sustainability-linked loans assess borrowers against predefined key performance indicators (KPIs) — in this case, energy generation from renewables and emissions reductions. Failure to meet the agreed sustainability performance targets can trigger financial penalties or reduced loan incentives, ensuring accountability and measurable progress.

For Envoy, this approach aligns with its long-standing focus on sustainable manufacturing. The company operates the world’s first platinum-certified Leadership in Energy and Environmental Design (LEED) denim facility, as recognized by the U.S. Green Building Council. With an annual production capacity of 54 million yards, Envoy accounts for roughly 10% of Bangladesh’s total denim output.

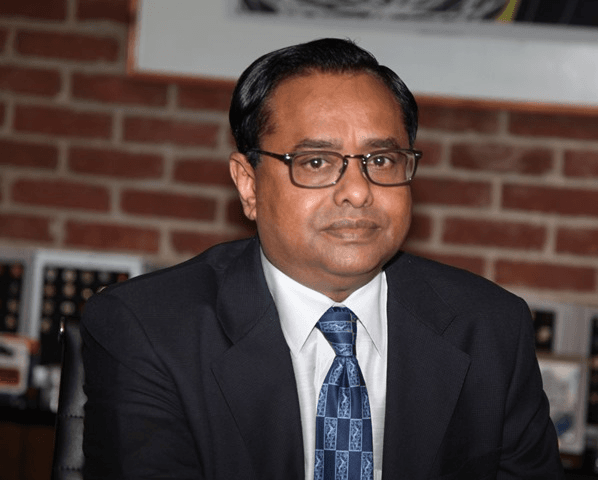

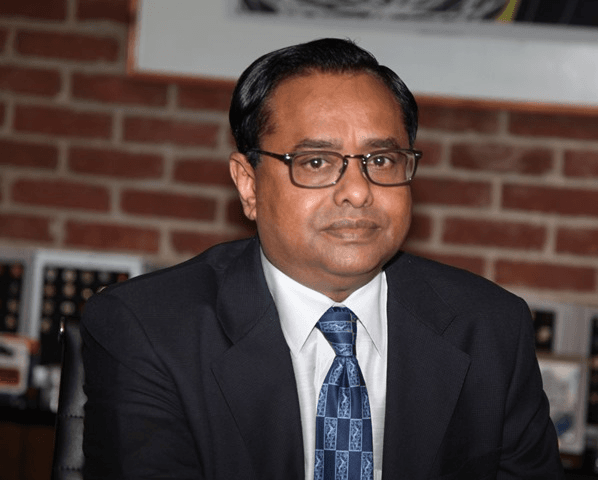

“We are honored to receive continued support from ADB, whose partnership affirms our commitment to sustainable growth and innovation,” said Envoy Chairman Kutubuddin Ahmed. “This sustainability-linked loan will enable us to expand our production capacity, invest in renewable energy, and further reduce our environmental footprint.”

Regional significance and ESG implications

The loan reflects ADB’s growing use of sustainability-linked instruments to accelerate low-carbon industrial transitions in Asia. By tying capital access to measurable environmental performance, multilateral lenders are testing frameworks that could shape broader private-sector financing across developing economies.

For Bangladesh, where the textile sector’s energy mix remains heavily dependent on grid electricity, the integration of distributed solar generation is a tangible step toward decarbonizing one of the country’s largest export industries. The initiative also aligns with ADB’s broader climate finance strategy, which aims to provide $100 billion in cumulative climate financing across Asia and the Pacific by 2030.

As global apparel brands intensify pressure on suppliers to decarbonize and disclose emissions, transactions like the ADB–Envoy loan point to a shift in how sustainability is financed in emerging markets — from compliance-based efforts to performance-tied growth.

If successful, the model could provide a replicable blueprint for sustainable lending across South Asia’s textile sector, where demand for ESG-aligned investment is growing alongside export diversification.

Follow ESG News on LinkedIn