Oil prices rose by 1% early on Wednesday as the U.S.-Iran tensions continue to rise and Israeli Prime Minister Benjamin Netanyahu is set to meet U.S. President Donald Trump.

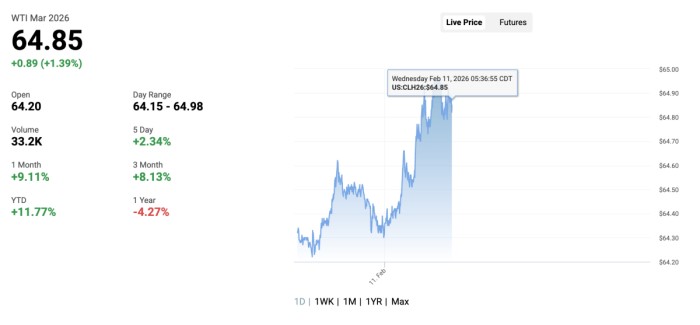

In morning trade in Europe on Wednesday, the U.S. benchmark, WTI Crude, was up by 1.39% to $64.85 per barrel. The front-month futures traded at $64.85.

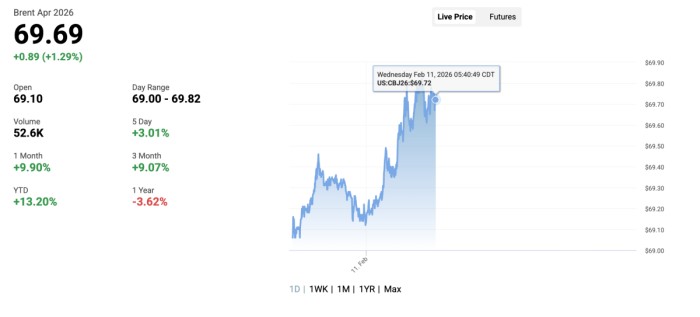

The international benchmark, Brent Crude, traded very close to the $70 per barrel mark, as it was up 1.29% on the day to $69.69.

This week, the U.S.-Iran tensions and negotiations have been in the spotlight, with the oil market assessing the chances of a deal.

Israel’s Netanyahu said before departing for Washington, D.C., “I will present to the president our outlook regarding the principles of these negotiations.”

Israel is expected to ask President Trump to seek a deal that would put an end to Iranian uranium enrichment, and limit its support for Hamas and Hezbollah.

“The Prime Minister believes that any negotiations must include limiting ballistic missiles and ending support for the Iranian axis,” Netanyahu’s office said ahead of his trip to the U.S.

President Trump has warned the U.S. could send a second aircraft carrier to the region if the talks fail.

The ongoing tensions have supported oil prices this week, although they wobbled in Tuesday trade after the American Petroleum Institute (API) estimated that crude oil inventories in the United States increased by a whopping 13.4 million barrels in the week ending February 6. The estimated increased more than offset the prior week’s draw of 11.1 million barrels.

Reports that the U.S. was considering seizing sanctioned tankers carrying Iranian oil have also pushed prices higher.

But such an action with Iran “would be escalatory and would likely see the market needing to price in an even larger risk premium than it already is, given the potential for Iranian retaliation,” ING’s commodities strategists Warren Patterson and Ewa Manthey said in a Wednesday note.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com