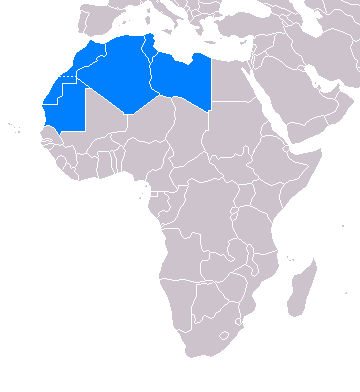

The meeting held in Madrid on Feb. 8, 2026, was more than a mere acceleration of American diplomacy under the Trump administration. It marked the formal deconstruction of a long-standing geopolitical mirage: the narrative of Algeria as the “indispensable pillar” of North African security. While delegations from Morocco, Mauritania, the Polisario Front, and – crucially – Algeria itself gathered under Washington’s aegis, the dynamic in the room spoke volumes. The talks, aimed at reviving efforts toward a political settlement in line with UN Security Council resolutions, signaled that the era of Algerian veto power over regional progress is coming to an end.

The reality is now stark: Algeria’s regional hegemony is not just fading; it is collapsing.

For decades, Algiers leveraged its revolutionary credentials and hydrocarbon wealth to position itself as the arbiter of the Maghreb. But as the veteran journalist Ignacio Cembrero has meticulously documented, the tectonic plates of global power have shifted, leaving Algeria stranded on a shrinking island of 20th-century dogmatism; trapped by its own model.

The Crumbling Wall of Ideological Allies

Algeria’s strategic isolation is no longer a localized phenomenon; it is systemic. The recent fall of the Maduro regime in Venezuela has stripped Algiers of its most vocal ideological twin in the Global South. Simultaneously, the tightening noose around Tehran – Algeria’s primary strategic partner in the Middle East – has deprived the North African power of its traditional diplomatic depth.

Domestically and regionally, the so-called “Algerian Pillar of North African security” now stands on hollow ground. The regime increasingly draws what remains of its regional influence through a single, fragile artery: Tunisia. For too long, Tunis has been coerced into serving as a diplomatic and security buffer for an increasingly suffocated Algiers. Yet, this dependency is not a historical mandate; it is a geopolitical lock that Washington now appears prepared to pick.

The Tunis-Rabat Axis: A New Regional Titan

The true masterstroke of the current American strategy lies in the emancipation of Tunisia. By pivoting toward a formal Tunis-Rabat Axis, Washington is not merely isolating a recalcitrant Algiers; it is fostering the emergence of a new economic powerhouse. The incentives for Tunis to break its chains are overwhelming:

Energy Sovereignty: Washington is positioned to shatter the Algerian gas monopoly. By facilitating Tunisian access to American LNG and catalyzing massive investment in solar infrastructure, the U.S. can transform Tunisia from a dependent energy satellite into a sovereign power.

The Phosphate Cartel: A Morocco-Tunisia partnership would, in effect, form an “OPEC of phosphates.” Controlling a big chunk of global reserves, this axis would become a cornerstone of global food security and a primary partner for U.S. agriculture; while offering a strategic alternative to China-dominated phosphate supply chains, strengthening American food-security sovereignty, and directly advancing the America First objective of securing critical inputs through reliable allied partners rather than geopolitical competitors.

A Growth Engine: Released from Algiers’ shadow, Tunisia’s sophisticated service economy – above all its world-class but still embryonic healthcare exports – could finally scale to global demand, fueled by American capital and reinforced by Moroccan logistical integration. Just as importantly, it would offer a concrete pathway for young Tunisian doctors to return home, rebuilding national capacity and restoring confidence in Tunisia’s future.

The End of Security Blackmail

The “security pillar” argument – the claim that Algeria is the sole force preventing chaos in the Region – has lost its currency. The administration of Donald Trump has recognized that real stability flows from economic integration and pragmatic alliances, not from the management of frozen conflicts such as Western Sahara.

It is often argued that Algeria has shown resilience in the past, weathering oil price shocks and containing domestic unrest. But this “resilience” has come at a high structural cost: sustained repression, fiscal drawdowns, and the postponement of necessary economic reforms. Stability achieved through rent redistribution and security control is not the same as sustainable resilience. An economy that remains overwhelmingly dependent on hydrocarbons – accounting for roughly 95 percent of export revenues – is inherently vulnerable to external shocks. Each downturn tightens fiscal space, fuels social pressure, and erodes the very foundations of the security narrative. In other words, Algeria’s past ability to absorb crises does not constitute a viable model for future regional stability.

By presenting a robust, 40-page autonomy plan, Morocco has offered a viable future. By backing it, the U.S. is signaling that the era of Algerian veto power over regional progress is over.

In 2026, the Maghreb is being redesigned. The new architecture is built on the pragmatism of Rabat and the potential of a liberated Tunisia; not as a replacement hegemon, but as a catalytic platform for regional integration. This is not about sidelining Algeria; it is about moving beyond a security paradigm rooted in veto power, hydrocarbons, and frozen conflicts, toward one anchored in economic connectivity, energy sovereignty, and human capital regeneration.

The administration of Donald Trump – with figures such as Massad Boulos playing a central role – now treats Algerian security cooperation as a technical baseline, no longer as a political bargaining chip. Washington accepts Algeria’s operational contribution against groups like Al-Qaeda, but rejects its use as leverage to block progress on Western Sahara. For the United States, long-term stability requires resolving the Saharan conflict ; even if this unsettles Algeria’s military establishment.

To be sure, Algeria retains the ability to act as a spoiler ; through energy leverage, diplomatic obstruction, or asymmetric pressure on both Tunisia and Morocco. But nuisance power is not leadership, and disruption is not strategy. By signing cooperation frameworks with United States Africa Command while remaining closely aligned with Russia through arms purchases and continuing to back the Polisario Front, Algiers has tried to play multiple sides at once. That balancing act is now untenable. Washington no longer accepts that Algerian security capabilities be used to preserve a status quo that ultimately serves Russian or Iranian interests in North Africa.

Tunisia is not being cast as a new “security pillar,” but as a geo-economic bridge linking North Africa to Atlantic markets, American capital, and regional supply chains in ways Algeria’s inward-looking model no longer can. As its global sponsors vanish and its neighbors look toward a prosperous horizon, Algeria faces a harrowing choice: adapt to the new century or remain a relic, watching from the sidelines as the region it once sought to lead moves on without it.

Ghazi Ben Ahmed is a recognized expert on Mediterranean and Middle Eastern affairs and the Founder of the Mediterranean Development Initiative. With extensive experience in regional economic development, geopolitics, and international relations, he has worked closely with policymakers, think tanks, and institutions across the MENA region. The views and opinions expressed in this article are those of the author.