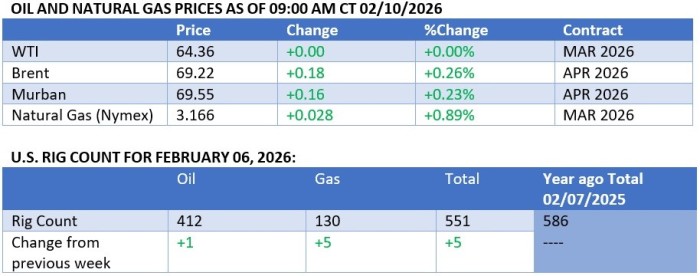

Rising U.S.–Iran tensions, and new U.S. maritime guidance are pushing oil higher as traders reassess geopolitical risk.

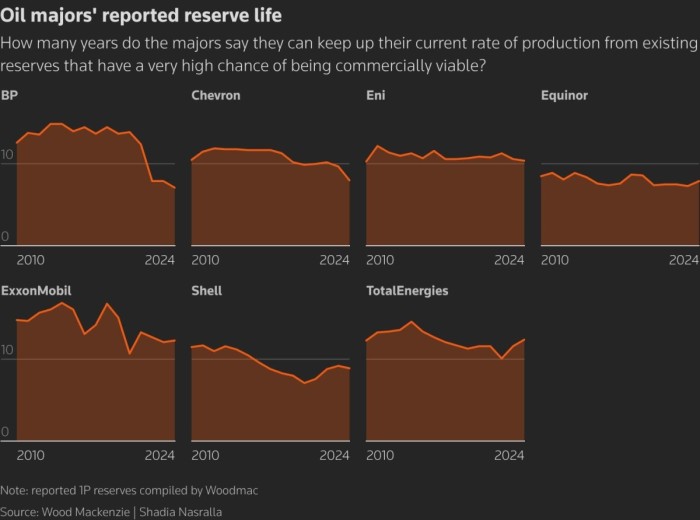

Are Oil Majors Running Out of Reserves?

– Shell’s disappointing 2025 results continue to create ripples across oil markets as the London-based energy major now only wields proven reserves of 8.1 billion barrels of oil equivalent, less than 8 years of its current production.

– Shell is now facing a 200,000 boe/d production gap by 2030, despite its corporate policy pledging to grow total hydrocarbon output by 1% annually and to keep crude production flat.

– Shrinking reserves might be the key factor in triggering a long-mooted Shell-BP merger, especially as BP’s own reserve replacement ratio came in at 90% in 2025, taking its own reserve life to just 6 years of current production.

– Saudi Aramco towers above oil majors with 52 years of reserve life, with ExxonMobil posting the strongest reserve numbers among Western firms with 12 years’ worth of proven reserves.

– The reserve plight of majors is underscored by particularly weak exploration results last year as the 2025 total amounted to 8.2 billion boe, with the largest discovery of all (Bumerangue in Brazil) remaining an open question in terms of commerciality due to extremely high CO2 levels.

Market Movers

– Oilfield services giant Transocean (NYSE: RIG) has agreed to purchase peer company Valaris (NYSE:VAL) in an all-stock deal valued around $5.8 billion, creating a $17 billion drilling major with a fleet of 73 rigs.

– Italy’s oil major ENI (BIT:ENI) has loaded its inaugural cargo of liquefied natural gas from the Nguya FLNG facility in the Republic of Congo, marking the start of the 3 mtpa Phase Two of the Congo LNG project.

– UK’s struggling energy giant BP (NYSE:BP) has announced that it would suspend its buyback programme after taking a $4 billion impairment on its renewable and biogas assets, sending its shares down 6% on Tuesday.

– US oil major ExxonMobil (NYSE:XOM) is reportedly in talks with the government of Ivory Coast to explore and appraise three exploration license blocks, CI-524, CI-803 and CI-806, after distressed explorer Tullow Oil relinquished its acreage in the country.

Tuesday, February 10, 2026

Oil prices have edged higher so far in the second trading week of February, with ICE Brent pushing towards $70 per barrel on rising expectations of US-Iran confrontation. After the failure of nuclear talks in Oman to bridge the gap between the two sides, the US Department of Transportation has boosted oil bulls with its guidance to any US-flagged commercial vessels to avoid Iranian waters and decline permission to board if asked. Could this be a prelude to another series of US strikes of Iran?

OPEC+ Output Decline as Oversupply Fears Fade. According to S&P Global, OPEC+ production dipped in January to 42.56 million b/day, a 270,000 b/day decline compared to December levels and the first monthly drop in 13 months, driven by output cuts in Kazakhstan, Russia, Nigeria and Libya.

Venezuela’s Oil Recovers Fully. Venezuela’s PDVSA has reversed most of its production cuts, implemented as precautionary measure vis-à-vis the Trump administration’s pressure policy in November-December, reporting that its oil output in the Orinoco Belt is now close to 1 million b/d.

Namibia Gets Funky with Its Oil Riches. The government of Namibia said it would not recognize the recent purchase of stakes in the PEL 104 exploration license offshore Namibia by TotalEnergies (NYSE:TTE) and Petrobras (NYSE:PBR), claiming that the majors were ‘not following due procedure’.

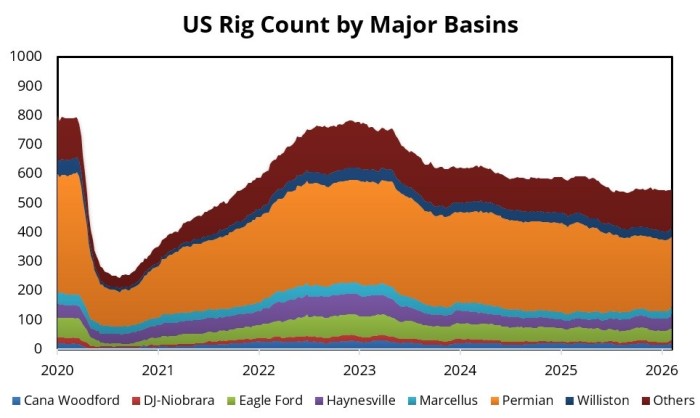

US Oil Output Declines in November. EIA monthly figures show that US crude oil production in November dropped by 82,000 b/d from the all-time high of October at 13.78 million b/d, putting it on a trajectory for three straight monthly declines as cold snaps impacted December-January supply.

Indian Refiners Slam the Brakes on Russian Oil. According to Reuters, some of India’s top refiners – IOC, BPCL and Reliance – will avoid Placing any nominations for Russian oil barrels delivered in April, seeking to placate the Trump administration as Delhi hopes to clinch a trade deal by end-March.

China Cuts Iranian Imports on Russian Surge. Chinese independent refineries, mostly located in the northeastern Shandong Province, slashed their imports of Iranian crude to 1.17 million b/d in January, with higher Russian incoming volumes increasingly squeezing out inflows from Iran.

Tengiz Production Takes Time to Recover. Oil output at the Chevron-operated (NYSE:CVX) giant Tengiz field in Kazakhstan, hampered by a fire incident at its power facilities on January 18, has been recovering gradually and currently stands at 550,000 b/d, or 60% of its nameplate capacity.

Brussels Eyes Sanctions on Georgia, Indonesia. The European Commission has proposed extending sanctions against Russia to also include Georgia’s Kulevi and Indonesia’s Karimun ports for allegedly handling Russian oil, the first time that Brussels would target infrastructure in third countries.

Qatar Postpones Start of Giant Expansion. QatarEnergy has pushed back the start of its giant 32 mtpa North Field East expansion project, developed at an estimated cost of $29 billion, towards the end of 2026 and could potentially launch it in early 2027 if construction delays continue.

New Zealand to Turn to LNG Imports Soon. New Zealand expects to commission its first ever LNG import terminal by early 2028 as the island nation’s government is assessing commercial proposals for contracting, with recurring draughts prompting its buyers to turn towards coal imports.

US Boards Runaway Venezuelan Tanker. The US Navy has seized the eighth Venezuelan tanker in 2026 to date, boarding the Aquila II tanker in the Indian Ocean as it was nearing Indonesian waters, with the vessel having reportedly loaded a cargo of high-sulfur fuel oil in early December 2025.

Nigeria Invites Chinese Firms to Revive Its Refineries. Nigeria’s national oil company NNPC is reportedly in advanced negotiations with China’s state-controlled Sinopec (SHA:600028) to take up minority stakes in three of its idled refineries, the 125,000 b/d Warri plant and two in Port Harcourt.

Congo Wants Miners to Share Their Stakes. Attesting to Africa’s increasingly protectionist policies, the Democratic Republic of Congo informed miners that it would from now on enforce a long-dormant rule that required a 5% local employee ownership in operating cobalt and copper mines.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com