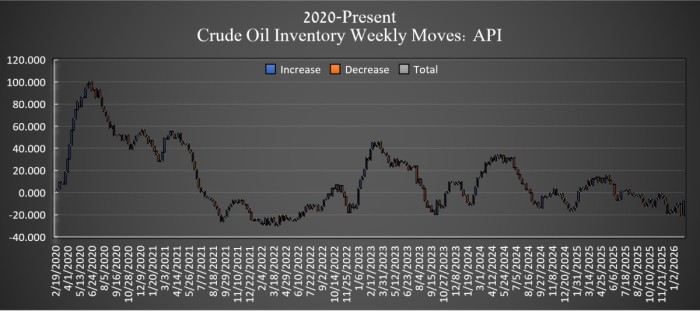

The American Petroleum Institute (API) estimated that crude oil inventories in the United States increased by a whopping 13.4 million barrels in the week ending February 6, and more than offsetting the prior week’s draw of 11.1 million barrels.

Inventories in the US Strategic Petroleum Reserve (SPR) keep climbing week after week. The Department of Energy (DoE) reported that crude oil inventories stayed the same at 415.2 million barrels in the week ending February 6. This is 310.3 million barrels shy of maximum capacity.

US production fell for the fifth week in a row during the week of January 30 to 13.215 million bpd, down from 13.696 million bpd in the week prior, according to the latest EIA data. This is 263,000 bpd less than this same time last year.

At 4:30 pm ET, Brent crude was trading down on the day at $68.98 (-0.09%). Brent is now roughly $0.88 per barrel up from this time last week. WTI was also trading down on the day, by $0.19 (-0.30%) at $64.17.

Gasoline inventories rose this week, gaining 3.3 million barrels in the week ending February 6. In the week prior, gasoline inventories rose by 4.7 million barrels. As of last week, gasoline inventories were 4% above the five-year average for this time of year, according to the latest EIA data.

Distillate inventories fell in the reporting period by 2.0 million barrels, after losing 4.8 million barrels in the week prior. Distillate inventories were 2% above the five-year average as of the week ending January 30, the latest EIA data shows.

Cushing inventory—the inventory kept at the delivery hub for the WTI Crude futures contract—grew by 1.4 million barrels, after decreasing by 1.4 million barrels in the prior week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com