Two memory-product entrepreneurs have seen their fortunes rocket this year thanks to heady demand from AI giants.

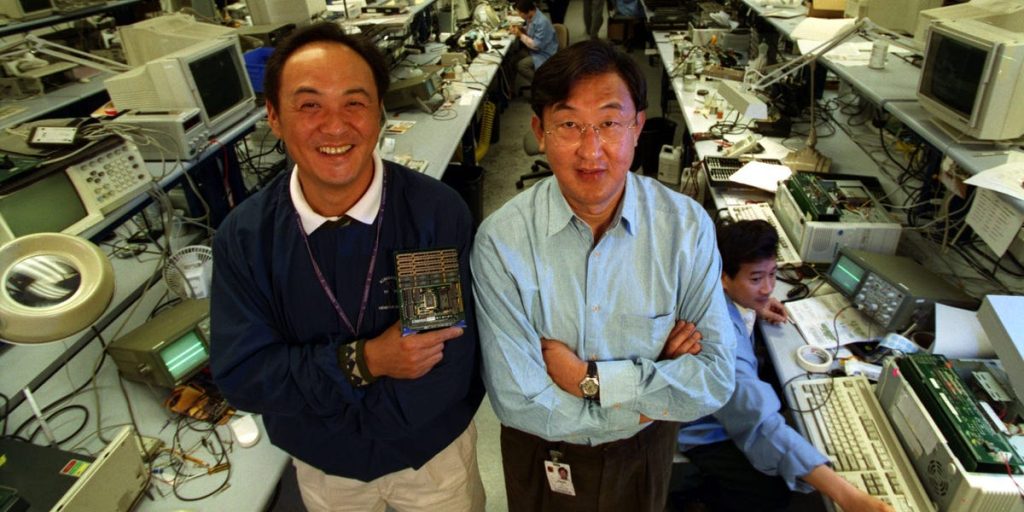

David Sun, 74, and John Tu, 84, are the cofounders and 50-50 owners of Kingston Technology, a leading maker of computer drives and memory modules. Sun is the California company’s operating chief, while Tu is president and CEO.

The pair have seen their respective net worths soar by 44%, or nearly $14 billion, since the start of January, the Bloomberg Billionaires Index shows.

Only Tesla and SpaceX CEO Elon Musk, Czechoslovak Group CEO Michal Strnad, and Mexican tycoon Carlos Slim have gained more wealth so far this year.

Sun and Tu have even outpaced Jim, Alice, and Rob Walton; the heirs to the Walmart fortune were up about $13 billion each for the year at Thursday’s close.

The memory magnates are both worth about $45 billion, putting them in 45th and 46th place respectively on the rich list — ahead of the likes of MacKenzie Scott, SoftBank’s Masayoshi Son, and Miriam Adelson.

Sun and Tu were born in Taiwan and mainland China, respectively, studied electrical engineering in college, and emigrated to the US in the 1970s, per Bloomberg. They met in Los Angeles, where they bonded over basketball and went into business together.

The pair founded a memory-device company, Camintonn, in 1982, and sold it four years later for $6 million, Bloomberg says. They lost all their savings in the Black Monday crash of 1987, but went on to found Kingston and sell 80% of it to SoftBank for $1.5 billion in 1996. They bought back the stake for $450 million in 1999.

AI hyperscalers have been clamoring for memory chips to build out data centers, fueling a severe global shortage that has driven prices skyward.

This “memory supercycle” promises to boost revenues and profits at memory-product companies, which has propelled their stock prices in recent months.

For example, Micron Technology stock has more than quadrupled over the past 12 months, valuing the memory-chip maker at $470 billion — more than Mastercard, Oracle, Costco, Bank of America, or Home Depot are worth.