In his opening keynote, Ken Chadwick, Vice President and Distinguished Advisor at Gartner, tackled one of the biggest challenges facing supply chain leaders today: making decisions in a world defined by divergence. From AI disruption to geopolitical uncertainty, Chadwick laid out a roadmap for how supply chains can turn complexity into competitive advantage.

1. Divergence Is the New Normal, and It’s Not Temporary

What’s Related

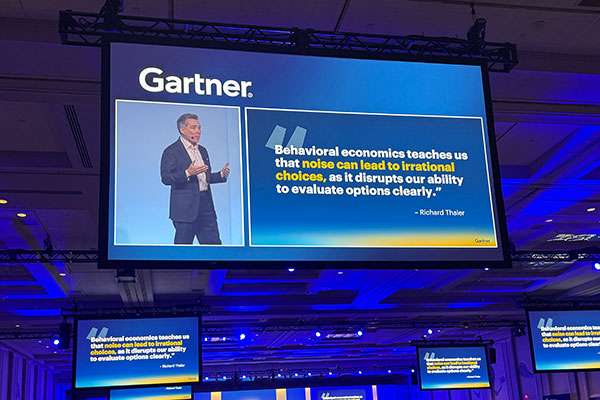

Chadwick opened with a sobering message: the disruptions we’re facing are no longer short-term or cyclical. Whether it’s AI hype vs. real adoption, global growth vs. stagnation, or open trade vs. fragmented blocks, business leaders must operate in a world of mixed signals and conflicting trends.

“Divergence pulls us into the future while anchoring us in the present,” Chadwick said. “It generates chaos, but it also creates opportunity.”

2. Visibility Isn’t Optional Anymore, It’s the Foundation

Despite years of effort, visibility remains a top challenge in supply chain strategy. Most companies have access to more data than ever, yet struggle to turn it into useful insight.

“Today’s cars can see, interpret, and act — your supply chain should do the same,” Chadwick said. He urged leaders to prioritize targeted investments that improve real-time visibility across operations, even if the tech stack isn’t perfect. The goal is clear: get closer to one version of the truth.

3. Scenario Planning Must Be a Daily Discipline

Planning for disruption once a year is no longer enough. Chadwick emphasized that scenario planning should become a continuous process, using structured models and signals to anticipate, prepare, and adapt.

He cited an example from JTI, which segmented its manufacturing sites by risk levels and reduced time-to-recovery by 80% through proactive planning. “You can’t predict everything — but you can prepare for anything,” he said.

4. Innovation Happens When You Let Go of Old Models

According to Chadwick, innovation isn’t just about launching new tools — it’s about helping people transition to new ways of working. “Change is what happens on paper. Transition is what happens in people,” he said.

He outlined two kinds of innovation:

Tactical innovation that focuses on quick, low-cost improvements.

Transformational innovation that reshapes capabilities for the future.

The key is not scale, but relevance — choosing innovation that meets the needs of today while preparing for tomorrow.

5. It’s Time to Shift from Classical to Jazz

In one of the keynote’s most memorable moments, Chadwick drew a bold analogy: supply chains need to move from classical music — structured, rigid, and hierarchical — to jazz, which is adaptive, improvisational, and responsive.

“You are the musicians,” he told the audience. “The planning tools are just instruments.” The future of supply chain isn’t about perfection — it’s about playing in sync with disruption and orchestrating outcomes in real time.

Closing Thought

Chadwick closed with a reminder that supply chain professionals are not just operators — they’re strategic enablers. “You are the competitive edge your CEO needs,” he said. “In a world where the impossible feels closer every day, the question isn’t if you can lead — it’s how you’ll do it anyway.”