Three longtime venture capitalists, who backed some of the most consequential technology companies of the last decade as partners at Singapore’s $800 billion sovereign wealth fund GIC, have reunited.

They aim to recreate the magic that led them to make early bets on DoorDash, Uber, Zoom, Coinbase, and Snowflake. And while many of these companies came out of the Bay Area, these VCs say advances in AI mean the next wave of category-defining companies will not be confined to San Francisco.

“Great venture teams are like great bands,” said Ethel Chen, one of the partners who backed Databacks and Anthropic. “You know when the chemistry is right. We’ve done this before globally, and now we’re bringing that playbook to founders who are building at the intersection of AI, infrastructure, and global commerce.”

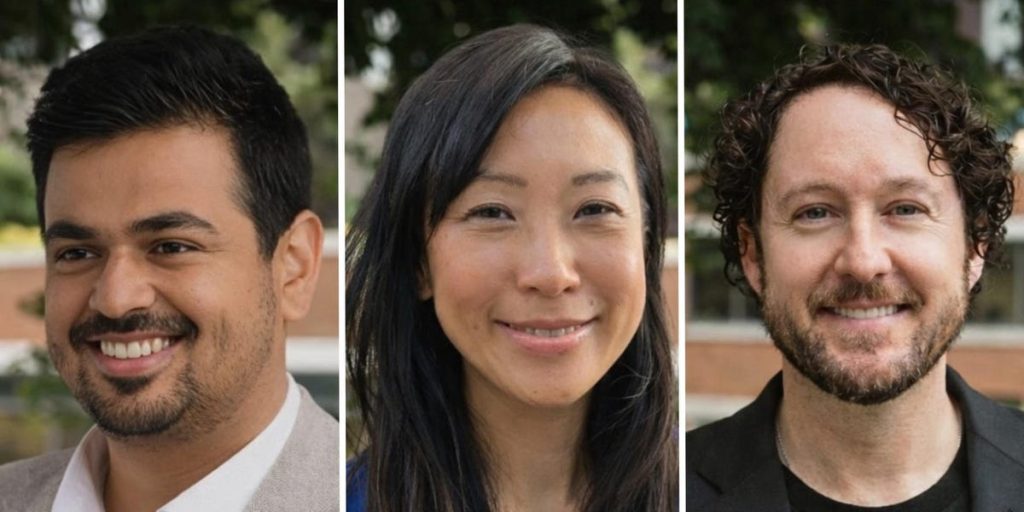

Jeremy Kranz founded Sentinel Global in 2022 with a $213 million solo fund. Recently, he brought on former GIC colleagues Chen and Karan Sharma, who invested in Anduril, Coinbase, and SpaceX. The firm is intentionally small, senior-led, and built around research and engineering support rather than a large junior investing staff.

“We are a SWAT team model,” said Kranz, who was an early investor at DoorDash and Affirm and served on those companies’ board of directors. “Let’s run a playbook that we know works.”

That’s not to say Kranz will do everything the same as when he spent 17 years at GIC, working his way up to managing director of its technology group.

Kranz says AI has made companies leaner, meaning there will be many more companies worth $1 billion that only raised $20 million.

“We think that AI is one of the black swans that impacts how you build a firm,” he said. “As a VC, my job is efficiency.”

Sentinel’s investment focus spans enterprise AI, programmable money, and what Kranz calls the “connected commerce,” startups linking the physical world with software and AI.

Despite being based in the Bay Area, Kranz says venture capital has become too geographically concentrated, and the firm also plans to focus on finding scrappy startups from other regions.

“We think the world has been very California-centric, but the pendulum’s going to swing back,” Kranz said.

Kranz says advances in AI tooling, automation, and open-source models will quickly reduce the cost and number of employees required to build meaningful companies, weakening Silicon Valley’s traditional advantages. It will happen faster than most people expect, within a year, he says.

“You don’t have to raise crazy amounts of money to build an AI company,” he said. “You also don’t need the depth of talent.”

Kranz believes those economics favor founders outside Silicon Valley, particularly in regions where efficiency has always mattered.

“I love the emerging markets because they tend to be shrewd sooner,” he said. “I wouldn’t call Silicon Valley shrewd right now. They’re not trying to figure out how to manage their expenses.”

Sentinel typically makes fewer than 10 investments annually, writing checks ranging from $5 million to $30 million. Kranz says VCs have become too enamored of check size and not focused enough on maintaining a significant ownership stake, a lesson he learned from storied longtime Sequoia Capital partner Michael Moritz.

“He told me the number one thing you need to measure is your percent of ownership,” said Kranz.