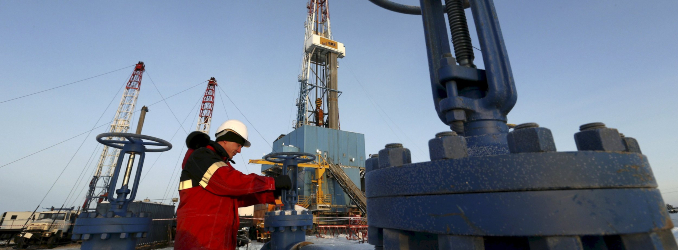

(Bloomberg) — Russia’s oil producers reduced drilling activity in 2025 to the lowest level in three years, potentially weighing on future production as sanctions, weaker prices and currency pressures squeeze revenues.

Operators drilled about 29,140 km of production wells last year, down 3.4% from 2024, according to industry data cited by Bloomberg. After strong activity early in the year, drilling began to slow in mid-2025 and dropped sharply toward year end, with December footage down roughly 16% year-on-year.

The slowdown reflects mounting financial pressure on Russian producers. Lower global crude prices, widening discounts on Urals exports due to tighter Western sanctions, and a stronger ruble have reduced export profitability and curtailed available cash for reinvestment. Analysts say the decline in drilling is a rational response as companies prioritize capital preservation.

Production has already eased in recent months amid export constraints and geopolitical pressures, and reduced drilling could further impact output later in 2026. Russia typically needs to drill roughly 26,000–29,000 km of wells annually to sustain production near current levels, with any sustained decline likely to translate into lower supply.

While Russia retains the technical capacity to maintain or even increase output over the long term, analysts note that future production will depend on market conditions, sanctions, OPEC+ policy and access to technology and financing.