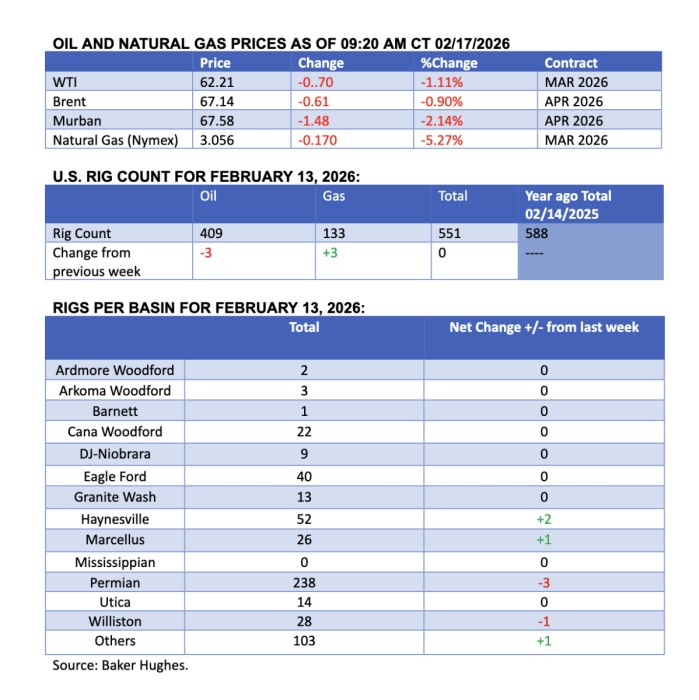

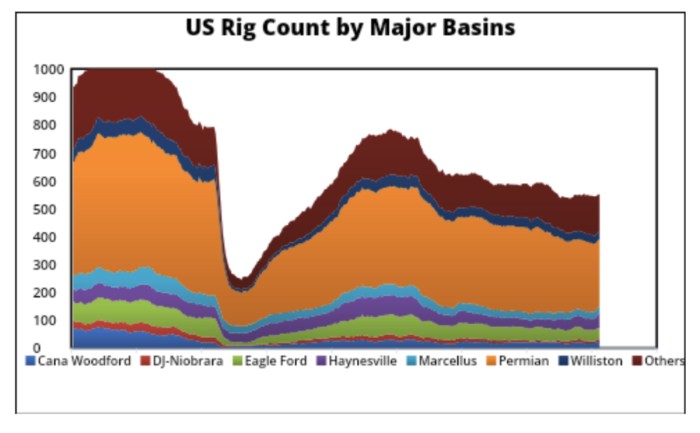

This week’s energy newsletter reviews oil and gas price shifts, U.S. rig count figures, key corporate acquisitions and discoveries, and analyzes major geopolitical events impacting global oil trade, including shipping market manipulation and rising Chinese imports of Russian crude.

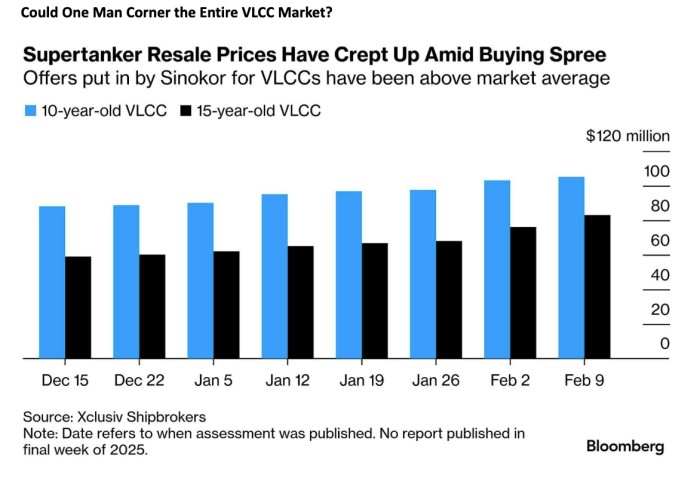

The oil market’s shipping segment is being rocked by a brazen attempt to corner it, with a South Korean shipping tycoon hoovering up any available VLCCs in the market. Ga-Hyun Chung’s Sinokor Group has bought or chartered over 120 very large crude carriers (VLCC), 10% of the total market that currently counts an aggregate 1,032 operational tankers. In one of the most recent purchases, Sinokor bought eight VLCCs, mostly built in 2015 and 2016, from Cyprus-based Frontline for a whopping $831.5 million.There is a widespread speculation that Sinokor in fact isn’t acting alone, but in unison with the world’s pre-eminent shipping magnate, Gianluigi Aponte, who runs the MSC empire. The price of 10-year-old VLCCs have gone up by $20 million in just six weeks, currently around $105 million per ship, with VLCC rates soaring globally as charterers are struggling to find adequate tonnage.

Market Movers

Germany’s shipping giant Hapag-Lloyd (ETR:HLAG) has agreed to buy Israel’s Zim Integrated Shipping Services in a deal worth $4.2 billion, a 58% premium over Zim’s stock at Friday’s close last week. Norway’s state oil firm Equinor (NYSE:EQNR) has discovered an oil and gas field with its Granat exploration well in the Norwegian North Sea, however its recoverable reserves are believed to be only 3-4 million boe. Italy’s oil major ENI (BIT:ENI) reported a ‘significant’ natural gas discovery with its Murene South wildcat, confirming a net gas pay of more than 50 m and potentially boosting the wider Calao South complex’s reserves to 5 TCf. US oil major Chevron (NYSE:CVX) and its Greek partner Helleniq Energy (ATH:ELPE) landed lease agreements with the government of Greece for four offshore blocks, seeking to tap into gas reserves to the south of the island of Crete.

Tuesday, February 17, 2026

Geneva sets the tone for mid-February trading, concurrently holding two high-stakes negotiations. The surprisingly positive vibes emanating from US-Iran talks are counterweighed by a much sterner sentiment in the Russia-Ukraine meeting, with the latter being much more bullish for crude amidst intensifying attacks on Russia’s energy infrastructure. ICE Brent has shed more than $1 per barrel after Tehran announced some form of understanding with the US, trading below $68 per barrel.

Tehran Holds Military Drills Amidst Talks. Iran has been sending mixed messages to oil markets after Foreign Minister Araqchi claimed to have reached an understanding on main principles with the US, only for Tehran’s IRGC forces to shut parts of the Strait of Hormuz for a couple of hours.

Chinese Imports of Russian Oil Set for New High. China’s seaborne imports of Russian oil are expected to surpass 2 million b/d for the first time on record, marking a hefty 300,000 b/d increase from the previous all-time high posted this January, as India’s buying of Russian Urals falters.

India Seizes Iran-Linked Tankers. India’s Coast Guard has seized three OFAC-sanctioned oil tankers linked to Iran, claiming they intercepted the Stellar Ruby, Asphalt Star and Al Jafzia vessels some 100 nautical miles west of Mumbai after detecting suspicious activity in its territorial waters.

Ukraine Blocks Russia’s Remaining Pipeline Flows. The governments of Hungary and Slovakia have turned to Croatia for help in supplying Russian oil through the Adriatic Sea after Ukraine halted transportation of crude through the Druzhba pipeline on January 27, citing damaged infrastructure.

Turkey Starts Exploring Somalia’s Wild Coast. Turkey has sent its deepwater drilling vessel Cagri Bey to Somalia, one of the last untapped exploration frontiers globally, to spud the Curad-1 exploration well in the African country’s maritime zone, expecting to start drilling operations by mid-April.

China’s Offshore Major Eye Refinery Deals. China’s state-controlled offshore specialist CNOOC (SHA:600938) is in advanced talks with fellow firm Sinochem to take over its 300,000 b/d Quanzhou refinery as well as adjacent retail and storage assets, as the latter posted a $280 million loss in 2025.

Ukraine Drone Hit Lifts Europe’s Coal Prices. Ukraine’s drone strikes on the Russian Black Sea port of Taman are expected to disrupt Russia’s coal exports, sending Europe’s API 2 coal benchmark in Rotterdam to $106 per metric tonne, a 4% weekly gain and the highest price since July 2025.

Vitol Moves into South Africa’s LNG. Global commodity trader Vitol has backed plans to build a 1.8 GW capacity gas-fired power plant along with an LNG import terminal in South Africa’s east coast Durban port, expecting to spend $3 billion on the project as it teams up with Saudi Arabia’s ACWA.

Kenya Gives Up on Refinery Ambitions. Kenya’s government has postponed plans for an 850-km crude pipeline connecting the upcoming 50,000 b/d South Lokichar project to the country’s coast, whilst also failing to garner finances for the redevelopment of the Mombasa refinery.

Pemex’s Debt Spree Continues. Ending its 6-year abstinence from local markets, Mexico’s state oil company Pemex sold a record $1.8 billion worth of local currency debt last week, the highest ever monthly debt issuance in the country’s markets even though February is only halfway through.

Kazakhstan Eyes New Refinery by 2033. Kazakhstan plans to launch a new refinery by 2033 as the Central Asian country struggles to overcome its structural gasoline and diesel deficits, with the new plant rumoured to have a capacity of 200,000 b/d and to be located in the central Ulytau region.

Santos Wins Big in Landmark Greenwashing Case. Australia’s top oil producer Santos (ASX:STO) has won a 2021 court case against environmentalists that claimed it misled shareholders on its 2040 net zero commitments, with a federal court in Sydney fully dismissing greenwashing allegations.

US Scares Shippers with New Wave of Port Fees. The White House announced a new proposal to impose port fees on ships built in third countries, introducing a so-called ‘universal infrastructure security fee’, suggesting a payment of $0.01/kg that could yield $66 billion in revenue over 10 years.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com