If artificial intelligence eliminates millions of jobs, it might make sense to scrap income taxes for the vast majority of Americans and target capital instead, Vinod Khosla says.

“AI will transform economies and need a rethink of capitalism & equity,” the billionaire venture capitalist wrote in an X post on Monday. “Labor portion of economy (vs capital) will decline sharply. Should we eliminate preferential treatment of capital gains tax and equalize to ordinary income?”

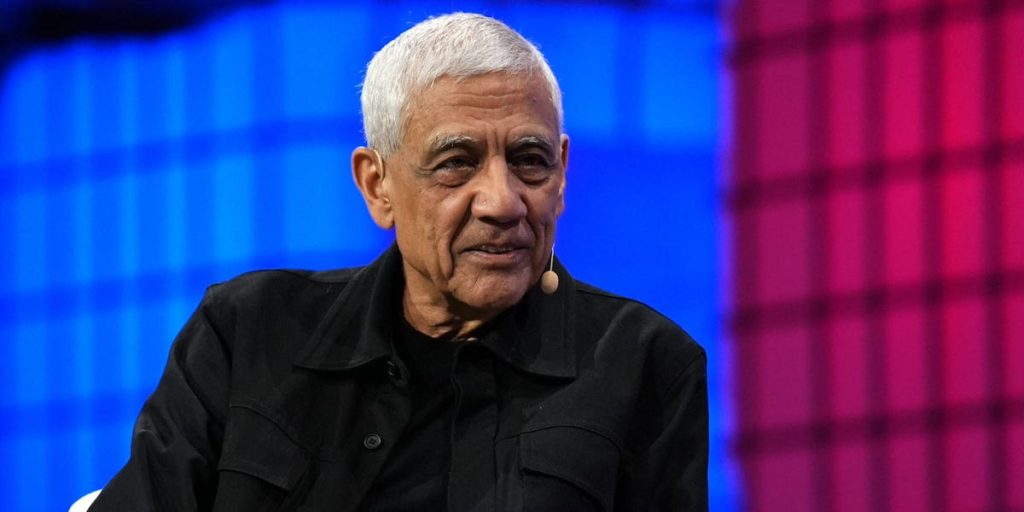

Khosla — who cofounded Sun Microsystems and made the first VC investment in OpenAI — was making the point that AI replacing labor on a grand scale might warrant greater taxes on assets such as stocks and real estate.

The veteran financier, who founded Khosla Ventures after leaving Kleiner Perkins, attached a video highlighting some of the jobs that could be taken by AI, from accountants and therapists to truck drivers and chip designers.

Khosla said in a follow-up post that ramping up taxes on capital would generate so much revenue that the government could scrap taxes for most of the roughly 150 million US taxpayers.

“Could easily eliminate bottom 125 million taxpayers from the tax rolls and be revenue neutral at the same time with a capital gains tax equal to ordinary income and a few other tweaks,” he wrote.

He added that tax breaks such as carrying over tax losses and tax-free borrowing against unrealized gains — which he called a “true abuse!” — are “special interest goodies inserted by lobbyists and campaign contributions, not true capitalism.”

Khosla didn’t address common critiques of higher taxes, including that they can discourage entrepreneurship and investment, that collecting them can be tricky, and that wealthy people may leave the country to avoid them.

Khosla has previously underscored that the advent of AI may require sweeping policy changes. He estimated in late 2024 that in 25 years’ time, AI could be doing 80% of the work in 80% of all jobs, and universal basic income might be needed to compensate for job destruction.

“As AI reduces the need for human labor, UBI could become crucial, with governments playing a key role in regulating AI’s impact and ensuring equitable wealth distribution,” he wrote on his firm’s website.

Khosla isn’t alone in predicting AI will change the fabric of society. Elon Musk suggested late last year that work could become “optional” and money might become “irrelevant” if advances in AI and robotics generate abundant resources for all.

Moreover, the Tesla and SpaceX CEO recently said that retirement savings may not be needed in 10 or 20 years, as everyone might have “whatever stuff they want.”

However, skeptics such as Michael Burry of “The Big Short” fame have cautioned the AI boom is a speculative bubble, tech companies are overinvesting in microchips and data centers that will quickly become obsolete, and true AI is further away than many think.